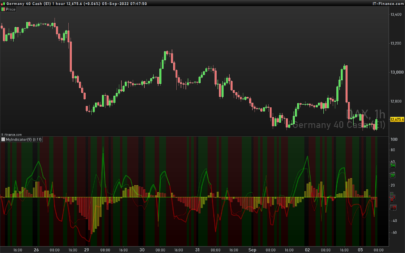

Wako Volume ratio

This oscillator proposed here is the WAKO Volume ratio, first published by IFTA, edited by Stewart Gault. You can find it at this link: https://ifta.org/public/files/journal/d_ifta_journal_08.pdf

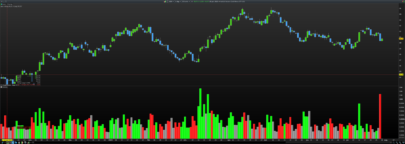

Wako calculates the difference between volumes of days (or other timeframes) defined distributive volume, if close is greater than open, and the others defined accumulative volume, if close is less than open, comparing the difference obtained with the total volume of the period.

The formula is therefore: (Total distributive volume-Total accumulative volume) / Total volume * 100

Wako uses only volume for its construction, a rare feature for this kind of oscillators.

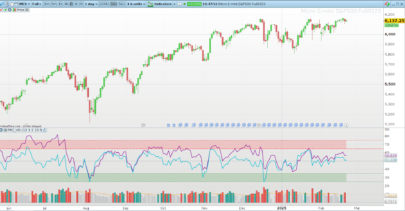

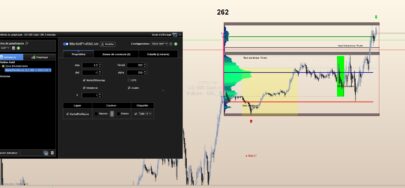

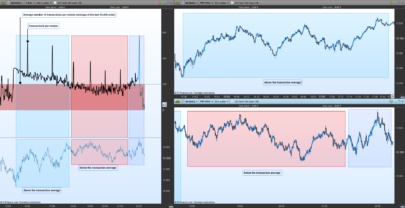

Wako offers indications of distributional and accumulative phases, above and below the zero line. Attention levels vary with the different assets considered (approximately 40/60, -40/-60). Above 80 and below -80 there are indications of extreme possible return to the equilibrium line. Reading the pdf provides every detail of the author’s work.

I thank Roberto Gozzi for his help in the realization of the oscillator for Prorealcode.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 |

// WAKO volume ratio IFTA anno 2008 period=X daypositivevolume = 0 daynegativevolume = 0 If Close > Open then daypositivevolume = Volume else daypositivevolume = 0 endif sommadaypositive= summation [X](daypositivevolume) If Close < Open then daynegativevolume = Volume else daynegativevolume = 0 endif sommadaynegative= summation [X](daynegativevolume) totalvolume=summation [X] (volume) Wako=(sommadaypositive-sommadaynegative)/totalvolume * 100 Return Wako as "Wako Volume ratio" ,0 as "linea 0",50 as "linea attenzione 50",-50 as "linea attenzione -50" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials