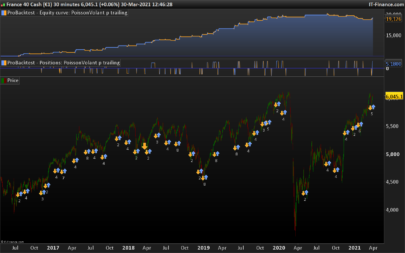

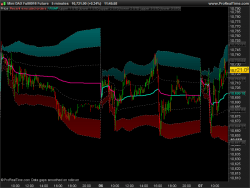

The Bollinger Bands % is useful to spot reversals and/or the beginning of a new trend. The VWAP %, built on the same principle, tends to be more reactive. It can be used as a tool to take partial profit, exit, or prepare to enter a position on a reversal. It can also be used on MTF. For example, you plot it on H4 chart and M15 chart. When the VWAP% is above its Signal line on the H4, then each time on the M15 you have the VWAP% crossing over its Signal you enter Long and exit at the crossing under.

VWAP code based on Nicolas’ work.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 |

// Based on https://www.prorealcode.com/topic/is-there-any-working-intraday-vwap/ post #116309 //PRC_VWAP intraday //07.09.2016 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge if day<>day[1] then d=0 else d=d+1 if volume >0 then VWAP = SUMMATION[d](volume*typicalprice)/SUMMATION[d](volume) endif sd = std[d](abs(typicalprice-vwap)) SDup2 = vwap+sd*2 SDlw2 = vwap-sd*2 endif vwapr = 100 * (close - SDlw2)/(SDup2 - SDlw2) Signal = Average[3](vwapr) RETURN vwapr coloured(0,102,204) style(line,3) as "VWAP %", Signal coloured("red") style(dottedline3,1) as "Signal" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials