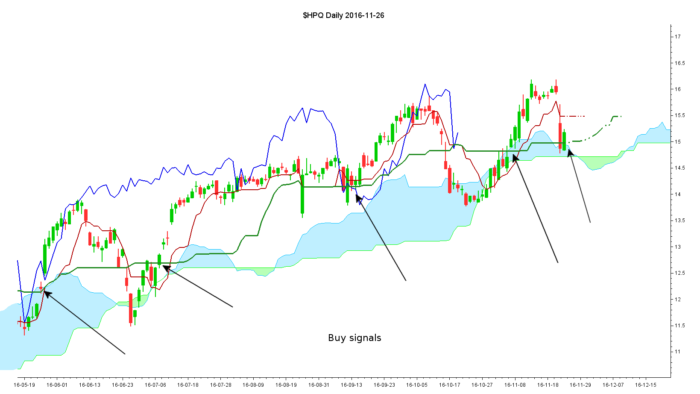

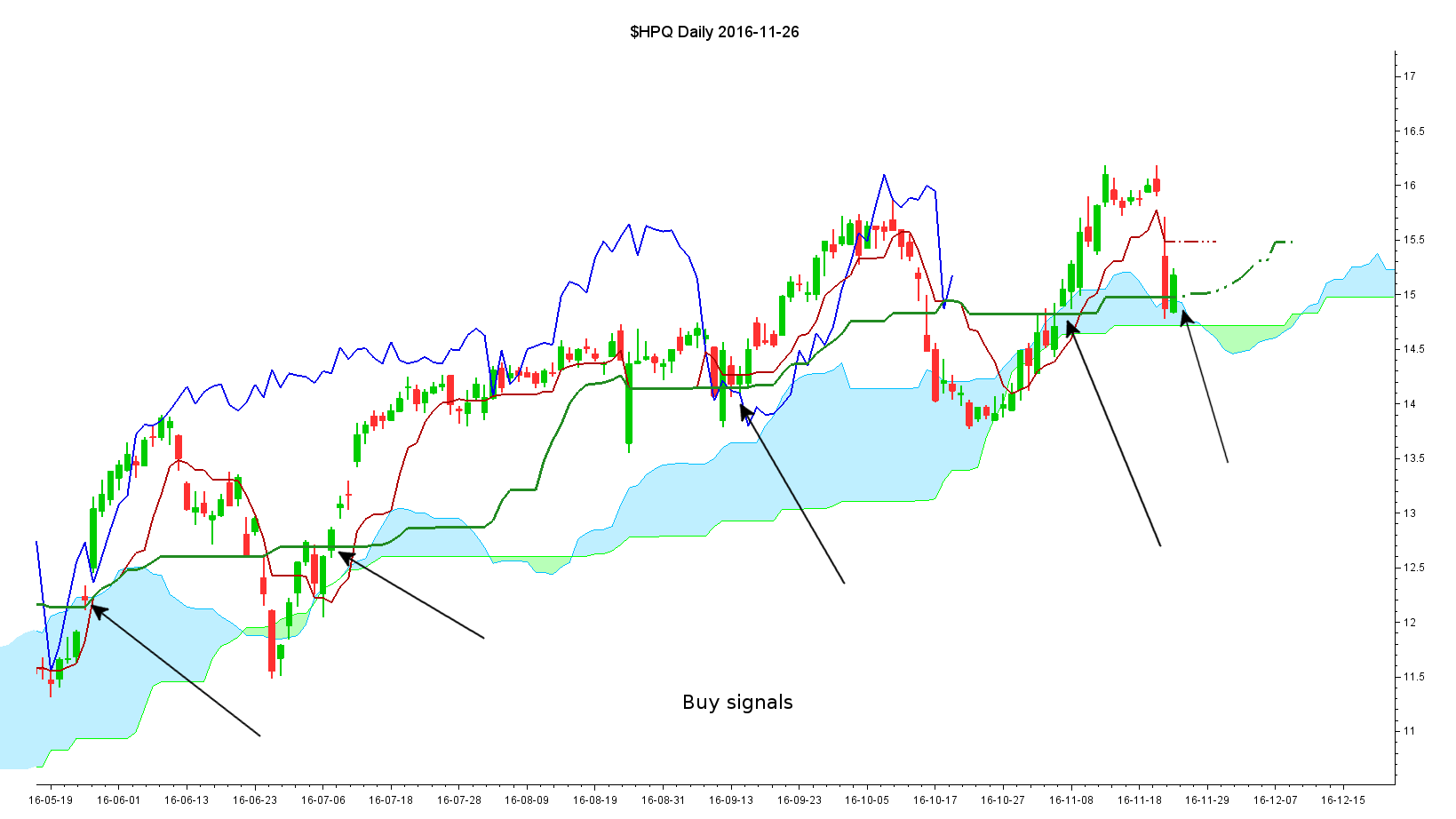

The simple strategy used in this screener is to find buying opportunity by locating daily throwback on Kijun Sen in a weekly uptrend using the Ichimoku Kinko Hyo system.

