Hi all,

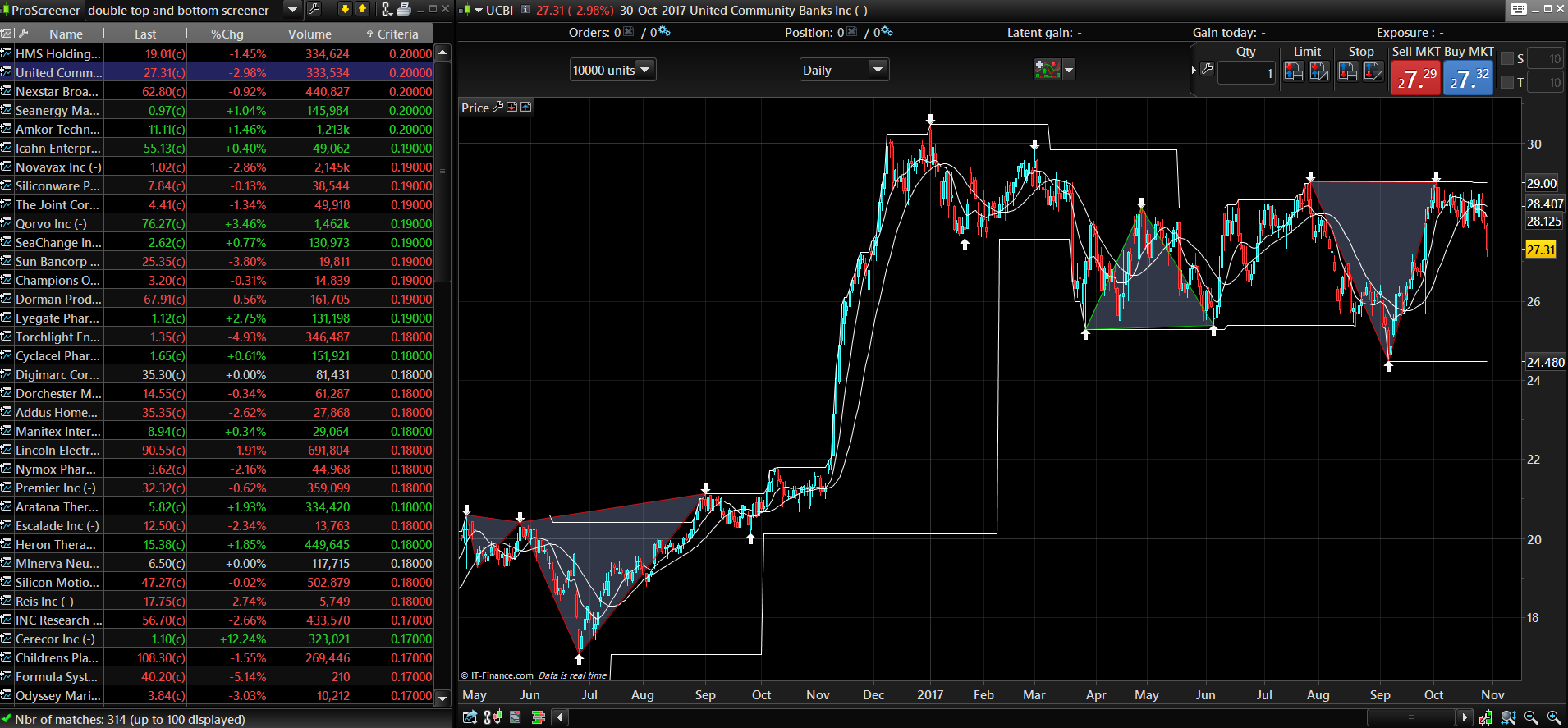

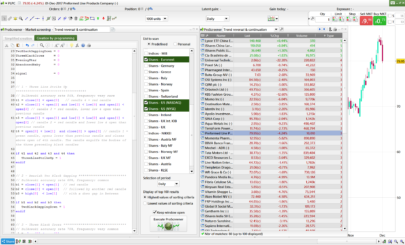

This is a screener that detect double top and double bottom.

