This screener is a simple compilation of several conditions to identify the actions rising during the current day, based on detections of candle size (the most recent being larger than the last 7) and breakouts of the weekly levels and monthly.

A trend filter based on exponential moving averages is also present.

I came across this strategy by browsing the internet the other day, you will find below the corresponding screener code:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 |

if DayOfWeek<DayOfWeek[1] then weeklyopen = open[0] endif If Month<>Month[1] then monthlyOpen = open[0] endif myrange = range count=0 for i = 1 to 7 do if myrange>range[i] then count=count+1 else break endif next c1 = count=7 c2 = close>open c3 = close>close[1] c4 = close[0]>weeklyopen c5 = close[0]>monthlyopen c6 = Volume[1]>10000 c7 = exponentialaverage[13]>exponentialaverage[26] c8 = exponentialaverage[20]>exponentialaverage[50] test = c1 and c2 and c3 and c4 and c5 and c6 and c7 and c8 screener[test] |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

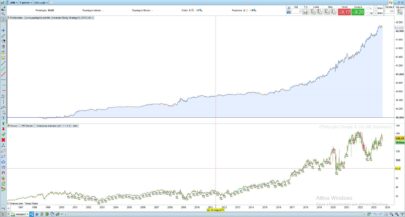

An interesting idea that was easily turned into a strategy on a shorter time frame that appears to work very well at first look. I had to remove the volume condition and change the average conditions to a different type and period and remove one of them and add my new trailing stop but the foundations were there! Thanks for posting in the library.

Hi Vonasi, is it possible for you to share your code here? thanks in advance

Sorry Stenozar. I have only really spent an hour or so on this strategy so far and it is far from developed enough to be shared at the moment – plus if it works well it will be for my eyes only! I have it on forward test at the moment. You can easily convert the above code yourself by adding buy conditions, removing the volume condition and adding one of the standard trailing stop codes that can be found on here and then play around with different averages and style of average and you won’t be far off what I have written (although my trailing stop is a new totally different one I am trialling too). Good luck.