Author: yamin151

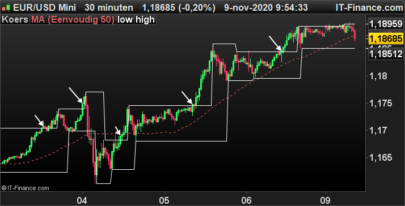

The bullish moving average crossing over system is one of the most famous. It is based on the observation that a rapid moving average crosses over a slow moving average when a bullish trend appears.

We are going to build a ProScreener that collects all the stocks on which the 4 days moving average crosses over the 9 days moving average.

Furthermore, we will compute the momentum of the difference between the two moving averages in order to evalutate how powerful the over crossing is. If this number is near 0, the crossing is slow and not very significant. But higher is this number stronger is the crossing.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 |

REM Compute a simple moving average on the last 20 days ma4 = AVERAGE[4] REM Compute a simple moving average on the last 50 days ma9 = AVERAGE[9] REM Compute the differential speed between the short and the long moving average speed = MOMENTUM(ma9-ma4) * 100 / CLOSE REM Select all the stocks on which that crossing over has just occured condition= ma4 CROSSES OVER ma9 SCREENER[condition] (speed AS"Speed") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials