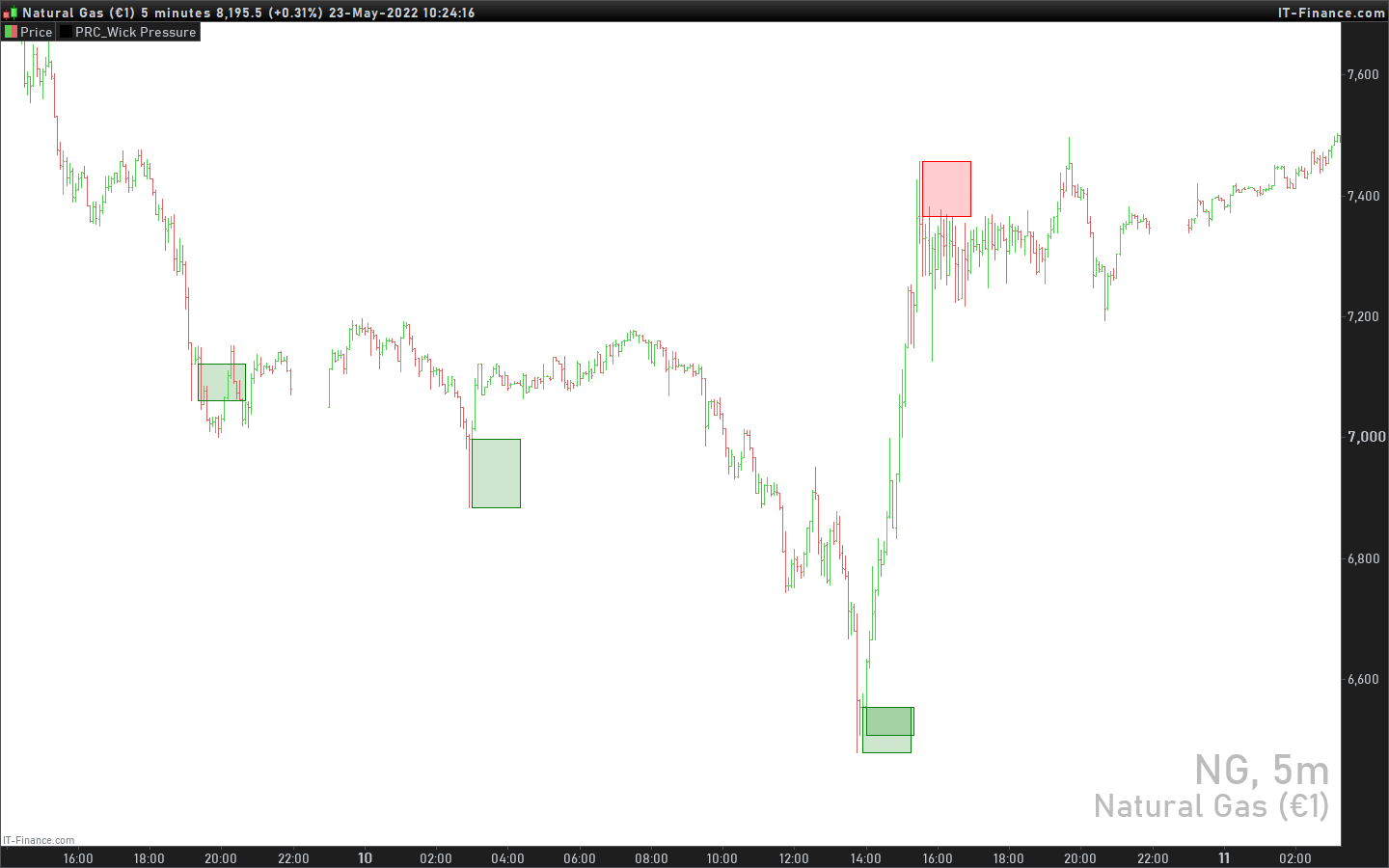

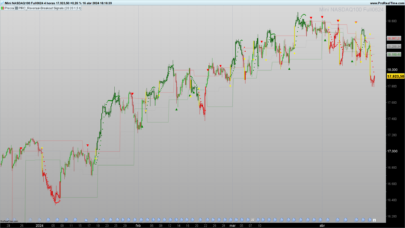

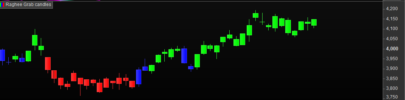

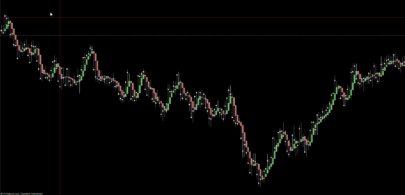

Multiple Wicks forming at OverSold & OverBought levels create Buying and Selling Pressure. This Script tries to capture the essence of the buy and sell pressure created by those wicks. Wick pressure shows that the trend is Exhausted.

How it works:

This Wick Pressure Indicator checks for three candles forming the wicks in overbought and oversold zones. The zones are set by RSI and can be changed in settings. Those three candles should form a bit long wick and length of the wick is determined by ATR. The ATR multiple can be changed from settings. And then the script draws a box in the area formed by three candle wicks.

Confluence:

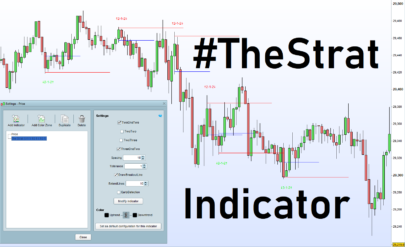

This indicator should not be used on its own. You should include it in your existing trading strategy. Any indicator should be rigorously tested before making any real trades.