A double top or a double bottom, are chartists figures that announce a reversal of trend. In general, a double top is created in the context of a downward trend and therefore marks its end and a return of the bullish movement while a double bottom, is created in the context of a downward trend and therefore marks its end and a return of the bullish movement.

Base on my Leo Moving Average indicator, the following screener detects double bottom and double top.

I am looking forward to read your comments and improvements in the systems.

If you earn money with this methodology please share your luck with the people in the world who do not.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 |

//LOCALS MINIMUMS AND MAXIMUMS USING LEO MOVING AVERAGE //Autor: LEO //VARIABLES TO BE OPTIMIZED PERIOD=40 //Period for analysis //Definition of what is a double top or double bottom Kdouble=0.2 //Factor for defining what is double top or bottom //----------- //Leo Moving Average, formula: LMA= WMA+(WMA-SMA) LMA=2*weightedaverage[period](close)-average[period](close) //Smoothed curve of Leo Moving Average IF BARINDEX > period THEN smoothLMA=weightedaverage[period](LMA) ELSE smoothLMA=undefined ENDIF // Direction or trend of the LMA // << Storage of minimums and maximums >> once mintemp=low once posmintemp=1 once maxtemp=high once posmaxtemp=1 IF BARINDEX>2 THEN // the value 0.7 is to ensure that the donchian channel is faster than the curves analysis (this value to be checked) IF low < lowest[round(0.7*period)](low[1]) THEN mintemp=low //minimum temporal posmintemp=BARINDEX //postition of minimum temporal ENDIF IF high > highest[round(0.7*period)](high[1]) then maxtemp=high //maximum temporal posmaxtemp=BARINDEX //position maximum temporal ENDIF ENDIF // << Detecting and locating a local minimums >> // Where the LMA is crossing the smoothed LMA, there is a maximum or minimum nearby // If there is a new local min/max, the preivus one is stored in de varible B... (before) once LEVMIN=low once POSLEVMIN=1 once LEVMAX=high once POSLEVMAX=1 once bullcross=0 once bearcross=0 IF BARINDEX > PERIOD THEN //For avoid computer errors bullcross=LMA crosses over smoothLMA bearcross=LMA crosses under smoothLMA ENDIF IF bullcross and POSLEVMIN<>posmintemp THEN BLEVMIN=LEVMIN //previus local minimum is saved BPOSLEVMIN=POSLEVMIN LEVMIN=mintemp POSLEVMIN=posmintemp support=LEVMIN ENDIF // --> Detecting and locating a local maximum IF bearcross and POSLEVMAX<>posmaxtemp THEN BLEVMAX=LEVMAX //previus local maximum is saved BPOSLEVMAX=POSLEVMAX LEVMAX=maxtemp POSLEVMAX=posmaxtemp resistance=LEVMAX ENDIF support=min(low,support) resistance=max(high,resistance) // << DETECTING DOUBLE TOP OR BOTTOMS >> once WidthDoubleTop = high-low once WidthDoubleBottom = high-low once Wpattern=0 once Mpattern=0 // <<<<<< Double bottoms >>>>>>>>> //looking for the top between two local minimums IF bullcross THEN doublebottomtop=high[BARINDEX-POSLEVMIN+1] // we start looking for the top in between two local minimums //POSdoublebottomtop=BARINDEX-POSLEVMIN+1 FOR i = (BARINDEX-POSLEVMIN+1) to (BARINDEX-BPOSLEVMIN-1) DO IF high[i] > doublebottomtop THEN doublebottomtop=high[i] //POSdoublebottomtop=BARINDEX-i ENDIF NEXT WidthDoubleBottom = doublebottomtop-(BLEVMIN+LEVMIN)/2 // (top betwen local minimums) - (average of the las two local minimums) IF abs(BLEVMIN-LEVMIN) < Kdouble*WidthDoubleBottom THEN // we have a double bottom Wpattern=1 else Wpattern=0 ENDIF ENDIF // <<<<<<<<<< Double tops >>>>>>> //looking for the bottom between two local maximums IF bearcross THEN doubletopbottom=low[BARINDEX-POSLEVMAX+1] //POSdoubletopbottom=BARINDEX-POSLEVMAX+1 FOR i = (BARINDEX-POSLEVMAX+1) to (BARINDEX-BPOSLEVMAX-1) DO IF low[i] < doubletopbottom THEN doubletopbottom=low[i] //POSdoubletopbottom=BARINDEX-i ENDIF NEXT WidthDoubleTop=(BLEVMAX+LEVMAX)/2 -doubletopbottom IF abs(BLEVMAX-LEVMAX) < Kdouble*WidthDoubleTop THEN // we have a double top Mpattern=1 else Mpattern=0 ENDIF ENDIF // <<<<<<<<<< DOUBLE TOP AND DOUBLE BOTTOM FOR TRADING >>>>>>>> myATR=AverageTrueRange[2*period](close) IF Wpattern=1 THEN IF close > (doublebottomtop+myATR) or close < (LEVMIN-0.5*myATR) THEN Wpattern=0 // <<<< double bottom has been activated or it was cancelled >>>>> ELSE // <<<<<<< HERE WE HAVE A DOUBLE BOTTOM FOR TRADING >>>>> exactness=abs(BLEVMIN-LEVMIN) / WidthDoubleBottom ENDIF ENDIF IF Mpattern=1 THEN IF close < (doubletopbottom-myATR) or close > (LEVMAX+0.5*myATR) THEN Mpattern=0 //double top has been activated or it was cancelled ELSE // <<<<<<< HERE WE HAVE A DOUBLE TOP FOR TRADING >>>>> exactness= abs(BLEVMAX-LEVMAX) / WidthDoubleTop ENDIF ENDIF SCREENER[Wpattern=1 or Mpattern=1](exactness) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

many thanks Leo!!! Great!!

Great addition Leo, many thanks for your work on this project and for sharing the code with us! 😉

Thanks for your time invested here as well. I hope we all find a way to made a very profitable strategy out of it

Bonjour Léo,

est t’il possible d’avoir le code de l’indicateur ton Double haut et double fond, les screener ne m’est pas utile. Merci

Thanks Leo, great piece of code !

please help i dont know how to convert code to indicator

Thanks Very Much Leo, could you help us with an example of trading strategy using these signal?

the indicator is here: https://www.prorealcode.com/prorealtime-indicators/double-top-double-bottom-detector/

Merci beaucoup pour le partage à bientôt Leo.

Hi all,

We are adding all our ideas and improvements here :

https://www.prorealcode.com/topic/dobule-bottom-or-double-top/

Nice Screener ! Is it possible to screen when a green or red arrow appears ? thks in advance.

I do not focus so much in screeners. You can see our progress in the forum.

Cheers

it’s very good job léo

Is there a way to sort the results by price? Let’s say just return stocks under X price? Thanks

I am using the this code to buy or sell in a program which is not working

I am using

if [Wpattern=1 and (exactness) then

buy at market

endif

however system is not accepting the code for buy orders , what is the correct for buy?

Hi Leo. I am not an IT person so I need help to know how I can run this code. I am a trader in South Africa.

Download the itf file on this page, import it into your platform and run it through the ProScreener module.

Bonjour,

J’ai deux questions concernant Double top and double bottom detector – M&W patterns

a) A partir de quand les flèches dessinées sur le graphique sont-elles définitives, car :

https://www.prorealcode.com/prorealtime-indicators/double-top-double-bottom-detector/

« lokbuscas • 25/10/2017 #

Salut les signaux que la peinture est fantastique. Mais j’ai un doute. L’indicateur repeint-il? ? Dans le passé marque très bien des hauts et des bas Mais dans le présent je n’ai pas de stock que l’indicateur montre les signaux merci »

« Nicolas • 25/10/2017 #

Je ne pense pas que cet indicateur “repeigne” la façon dont vous pensez. Il donne des signaux après, mais il ne doit pas supprimer un signal donné une fois la barre fermée. »

b) Peut-on screener uniquement les flèches en fin de journée et quel en serait le code ?

Merci par avance pour vos réponses

Incredible workLeo. Thankyou to share you time and knowledge

what does the criteria mean in the box on the screen is it the time frame the screener searches ie 01.1hour TF , 0.2 2hour? thanks tom

Hello dear

Can you please write it also in java script?