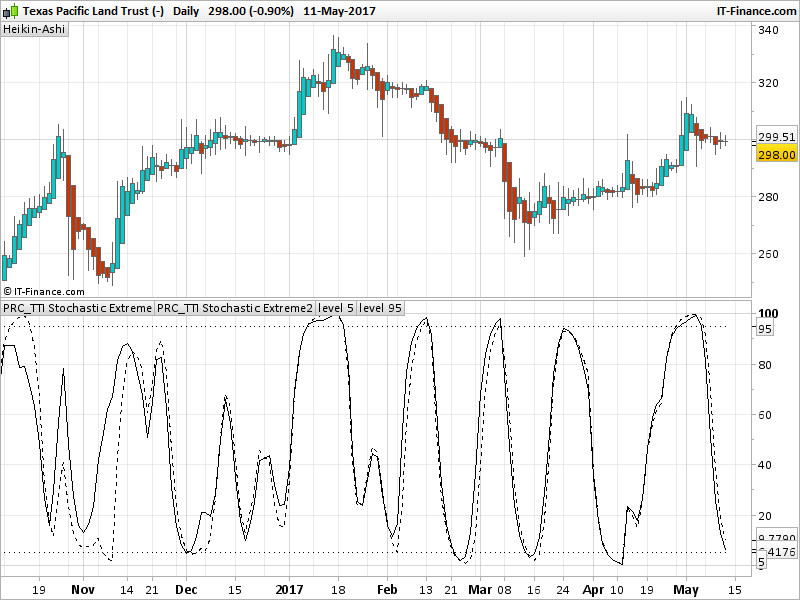

This indicator was described in the book “Volatility-based technical analysis” from Kirk Northington.

This version of the classic stochastic oscillator embed an ATR volatility factor so that it will become more effective through volatility sensitivity. In this way it will reduces the quantity of signals generated so that the quality of them can be improved.

(from the author description).

Translated from TradeStation code by a request in the Italian forum section.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 |

//PRC_TTI Stochastic Extreme | indicator //12.05.2017 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge if close>average[14] then x1 = std[14] else x1 = -1*std[14] endif x2 = (summation[3](x1-lowest[5](x1))/summation[3](highest[5](x1)-lowest[5](x1)))*100 x3 = x1*averagetruerange[5] x4 = (summation[3](x3-lowest[5](x3))/summation[3](highest[5](x3)-lowest[5](x3)))*100 a = average[3,1](x2) b = average[3,1](x4) return a style(dottedline),b, 5 style(point) as "level 5", 95 style(point) as "level 95" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials