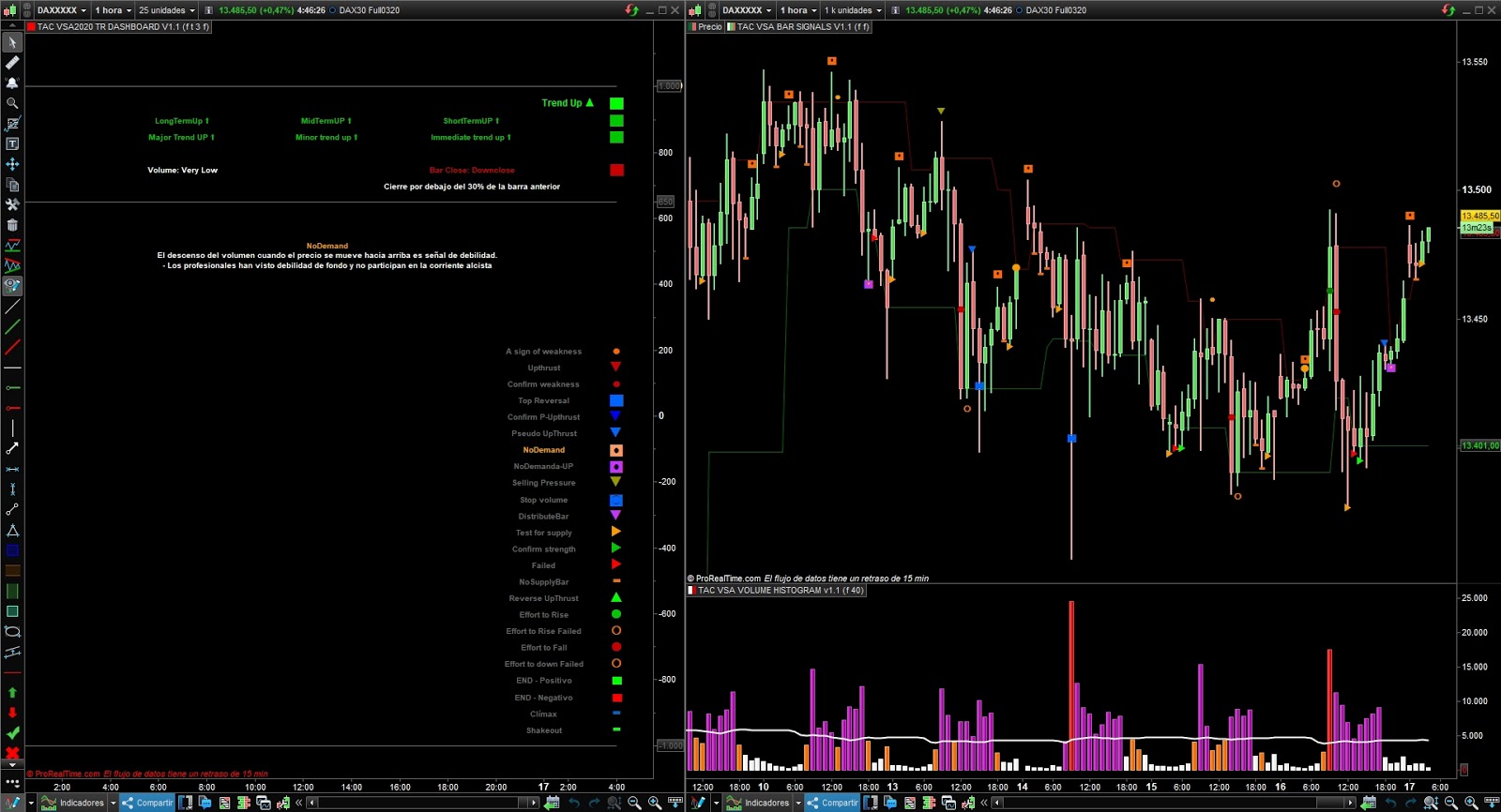

The “Volume Spread Analysis” VSA focuses on the price and volume action sought by professional operators (or Smart Money).