Settings is the Key:

Settings are key to all of my indicators. Play around with it a bit. Change the ATR multiplier. Read the tooltips to understand what each settings mean. Tooltips are the (i) button in-front of each settings.

(description from original author: SiddWolf)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 |

//PRC_Wick Pressure | indicator //23.05.2022 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //converted from pinescript // --- settings atrmult = 0.7 //ATR Multiplier (The Wick area is filtered on the basis of atr and this is multiplier to that ATR. The more the multiplier value, the less the signals and vice versa) boxlength = 16 //Length of Wick Pressure Box rsiob = 60 //RSI based on which signnals are filtered rsios = 40 //RSI based on which signnals are filtered // --- end of settings meersi = rsi[14](close) //bullish wick pressure rsibullishcond = meersi < rsios or meersi[1] < rsios or meersi[2] < rsios ll3 = lowest[3](low) lc3 = min(lowest[3](close),lowest[3](open)) if low<=lc3 and low[1]<=lc3 and low[2]<=lc3 and open>=lc3 and open[1]>=lc3 and open[2]>=lc3 and lc3-ll3>(atrmult*AverageTrueRange[14](close)) and rsibullishcond and close>open then drawrectangle(barindex,lc3,barindex+boxlength, ll3) coloured("green",50) bordercolor("green") endif //bearish wick pressure rsibearishcond = meersi > rsiob or meersi[1] > rsiob or meersi[2] > rsiob hh3 = highest[3](high) hc3 = max(highest[3](close), highest[3](open)) if high>=hc3 and high[1]>=hc3 and high[2]>=hc3 and open<=hc3 and open[1]<=hc3 and open[2]<=hc3 and hh3-hc3>(atrmult*AverageTrueRange[14](close)) and rsibearishcond and close<open then drawrectangle(barindex,hh3,barindex+boxlength, hc3) coloured("red",50) bordercolor("red") endif return |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Nicolas

Thank´s for this great indicator !

Arnaud

Bonjour Nicolas, existe il un screeners indicateur qui détecte les marteaux avec meche au moins 2.5 fois le corps sur tendance haussiere et apres 2 ou 3 bougies rouge ? Merci beaucoup

Dear Nicolas, This isa great indicator. I want to thank you for all you do in this forum -I am very impressed to see all what you share with the community. Thank you. I have recently see the block indicator (the new one) – what is actually the difference between the wick and the block indicator and do they ever overlap? If i may ask this question.

Buongiorno, ho scaricato questo indicatore, che sembra essere interessante, solo che sul grafico non mi compare nessuna linea. C’è forse da aggiungere qualcosa dopo la voce return del codice? Grazie

Provate a modificare le impostazioni per adattarle al timeframe e allo strumento a cui avete applicato l’indicatore.

Grazie per la risposta. Ho provato a modificare i vari parametri, ho provato su diversi time frames, ma il risultato è uguale: nessuna linea compare sul grafico

Ho appena provato su DAX 1 minuto con le impostazioni predefinite e ho ottenuto molti segnali. Sei sicuro di applicare sul grafico del prezzo e non sotto?

Si, si, intendevo sul grafico del prezzo, non sotto. Ho provato sul grafico del dax a 1 minuto e lì in effetti si vedono dei box. Oggi vedo 4 soli segnali: uno dalle 8:36, un altro alle 9, poi alle 9:12 e l’ultimo alle 9:52. Risultano anche a lei o lei ne vede di più? Sul Fib che io utilizzo mi compare un segnale a partire dal TF 5 minuti. E’ così questo strumento, cioè dà pochi segnali e solo su alcuni TF oppure no?

Quelqu’un a t il un screener sur cet indicateur, merci?

Quelqu’un a t il pu créer un screener pour cet indicateur, cela serait très utile. Merci beaucoup

Je pense que le code ci-dessous doit fonctionner pour un screener:

//PRC_Wick Pressure | indicator

//23.05.2022

//Nicolas @ http://www.prorealcode.com

//Sharing ProRealTime knowledge

//converted from pinescript

// — settings

//atrmult = 0.7 //ATR Multiplier (The Wick area is filtered on the basis of atr and this is multiplier to that ATR. The more the multiplier value, the less the signals and vice versa)

//boxlength = 16 //Length of Wick Pressure Box

//rsiob = 60 //RSI based on which signnals are filtered

//rsios = 40 //RSI based on which signnals are filtered

// — end of settings

meersi = rsi[14](close)

signal = 0

//bullish wick pressure

rsibullishcond = meersi < rsios or meersi[1] < rsios or meersi[2] < rsios

ll3 = lowest[3](low)

lc3 = min(lowest[3](close),lowest[3](open))

if low<=lc3 and low[1]<=lc3 and low[2]=lc3 and open[1]>=lc3 and open[2]>=lc3 and lc3-ll3>(atrmult*AverageTrueRange[14](close)) and rsibullishcond and close>open then

drawrectangle(barindex,lc3,barindex+boxlength, ll3) coloured(“green”,50) bordercolor(“green”)

signal = 1

endif

//bearish wick pressure

rsibearishcond = meersi > rsiob or meersi[1] > rsiob or meersi[2] > rsiob

hh3 = highest[3](high)

hc3 = max(highest[3](close), highest[3](open))

if high>=hc3 and high[1]>=hc3 and high[2]>=hc3 and open<=hc3 and open[1]<=hc3 and open[2](atrmult*AverageTrueRange[14](close)) and rsibearishcond and close<open then

drawrectangle(barindex,hh3,barindex+boxlength, hc3) coloured("red",50) bordercolor("red")

Signal = -1

endif

screener[signal0](signal)

la dernière ligne doit être: screener[signal>0 or signal<0](signal)