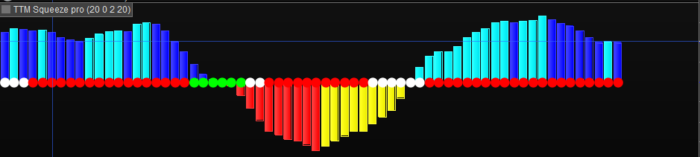

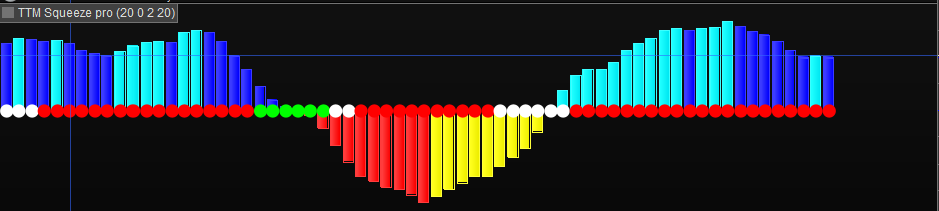

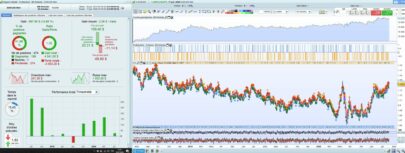

Hi guys, please find here the TTM squeeze pro. This updated version of the TTM squeeze now includes 3 levels of squeeze, low, mid and high compression rather than the previous mid squeeze only. It also includes the momentum histogram. Thanks to JS who helped with parts of the code.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 |

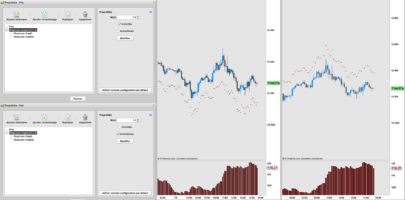

length=20 lengthkc=20 mult=2.0 DonchianMidline = (Highest[20](high)+Lowest[20](low)+Average[20](close) )/3 sma=close-(DonchianMidline) Delta = linearregression[20](sma) basis = exponentialaverage[length](close) dev = mult * Std[length](close) BBup = basis + dev BBdn = basis - dev //KC ma = exponentialaverage[lengthkc](close) myrange = averagetruerange[14] KC2up = ma+myrange * 2 KC2dn = ma-myrange * 2 KC15up = ma+myrange * 1.5 KC15dn = ma-myrange * 1.5 KC1up = ma+myrange * 1 KC1dn = ma-myrange * 1 sqzOnlow = (bbup<kc2up) and (bbup>kc15up) and (bbdn>kc2dn) and (bbdn<kc15dn) sqzOnmid = (bbup<kc15up) and (bbup>kc1up) and (bbdn>kc15dn) and (bbdn<kc1dn) sqzOnhigh = (bbup<kc1up) and (bbdn>kc1dn) if sqzOnlow then DrawPoint(BarIndex,0,3)Coloured(255,255,255) //AcolorR = 255 //AcolorG = 255 //AcolorB= 255 else //DrawPoint(BarIndex,0,3)Coloured(255,0,0) //colorR = 255 //colorG = 0 //COLORB=0 endif if sqzOnmid then DrawPoint(BarIndex,0,3)Coloured(0,255,0) //BcolorR = 0 //BcolorG = 255 //BcolorB= 0 else //DrawPoint(BarIndex,0,3)Coloured(255,0,0) //colorR = 255 //colorG = 0 //COLORB=0 ENDIF if sqzOnhigh then DrawPoint(BarIndex,0,3)Coloured(0,0,255) //CcolorR = 0 //CcolorG = 0 //CcolorB= 255 else //DrawPoint(BarIndex,0,3)Coloured(255,0,0) //colorR = 255 //colorG = 0 //COLORB=0 ENDIF If BBUP > KC2UP AND BBDN<KC2DN then DrawPoint(BarIndex,0,3)Coloured("Red") EndIf //histogram modifications if delta>0 and delta>delta[1] then plusI = delta plusD = 0 minusI = 0 minusD = 0 colorR=0 colorG=245 colorB=255 elsif delta>0 and delta<delta[1] then plusI = 0 plusD = delta minusI = 0 minusD = 0 colorR=0 colorG=0 colorB=255 elsif delta<0 and delta<delta[1] then plusI = 0 plusD = 0 minusI = 0 minusD = delta colorR=255 colorG=0 colorB=0 elsif delta<0 and delta>delta[1] then plusI = 0 plusD = 0 minusI = delta minusD = 0 colorR=255 colorG=255 colorB=0 endif RETURN plusI coloured(colorR,colorG,colorB) style(histogram,1) as "plus increase", plusD coloured(colorR,colorG,colorB) style(histogram,1) as "plus decrease", minusI coloured(colorR,colorG,colorB) style(histogram,1) as "minus increase", minusD coloured(colorR,colorG,colorB) style(histogram,1) as "minus decrease" |

