Author: Handlep

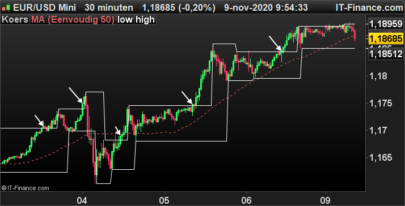

This screener will find candlesticks with a real body of one third or less the size of the overall candle, following a decline. Therefore it will detect Hangmen, Hammers, inverted Hammers, Spinning Tops, Dojis, etc.

I have used ProRealTime’s Bullish Engulfing code to detect the decline.

Note: Rather than write several screeners to detect the individual candle types, this screener is relatively generic, so will throw up candles which do not necessarily imply a reversal – for example, the main body may not be close enough to the end of the candle to be a true hammer or hanman, and not close enough to the centre to be a spinning top. Obviously any such detections should be discarded.

Good luck in your trading.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 |

REM Compute the power of the bearish trend // Find the highest quote on the last 8 bars HighPoint = HIGHEST[8](HIGH) // Compute the variation of price from this point to now Decline = HighPoint - CLOSE // Compute the usual volatility of the stock (median of True Range) Norm = SUMMATION[3](TR) - HIGHEST[3](TR) - LOWEST[3](TR) if norm <>0 then criteria=Decline / Norm else criteria=undefined endif REM Stock picking : only candles whose real body is equal to, or less than, one third of the overall range. Filter = ABS(open - close) <= (ABS(high-low))/3 REM We keep the most serious declines SCREENER [ Filter ] (criteria AS"Trend Power") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials