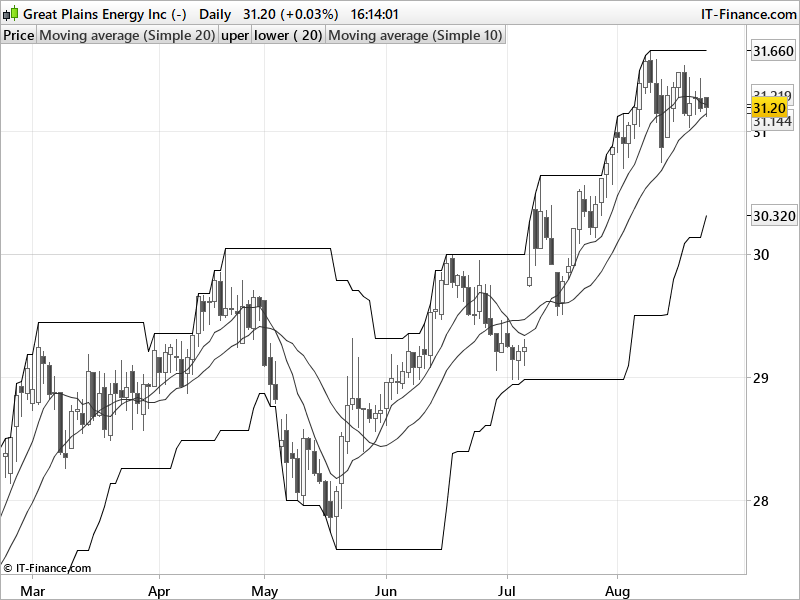

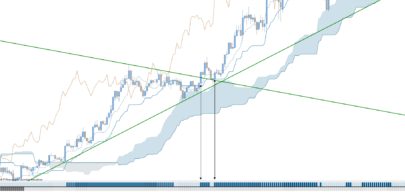

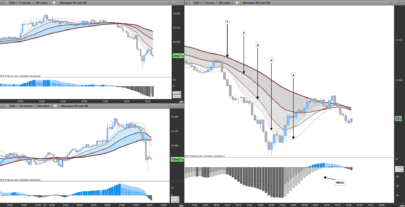

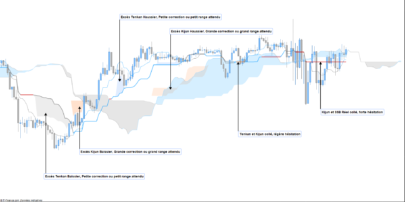

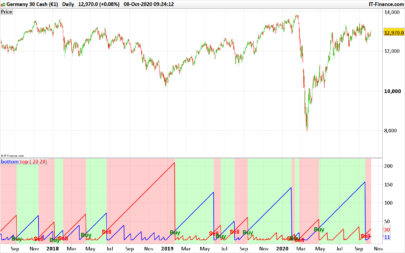

A simple but effective bullish swing setup that someone asked me recently.

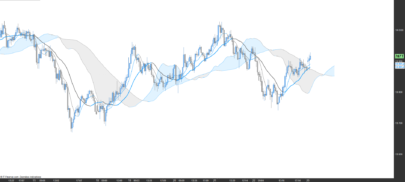

The bullish trend is established and price is consolidating and still near than the latest 20 days high and below the 10 days moving average, maybe a good time for a possible new buy? Hope it helps swing traders around here.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 |

//PRC_Bullish Swing Setup | screener //30.08.2017 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge c1 = close>average[20] c2 = average[50](volume)>20000 c3 = close<average[10] c4 = close/highest[20](high)>0.85 c5 = summation[20](average[10]>average[20])=20 swing = c1 and c2 and c3 and c4 and c5 screener[swing] (close/highest[20](high)) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

bonjour, ton screener semble intéressant …. merci pour le partage

Hi Nicolas – many thanks for your screener. One question if I may – how does condition 5 work in practice (summation[20](average[10]>average[20])=20)? I.e could you explain what this line does? Many thanks again.

In the last 20 periods, the SMA 10 periods was above the SMA 20 periods.