Author: arena74

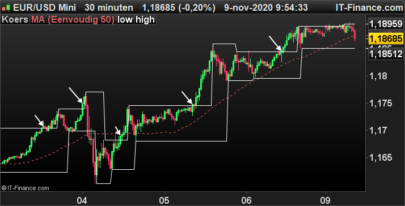

It helps to find stocks with a price under the SAR.Declining money flow ensures that there is no divergence. I favor stocks with prices under the SAR sorted by highest K of stochastic. The Volume must be greater than the Average Volume. It is good when DI- crosses above the DI+. This is a good moment to enter into a trade.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 |

REM The following is related to this timescale: daily TIMEFRAME(daily) indicator1 = SAR[0.02,0.02,0.2] c1 = (close CROSSES UNDER indicator1) indicator2 = Average[20](Volume) c2 = (Volume >= indicator2) c3 = (indicator2 >= 250000.0) indicator3 = MoneyFlow[21](close) indicator4 = MoneyFlow[21](Dclose(1)) c4 = (indicator3 < indicator4) criteria = Stochastic[14,4](close) SCREENER[c1 AND c2 AND c3 AND c4] (criteria AS"%K") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi lolo I have imported your screener but it’s giving me results that appear far from any cross under. For example SPLK or TRVN, it’s not giving me any results of a fresh cross under. What am I doing wrong?

Do you have real time data for these stocks?