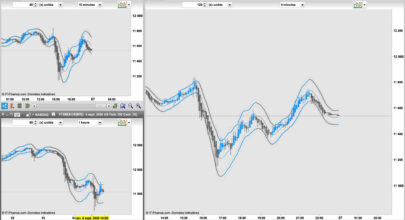

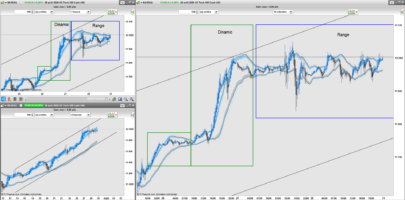

Here is an indicator that can help in reading the market

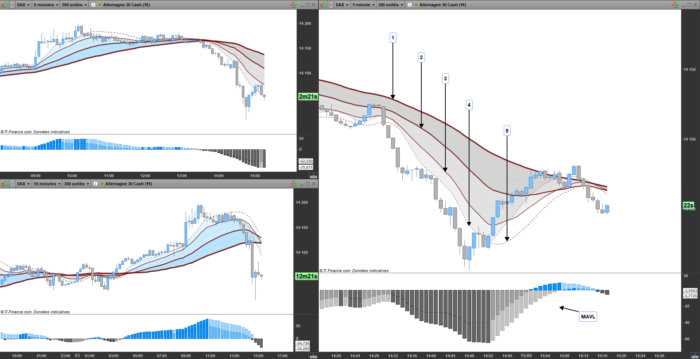

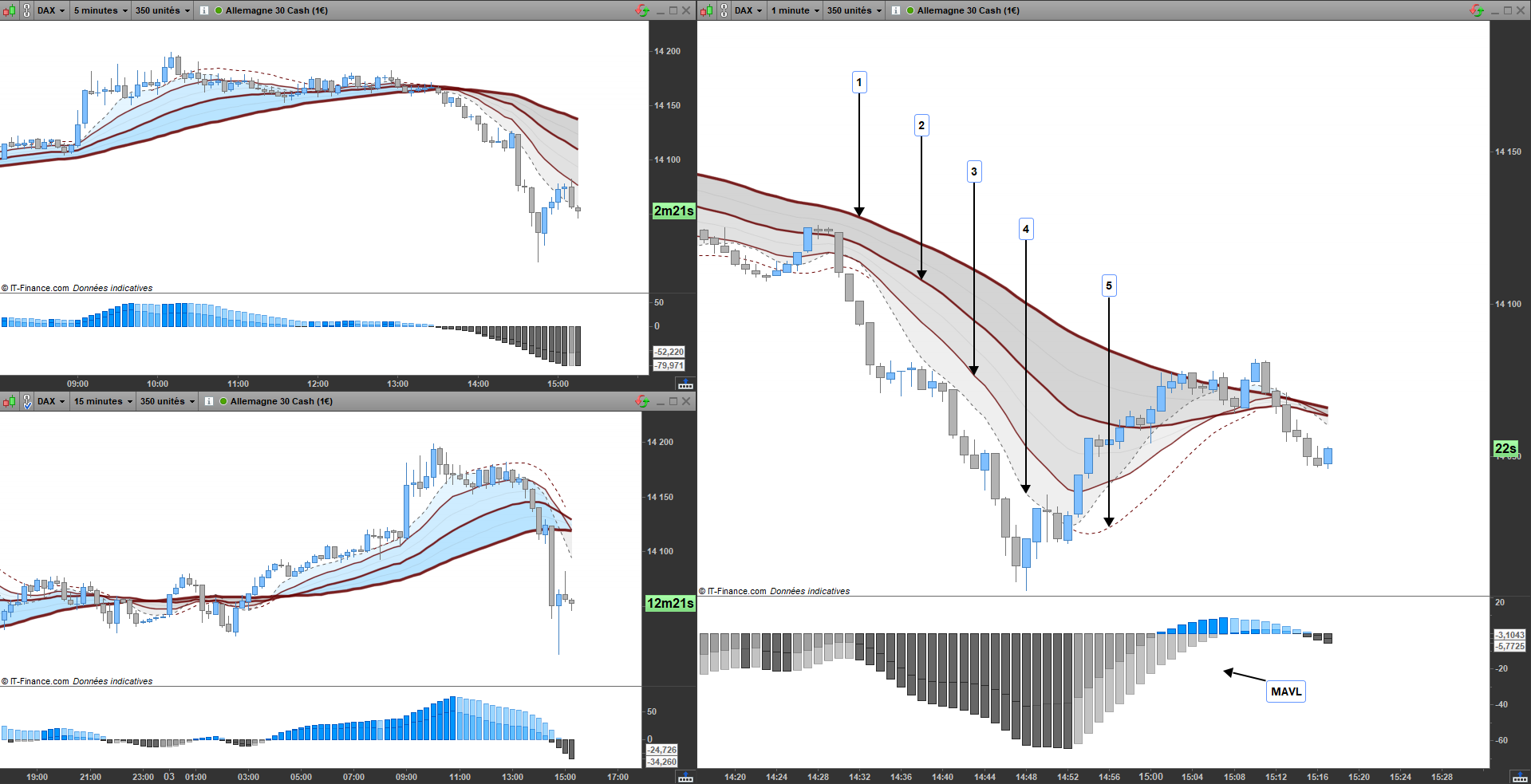

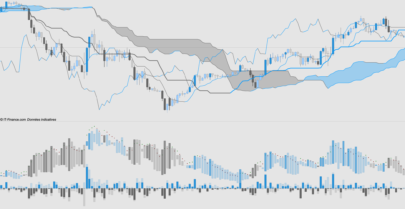

For the explanation, I will start with the main indicator “Trend Function”.

1: Long Line

2: Medium Line

3 : Fast Line

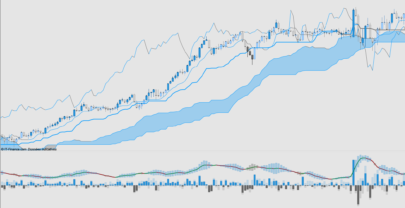

These lines are read together, they allow to give the volatility through their deviations, they are the result of several combined moving average in fibonacci period namely “8 – 13 – 21 – 34 – 55 – 64”.

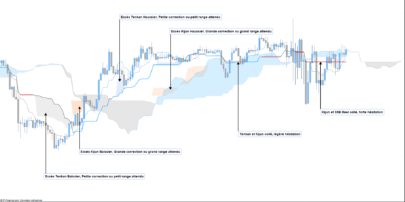

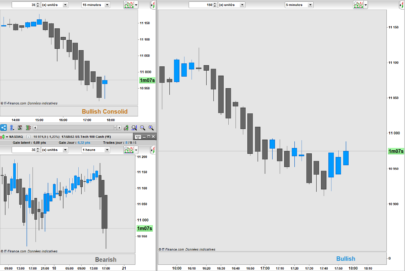

Line 3 can give another information, if the price is too close, then the trend phase is weak, it is when the prices start to move away from it that we speak of a strong trend.

The line 4, it can confirm the trend according to its positioning, if it is above all the other lines, then the upward trend and confirm, conversely for a downward trend

It can also be used as an entry point when the price crosses the line.

Line 5 is an average that corresponds to several moving means of Hull combined, when this line appears, prices are corrected and the trend marks a weakness, exceeding this line is advisable to take a position in order to regain the strength of the initial trend.

The MAVL indicator, this one calculates the deviation between the averages calculated on the indicator above, a dark blue color indicates an acceleration, a light blue color indicates a deceleration, inversely for bear phases

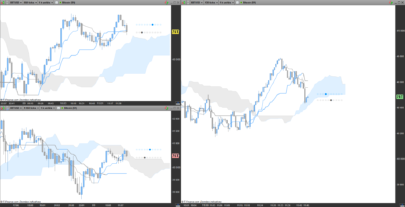

I recommend the use of Multi-timeframe for more relevance.

