Overview of the Volume SuperTrend AI Indicator

The Volume SuperTrend AI Indicator is a cutting-edge technical tool designed for forecasting price movement trends by integrating traditional SuperTrend calculations with artificial intelligence techniques, notably the k-nearest neighbors (KNN) algorithm. Its purpose is to arm traders with a more accurate means of discerning market trends, combining volume-weighted moving averages (VWMA) and the KNN algorithm to deliver both bullish and bearish signals.

How It Works

– Volume Analysis:

Leveraging volume-weighted moving averages (VWMA), the Volume SuperTrend AI underscores the significance of trading volume in determining trend direction. This enables a more precise reaction to market dynamics.

– Artificial Intelligence Integration – k-Nearest Neighbors (k-NN) Algorithm:

The k-NN algorithm is utilized to intelligently assess historical data points by comparing current parameters with past data. The nearest neighbors are used to generate predictive modeling, thus adapting to complex market patterns.

Usage Guide

– Trend Identification:

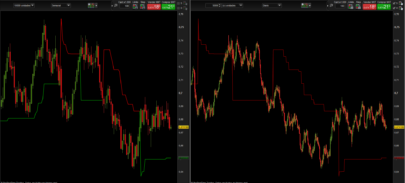

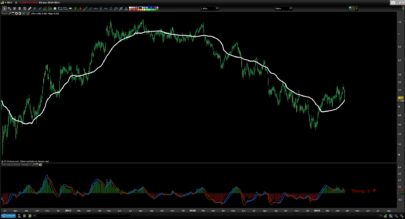

The indicator evaluates not just price movements but also trading volume, adding an additional layer to trend analysis. A green line below the price usually indicates an uptrend, reflecting bullish market sentiment, whereas a red line above the price denotes a downtrend, indicative of bearish conditions.

– Trend Continuation Signals:

The AI algorithm plays a critical role in determining the coloration of the Volume SuperTrend, facilitating trend prediction while retaining the fundamental attributes of the traditional SuperTrend.

– Dynamic Trailing Stop:

The Volume SuperTrend AI indicator acts as a dynamic trailing stop loss, adjusting to both price movement and trading volume. This method safeguards profits while allowing the trade to develop, incorporating volume for a more nuanced response to market shifts.

Settings

– AI Settings:

These include adjustments for the number of nearest neighbors to consider in the k-Nearest Neighbors (k-NN) algorithm and the amount of data points to analyze. These settings influence the model’s sensitivity to market fluctuations.

– AI Trend Settings:

This allows for the customization of the lengths of the weighted moving averages used for calculating both the price trend and the prediction trend. It includes options to enable or disable AI-generated trend signals.

– SuperTrend Settings:

These settings adjust the length of the SuperTrend and the factor, which is the multiplier for the Average True Range (ATR) in the SuperTrend calculation, as well as selecting the type of moving average for the SuperTrend calculation. This customization aligns with individual trading strategies and market conditions.

This comprehensive approach to market trend prediction merges traditional technical analysis with artificial intelligence innovations, offering traders a robust tool for decision-making in their trading activities.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 |

