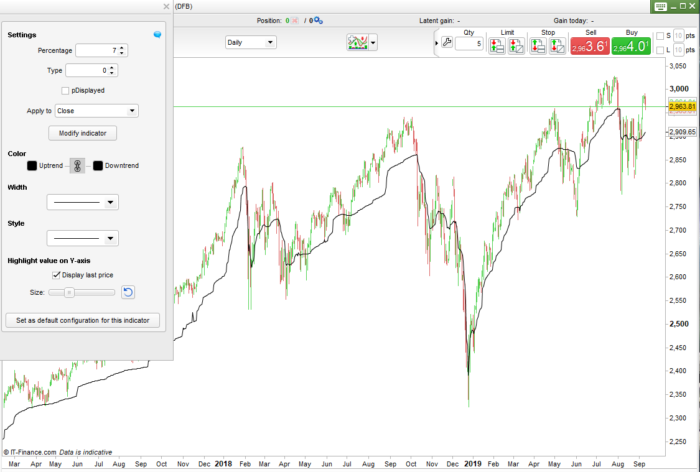

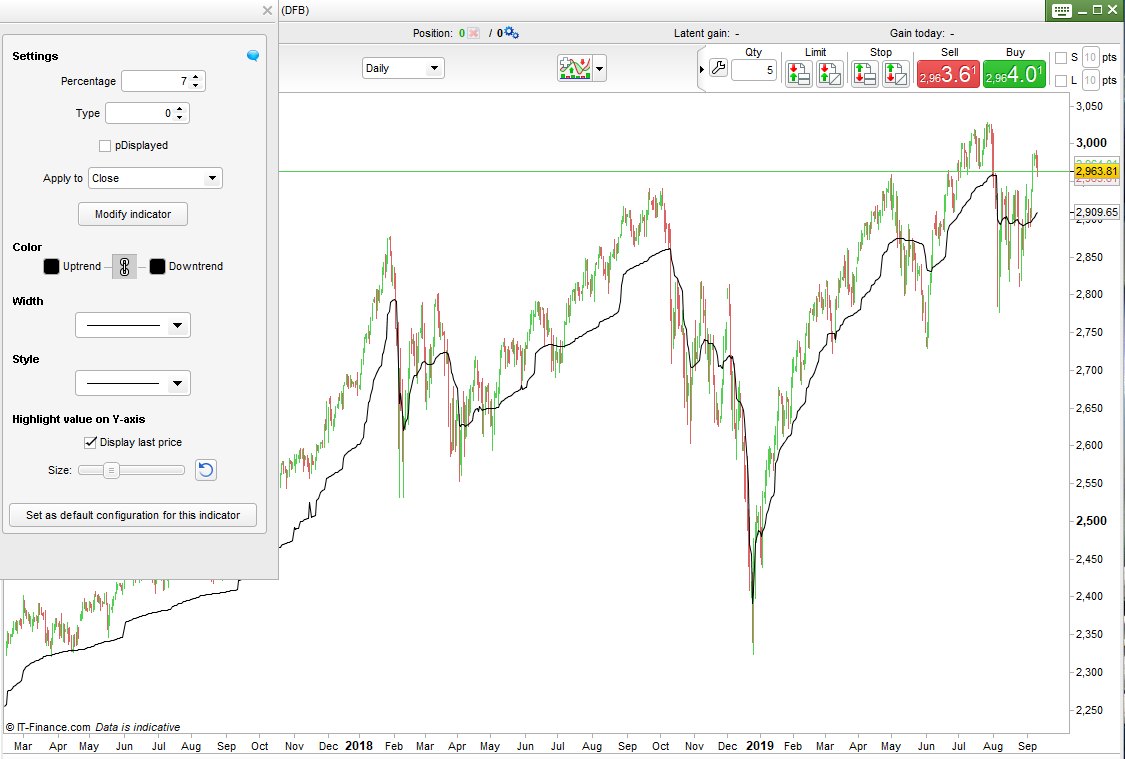

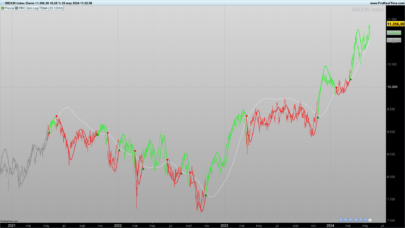

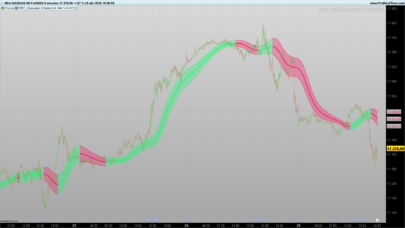

This VAMA indicator draws an average with a period of p. The value of p is changed depending upon recent market volatility.

You set a percentage and the indicator counts back how many bars are needed to find that the highest high minus the lowest low is greater or equal to the desired percentage of the current price. The value for p is the number of bars needed to find this range.

With this calculation when a market is not very volatile the value of p will be high and the average slower moving and in a volatile market the value of p will be low and the average faster moving.

You can change the average type drawn by changing the value of ‘type’ from 0 to 6.

- 0 = Simple

- 1 = Exponential

- 2 = Weighted

- 3 = Wilder

- 4 =Triangular

- 5 = End Point

- 6 = Time Series

Set ‘Percentage’ to whatever percentage of price you want to use to calculate the p value for the average.

You can turn on and off the display of the latest p value change.

Due to the loop the average can be quite slow to draw so I advise using the DEFPARAM CALCULATEONLASTBARS to reduce calculation time.

I advise downloading the ITF file and importing it to get full functionality.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 |

//VAMA - Volatility Adaptive Moving Average //By Vonasi //20190910 defparam calculateonlastbars = 1000 //percentage = 15 // percentage price move to calculate p on. //type = 1 //average type type = max(0,min(type,6)) if barindex >= 1 then hh = close ll = close p = 0 for a = 0 to barindex hh = max(hh,high[a]) ll = min(ll,low[a]) if (hh - ll)/close >= (percentage/100) then p = a+1 break endif next if p > 0 then vama = average[p,type](customclose) endif endif if pDisplayed then if p <> p[1] then drawtext("#p#", barindex, vama ,SansSerif,Bold,10) COLOURED(0,0,0) endif endif return vama |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks, Vonasi. Can this be adapted for a Hull moving average too? I’ve been looking for an ‘adaptive’ Hull for some time.

Sure that is possible. I will code it and make a post in the English ProBuilder forum and put a link here to that topic.

Vama v2 with Hull moving average included can be found here: https://www.prorealcode.com/topic/vama-with-hull-moving-average/

Thank you, Vonasi.