In finance, volume-weighted average price (VWAP) is the ratio of the value traded to total volume traded over a particular time horizon (usually one day). It is a measure of the average price at which a stock is traded over the trading horizon.

VWAP is often used as a trading benchmark by investors who aim to be as passive as possible in their execution. Many pension funds, and some mutual funds, fall into this category. The aim of using a VWAP trading target is to ensure that the trader executing the order does so in-line with volume on the market. It is sometimes argued that such execution reduces transaction costs by minimizing market impact costs (the additional cost due to the market impact, i.e. the adverse effect of a trader’s activities on the price of a security).

VWAP can be measured between any two points in time but is displayed as the one corresponding to elapsed time during the trading day by the information provider.

VWAP is often used in algorithmic trading. Indeed, a broker may guarantee execution of an order at the VWAP and have a computer program enter the orders into the market in order to earn the trader’s commission and create P&L. This is called a guaranteed VWAP execution. The broker can also trade in a best effort way and answer to the client the realized price. This is called a VWAP target execution; it incurs more dispersion in the answered price compared to the VWAP price for the client but a lower received/paid commission. Trading algorithms that use VWAP as a target belong to a class of algorithms known as volume participation algorithms.

(source wikipedia).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 |

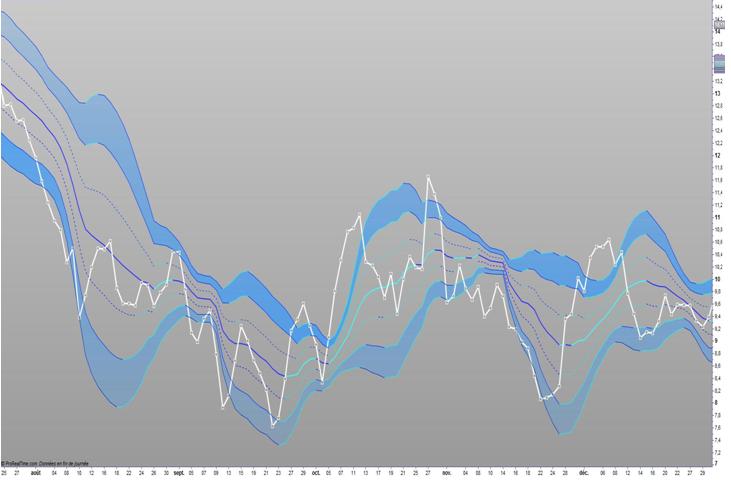

// VWAP DID d = 200 vw = volume*close vwsum = SUMMATION[d](vw) volsum = SUMMATION[d](volume) vwap = vwsum/volsum stv= STD[d] ( vwap ) //(close) upline = vwap + stv dnline = vwap - stv /////////////////////// upline1 = vwap + stv * 2 dnline1 = vwap - stv * 2 upline2 = vwap + stv * 3 dnline2 = vwap - stv * 3 cc = customclose RETURN vwap AS "VWAP" , upline AS "upper band" , dnline AS "lower band" , cc as " customclose " , upline1 AS "upper band 1" , dnline1 AS "lower band 1" , upline2 AS "upper band 2" , dnline2 AS "lower band 2" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

HelloI would like to start from zero the indicator at the start of the day every day … I tried to insert the feature IntradayBarIndex but I could not reach my goalcan you help me?thank you

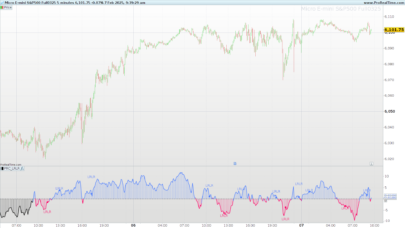

This is exactly what this other VWAP intraday indicator is doing: http://www.prorealcode.com/prorealtime-indicators/vwap-intraday/

Hi Nicolas, I would like to create 3 standard deviations (+/-) based on VWAP linked to volume bar (e.g. wall street 2.000 bars) instead of the classical time frame bars (5/15/60 min). Is someone able to make it? thanks M

Sure, please open a new topic about that specific query and with a complete explanation in the Probuilder forum.