It is an indicator delayed by its calculation from moving average, so it serves as a decision aid and not a use of absolute certidute.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 |

// //=/===============/=//=/===============/=//=/ Average Trend // //=/ Average A1 = average[8](close) A2 = average[13](close) A3 = average[21](close) A4 = average[34](close) A5 = average[55](close) A6 = average[64](close) //=/ Trend Line L1 = (A1+A2+A3)/3 L2 = (A2+A3+A4+A5)/4 L3 = (A4+A5+A6)/3 //=// L4 = (L1+L2)/2 L5 = (L2+L3)/2 //=/ Hull A1X = 2*weightedaverage[round(21/2)](close)-weightedaverage[21](close) H1 = weightedaverage[round(sqrt(21))](A1X) //=// A2X = 2*weightedaverage[round(34/2)](close)-weightedaverage[34](close) H2 = weightedaverage[round(sqrt(34))](A2X) //=// A3X = 2*weightedaverage[round(55/2)](close)-weightedaverage[55](close) H3 = weightedaverage[round(sqrt(55))](A3X) //=// A4X = 2*weightedaverage[round(64/2)](close)-weightedaverage[64](close) H4 = weightedaverage[round(sqrt(64))](A4X) //=// TH = (H1+H2+H3+H4)/4 //=// if (TH > L4 and TH > L5 and TH > A1 and TH > L1 and TH > L2 and TH > L3) or (TH < L4 and TH < L5 and TH < A1 and TH < L1 and TH < L2 and TH < L3) then CR = 255 else CR = 0 endif // //=/===============/=//=/===============/=//=/ Fin // return TH coloured(103,0,0,CR) style (dottedline,1) as "TH", L4 coloured(102,102,102,30) style (line,1) as "L4", L5 coloured(102,102,102,30) style (line,1) as "L5", A1 coloured(102,102,102,255) style (dottedline,1) as "A1", L1 coloured(103,0,0,100) style(line,2) as "L1", L2 coloured(103,0,0,100) style(line,3) as "L2", L3 coloured(103,0,0,100) style(line,4) as "L3", L1 coloured(103,0,0,200) style(line,1) as "L1", L2 coloured(103,0,0,200) style(line,2) as "L2", L3 coloured(103,0,0,200) style(line,3) as "L3" |

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 |

// //=/===============/=//=/===============/=//=/ MAVL // //=/ Average A1 = average[8](close) A2 = average[13](close) A3 = average[21](close) A4 = average[34](close) A5 = average[55](close) A6 = average[64](close) //=/ Trend Line L1 = (A1+A2+A3)/3 L2 = (A2+A3+A4+A5)/4 L3 = (A4+A5+A6)/3 //=// L4 = (L1+L2)/2 L5 = (L2+L3)/2 // //=/===============/=//=/===============/=//=/ Coloration // //=/ MAVL TH1 = (L5-L3) + (L2-L5) + (L4-L2) + (L1-L4) + (A1-L1) TH2 = (L4-L2) + (L1-L4) + (A1-L1) if TH1 => 0 and TH1 > TH1[1] then R = 0 G = 150 B = 255 T = 255 elsif TH1 => 0 and TH1 = TH1[1] then R = 255 G = 51 B = 0 T = 100 elsif TH1 => 0 and TH1 < TH1[1] then R = 0 G = 150 B = 255 T = 100 elsif TH1 < 0 and TH1 < TH1[1] then R = 102 G = 102 B = 102 T = 255 elsif TH1 < 0 and TH1 = TH1[1] then R = 255 G = 51 B = 0 T = 100 elsif TH1 < 0 and TH1 > TH1[1] then R = 102 G = 102 B = 102 T = 100 endif if TH2 => 0 and TH2 > TH2[1] then RX = 0 GX = 150 BX = 255 TX = 255 elsif TH2 => 0 and TH2 = TH2[1] then RX = 255 GX = 51 BX = 0 TX = 100 elsif TH2 => 0 and TH2 < TH2[1] then RX = 0 GX = 150 BX = 255 TX = 100 elsif TH2 < 0 and TH2 < TH2[1] then RX = 102 GX = 102 BX = 102 TX = 255 elsif TH2 < 0 and TH2 = TH2[1] then RX = 255 GX = 51 BX = 0 TX = 100 elsif TH2 < 0 and TH2 > TH2[1] then RX = 102 GX = 102 BX = 102 TX = 100 endif // //=/===============/=//=/===============/=//=/ Fin // return TH1 coloured(R,G,B,T) style(histogram,1) as "MAVL", TH2 coloured(RX,GX,BX,TX) style(histogram,1) as "MAVL // L" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Super travail !

c’est top j’adore