Enjoy!

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bonjour , est-il possible d’avoir un peu plus de commentaire sur les points au milieu de l’histogramme et sur l’unité de temps préférentielle , pour l’utilisation et l’efficacité de c’est indicateur SVP ? Merci . Salutations .

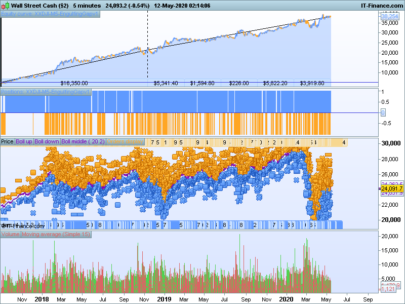

I dont speak French but i think i understand the question. The indicator is used for volatility breakouts, the dots show when a stock/market is in a “squeeze” which means that volatility has reduced. The low squeeze is when the Bollinger bands are inside the 2 ATR Keltner channels, the mid squeeze is when the Bands are within the 1.5 ATR Keltners and the high squeeze is when the Bollingers are inside the 1 ATR Keltners. The indicator can be used in any time frame.

2

Merci pour votre réponse .

bonjour si je comprends bien, qaund els points sont verts on regarde pour un long, le blanc c’est du range, et rouge on regarde pour un short ?

No, the dots only show the compression of the volatility. There are 3 levels of “squeeze” when volatility is narrowing, the white dots show the widest squeeze, the green dots show the medium compression and the blue dots the highest compression. The idea is that when volatility compresses to form a squeeze you often get an explosive breakout. To see the direction of the breakout you can use the histogram which is a linear regression of momentum. There is loads of information on the “squeeze pro” indicator on you tube if you would like to learn more about how people use it. John Carter is the creator and he has done many videos on this indicator. Best regards

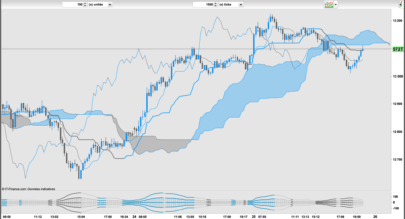

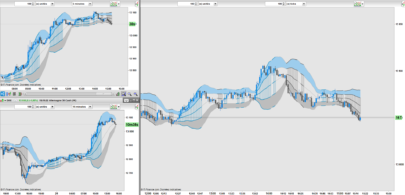

Hi Alfy, I’m trying to understand your indicator, so I made the Bollinger Bands and the Keltner Channels visivle in my price charts. Do both the upper and lower BB be within the Keltner channel, or is 1 good enough? What are your setting from the KC? 2 standard deviations or 1? But if I only want to use your indicator, what’s the best way to trade with it? When red dots, “go with the flow”? So if the candle are below 0, you can stay short, when above, stay long? When dots are white, you can expect a bigger move to come (because BB are within KC). Of course a trader wants to catch a big move instead of sideways action, what is the best set-up? In other words: what’s the colour of the dot I have to look for? And if the histogram is below 0, direction of the move should be down, and when above 0 up? Thanks in advance! Greeting, Ted