Use money management to limit the risk by trade.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 |

// Copyright (C) 2016 tasciccac. // // This is free software: you can redistribute it and/or modify // it under the terms of the GNU General Public License as published by // the Free Software Foundation, either version 3 of the License, or // (at your option) any later version. // // This is distributed in the hope that it will be useful, // but WITHOUT ANY WARRANTY; without even the implied warranty of // MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the // GNU General Public License for more details. // // You should have received a copy of the GNU General Public License // along with this. If not, see <http://www.gnu.org/licenses/>. // The simple strategy used in this screener is to find buying opportunity // Locate daily throwback on Kijun Sen in a weekly uptrend using Ichimoku Kinko Hyo system // Use money management to limit the risk by trade // Tenkan Sen Period TenkanSenPeriod = 9 // Kijun Sen Period KijunSenPeriod = 26 // Senkou Span Period SenkouSpanPeriod = 52 // Select the weekly time frame // To ensure a normal bullish trend TIMEFRAME(weekly) // Weekly Tenkan Sen TenkanSenW = (Highest[TenkanSenPeriod](High) + Lowest[TenkanSenPeriod](Low)) / 2 // Weekly Kijun Sen KijunSenW = (Highest[KijunSenPeriod](High) + Lowest[KijunSenPeriod](Low)) / 2 // Weekly SSA Senkou Sen A SenkouSpanAFutureW = (TenkanSenW + KijunSenW)/2 // Weekly SSB Senkou Sen B SenkouSpanBFutureW = (Highest[SenkouSpanPeriod](High) + Lowest[SenkouSpanPeriod](Low))/2 // Compute Trend Normality // Normality Of Trend is a Tasciccac indicator used to grade the quality of a trend // Normality Of Trend > 100 => Trend overheating (ie Overbuy) // 0 < Normality Of Trend < 100 => Trend normal => This is the configuration we look for a swing in this strategy // Normality Of Trend < 0 => Attempt a trend reversal // To find the trend direction I compare SenkouSenAFutureW & SenkouSenBFutureW // if (SenkouSenAFutureW > SenkouSenBFutureW) => BULLISH // if (SenkouSenAFutureW < SenkouSenBFutureW) => BEARISH NormalityOfTrendNormalityW = (TenkanSenW - KijunSenW) / (SenkouSpanAFutureW - SenkouSpanBFutureW) // With this condition we ensure the trend is clearly bullish in weekly TheWeeklyTrendIsBullishNormal=((SenkouSpanAFutureW > SenkouSpanBFutureW) AND (NormalityOfTrendNormalityW > 0) AND (NormalityOfTrendNormalityW < 100)) // Chikou is above its candle in weekly ChikouIsAbovePricesW = (Close > High[KijunSenPeriod]) // In daily time frame we look for a throwback below Kijun, while Tenkan stays above Kijun TIMEFRAME(daily) // Daily Tenkan Sen TenkanSenD = (Highest[TenkanSenPeriod](High) + Lowest[TenkanSenPeriod](Low)) / 2 // Daily Kijun Sen KijunSenD = (Highest[KijunSenPeriod](High) + Lowest[KijunSenPeriod](Low)) / 2 // Daily SSA Senkou Span A //SenkouSpanAFutureD = (TenkanSenD + KijunSenD)/2 // Daily SSB Senkou Span B //SenkouSpanBFutureD = (Highest[SenkouSpanPeriod](High) + Lowest[SenkouSpanPeriod](Low))/2 // Condition Tenkan is above Kijun TenkanSenIsAboveKijunSenDaily = (TenkanSenD > KijunSenD) // We look for a crosses over Kijun PriceCrossesOverKijunDaily = ((Close[1] < KijunSenD) AND (Close > KijunSenD)) // Mean volume on Kijun Sen period VolumeMeanKijunSenPeriod = Average[KijunSenPeriod](Volume) ROCVolume = 100*(Volume / VolumeMeanKijunSenPeriod) SCREENER[TheWeeklyTrendIsBullishNormal AND ChikouIsAbovePricesW AND TenkanSenIsAboveKijunSenDaily AND PriceCrossesOverKijunDaily] SORT BY ROCVolume AS "Rate of Change Volume" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks for contributing to the “ichimoku section” of the prorealtime code library

Don’t hesitate to add other codes if you can!

Thank you , this is a great indicator works beautifully.

Could you kindly modify to screen for BEARISH signals ?

Excuse me,… reading your code about spanB: [ SenkouSpanBFutureW = (Highest[SenkouSpanPeriod](High) + Lowest[SenkouSpanPeriod](Low))/2 ]

I can see others contributors define it as: SpanB = (highest[52](high[26])+lowest[52](low[26]))/2 (highs-lows delayed 26)

I wonder wich one definition is properly more suitable to be set. Thank you.