The “Volume Spread Analysis” VSA is a mode of analysis that dates back to the end of the 19th century. where price and volume are related.

In 1898 it appeared in the United States a mysterious book, signed by one ” Hoyle ” whose author is unknown.

Its content was a controversial both for the time, in him a little less than conspiratorial theory, which explained the true functioning of markets stated. ” Hands strong ” and ” weak hands “. He spoke of a new concept as the ” Pool “, the performance of such syndicated strong hands as if it were a single operator.

In addition to this, precisely defined basic market processes, which generate movements. Curiously, in a simultaneous time with the life and works of Charles Dow who is credited with this theory: “accumulation” and “distribution”.

In short, his book ” The game of Wall Street ” defined as strong hands, acting in a coordinated manner through processes of accumulation and distribution were able to move markets at will. This is the basis of the analysis approach (VSA) .

A few years later, at the beginning of the twentieth century, there was a succession of major operators stock in what we might call a “golden era of technical analysis.”

Among them legends in their own style of trading:

- Jesse Livermore: for many considered the best operator of all time. Operational was based on a thorough knowledge of reading the movements in prices and volume. He explained how markets are driven by professional traders.

- Richard Wyckoff: precursor operational by accumulation and distribution. With his literary works he laid the first seeds of this style would later be called (VSA) . However, their ” know-how “, the way it operates, was influenced by the work of Jesse Livermore .

There is no evidence of a direct link between the work of ” Hoyle ” and these two operators, though their methods are quite resembled the foregoing in it, the theory was behind it. Both were pioneers in this view of the markets and the results obtained during his career investment guarantee them.

More information

https://tiburonesdealetacorta.blogspot.com/2020/01/indicador-prorealtime-tac-vsa-volume.html

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

WELCOME BACK 🙂

Thanks 🙂

we missed you so much tacbolsa ..

🙂

I saw you blog and i am very Excited for the new production of the new “Volume Profile + Initial Balance + Channel VWAP”.

May i ask if you did it already?

It will only be for the Prorealtime 11 version when it is available on all Platforms, IG, Bankinter etc, etc.

Yes i know, i am asking becouse i have PRT 11 with interactive brokers

A new version is missing that solves some programming problems that I requested,

As soon as they are solved, I tell you.

Hi i saw your blog is private now, still no hope for more developing of your projects?

Realy. Thank you!

Bom Dia TACBOLSA. Me podes dar acesso ao teu Blog para acompanhar o teu excelente trabalho?? meu mail é lumarino68@gmail,com. gracias

Tenia un error en el blog, ya lo tienes disponible.

ok gracias

Good evening, I am new here and quite interested in Volume Price analysis. may I ask you if you could please grant me access to your blog as well? It says I can’t access because I am not invited.

Best regards

Me alegra ver que has vuelto a programar en Proreal, me gustaría poder acceder a tu blog, si es posible, gracias!!

Merci pour tout ce travail.

hello

I am new to VSA and PRTv11. I get a bug with the dashbaord, it prints nothing.

I get confused with all your addons that you offer. Can you tell me the one which is uptodate and the most useful for VSA ? So far I struggle a lot to identify ”up-thrust”, ”test”, ”weakness”, ”strength”, ”being locked in a range” and so on.

Also, can you do an addon showing the ”volume for the options of the underlying asset?”, for instance the volume for the options for SPX, CAC40, DAX, FTSE and NASDAQ. I don’t see it offered by stock PRTv11.

Buenos días TACBOLSA. Estoy muy interesado en ver tu blog para ver la explicación con detalle del VSA. Eres tan amable de enviarme una invitación ? Muchas gracias.

I would be interested an invite to your blog. I am still learning about the VSA and it looks very interesting to me because volume is a leading indicator.

Buenos días TACBOLSA. Yo también estoy interesado en visitar tu blog. Podrías enviarme una invitación para aprender más de este indicador tan bueno. Muchas gracias.

Hi, I just joined Pro Realtime and am very interested in VSA. I have read some books and did youtube study. I’d be thrilled to get an invite to your vsa blog. i understand if it’s no. Thank you.