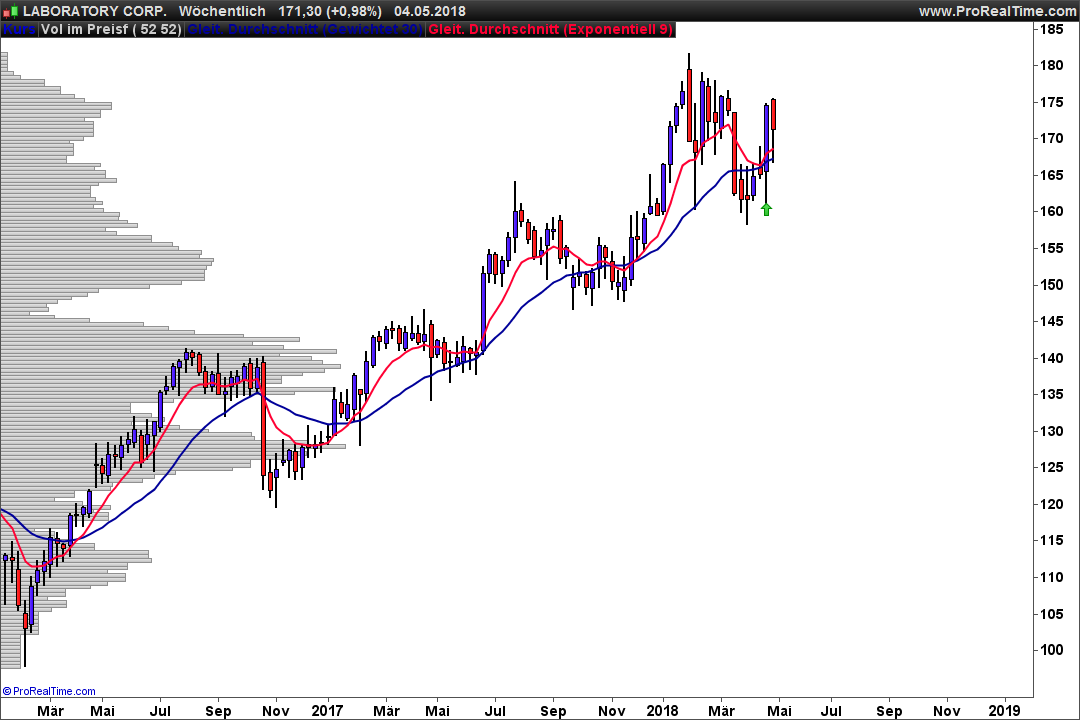

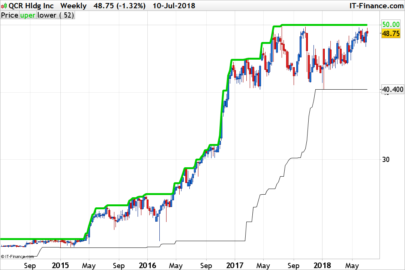

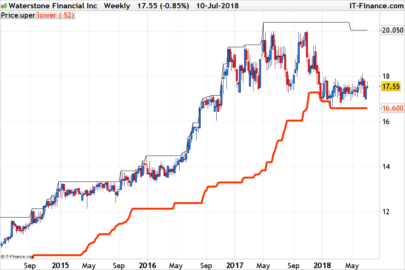

i use it on weekly chart for lower noise

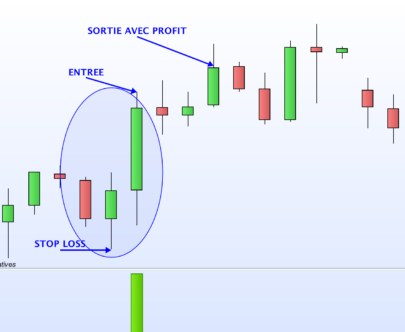

the strategy is a variation of the floor trader method and called 9/30 aggressive

i used it to trade german extra stocks

i only wanna stocks with a total traded volume (close * volume) of 3 mio euro (you can change this value)

no optimization needed

give every week o lot of candidates you have pick the cherrys manually

|

1 2 3 4 5 6 7 8 9 10 11 |

c1 = average[52](close*volume) > 3000000 c2 = ExponentialAverage[9](close) > WeightedAverage[30](close) c3 = close[1] < ExponentialAverage[9](close)[1] c4 = close > high[1] c5 = c1 and c2 and c3 and c4 c6 = ExponentialAverage[9](close) < WeightedAverage[30](close) c7 = close[1] > ExponentialAverage[9](close)[1] c8 = close < low[1] c9 = c1 and c6 and c7 and c8 c10 = c5 or c9 SCREENER[c10](volume*close as "traded volume") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

What do you mean by “German extra stocks”?

i mean german xetra stocks 🙂

Ok! Thanks.