//PRC_Volume SuperTrend AI //version = 0 //29.02.24 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge /////////////////////////////////////////////////////////////////////// //inputs // ~~ Input settings for K and N values k = 3 // Neighbors 1 to 100 m = 10 // Data n = max(k,m) //// ~~ Input settings for prediction values KNNPriceLen = 20 // Price Trend 2 - 500 step 10 KNNSTlen = 100 // Prediction Trend 2 - 500 step 10 aisignals = 1 // Boolean AI Trend Signals //// ~~ Define SuperTrend parameters len = 10 // Length factor = 3.0 // step 0.1 maSrc = 0 // MaType // ~~ Calculate the SuperTrend based on the user's choice vwma = average[len,maSrc](close*volume)/average[len,maSrc](volume) atr = averagetruerange[len](close) upperband = vwma + factor*atr lowerband = vwma - factor*atr if barindex < len then upperband = close lowerband = close direction = 1 else //Redefine upperband if upperband < upperband[1] or close[1] > upperband[1] then upperband = upperband else upperband = upperband[1] endif //Redefine lowerband if lowerband > lowerband[1] or close[1] < lowerband[1] then lowerdband = lowerband else lowerband = lowerband[1] endif //Define upperband prevSupertrend = mysuperTrend[1] if prevSupertrend = upperband[1] then if close > upperband then direction = -1 else direction = 1 endif else if close < lowerband then direction = 1 else directon = -1 endif endif endif if direction = -1 then mysupertrend = lowerband else mysupertrend = upperband endif // ~~ Collect data points and their corresponding labels myprice = WeightedAverage[KNNPriceLen](close) sT = WeightedAverage[kNNSTlen](mysupertrend) for i=0 to n-1 do $data[i]=mysupertrend[i] if myprice[i] > sT[i] then $labels[i] = 1 else $labels[i] = 0 endif next // ~~ Classify the current data point currentsuperTrend = mysuperTrend //label = knn_weighted(data, labels, k, current_superTrend) // Compute distances from the current point to all other points n1 = lastset($data) for i = 0 to n1-1 do $distances[i] = abs(currentsuperTrend[i]-$data[i]) $indices[i] = i next // Sort distances and corresponding indices in ascending order // Bubble sort method for i=0 to n1-2 do for j=0 to n1-i-2 do if $distances[j]>$distances[j+1] then tempDist = $distances[j] $distances[j]=$distances[j+1] $distances[j+1]=tempDist tempindex = $indices[j] $indices[j]=$indices[j+1] $indices[j+1]=tempindex endif next next // Compute weighted sum of labels of the k nearest neighbors weightedsum=0 totalweight=0 for i=0 to k-1 do myindex = $indices[i] labeli = $labels[i] weighti = 1 / ($distances[i]+pow(10,-6) ) weightedsum = weighti*labeli+weightedsum totalweight = weighti+totalweight next label = floor(weightedsum / totalweight,2) // ~~ Plot if label = 1 then r=0 g=250 b=0 elsif label = 0 then r=250 g=0 b=0 else r=0 g=0 b=250 endif middleprice = (open+close)/2 colorbetween(middleprice,mysupertrend,r,g,b,40) // ~~ Ai Super Trend Signals starttrendup = label = 1 and label[1]<>1 and aisignals starttrenddn = label = 0 and label[1]<>0 and aisignals TrendUp = direction = -1 and direction[1] = 1 and label = 1 and aisignals TrendDn = direction = 1 and direction[1] = -1 and label = 0 and aisignals if starttrendup or starttrenddn then drawpoint(barindex,currentsuperTrend,2)coloured(r,g,b) elsif Trendup then drawtext("▲",barindex,currentsuperTrend)coloured(r,g,b) elsif Trenddn then drawtext("▼",barindex,currentsuperTrend)coloured(r,g,b) endif return currentsuperTrend as "SuperTrend" coloured(r,g,b)style(line,2) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Grazie Ivan

una domanda:

quale TF ci puoi suggerire per operare sugli indici americani CFD?

I personally like it in daily timeframe

Many thanks Ivan,

I copy/paste your code to try it but could only get a constant stable uniform value for the SuperTrend.

Is anything missing in the code?

I think the problem is coming from “vwma = average[len,maSrc](close*volume)/average[len,maSrc](volume)”

What did you intend to write here?

Also, what is the use of “myindex = $indices[i]”?

Hi,

I’ve copied the code above and it works… what asset are you trying?

$indices array use is to be complemented with $distance array. Currently not used in the code, but if you want to know an especific $distance it could be useful.

If you want you can delete it.

Hallo Ivan,

are you shure that line 107 “myindex = $indices[i]” myindex is correct?

Dear Iván,

I am trying to set this indicator in a trading system.

However, I have some issue at the end of the first part, when your indicator evaluates ‘mysupertrend’ before collecting data points.

If used as an indicator then it returns a proper ‘mysupertrend’ signal, but when used in a code then it does not give any value. What could be the reason for that?

// ~~ Calculate the SuperTrend based on the user’s choice

vwma = average[len,maSrc](close*volume)/average[len,maSrc](volume)

atr = averagetruerange[len](close)

upperband = vwma + factor*atr

lowerband = vwma – factor*atr

if barindex < len then

upperband = close

lowerband = close

direction = 1

else

//Redefine upperband

if upperband < upperband[1] or close[1] > upperband[1] then

upperband = upperband

else

upperband = upperband[1]

endif

//Redefine lowerband

if lowerband > lowerband[1] or close[1] < lowerband[1] then

lowerdband = lowerband

else

lowerband = lowerband[1]

endif

//Define Supertrend

prevSupertrend = mysuperTrend[1]

if prevSupertrend = upperband[1] then

if close > upperband then

direction = -1

else

direction = 1

endif

else

if close < lowerband then

direction = 1

else

direction = -1

endif

endif

endif

if direction = -1 then

mysupertrend = lowerband

else

mysupertrend = upperband

endif

Hi. It works… just delete drawing lines and place buy and sell conditions.

For example, if you want to enter long/short when the arrow appears:

if Trendup then

//drawtext(“▲”,barindex,currentsuperTrend)coloured(r,g,b)

buy 1 contract at market

elsif Trenddn then

//drawtext(“▼”,barindex,currentsuperTrend)coloured(r,g,b)

sellshort 1 contract at market

endif

graphonprice currentsuperTrend as “SuperTrend” coloured(r,g,b)

Yes, I am sure it should work perfectly, but I found very strange vehavior like this one:

If I set these lines right after the code:

if g=250 then

test=1

elsif r=250 then

test=-1

else

test=0

endif

graph test

and then there is non matching between the colors of the indicator and what the code gives.

Would you see something similar?

(sorry but I can’t find how to attach a picture)

well,

it seems that the issue came from my backTest period which was not long enough.

sorry

Dear Ivan,

why, in line 86, there is “currentsuperTrend[i]” and not “currentsuperTrend” only?