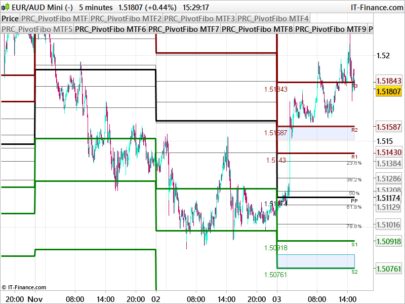

This is a stock screener that catch candlestick close which are within 1% of the last 65 days 61.8% retracement (38.2% for a up trend) of Fibonacci levels.

While price usually bounce on Fibonacci levels, this one can reveal good entry point for trend continuation.

|

1 2 3 4 5 6 7 8 9 10 |

hh = highest[65](high) ll = lowest[65](low) fib618 = (hh-ll)*0.618 level618 = ll+fib618 nearpercent = ABS(1-(close/level618))*100 SCREENER[nearpercent<1] |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Nicolas this seems to return in both directions, uptrend and downtrend.

would it still be accurate as 618 is being added to the low, shouldn’t it be subtracted from the high for uptrend retracement ect?

what if we wanted to confirm the resumption of the trend? would it be as simple as checking that the current high > low and vice versa?

Yes it returns 61.8% level, same as 38.2% one. Depends on how you are applying the retracement on a chart, from high to low or from low to high.

Hello Nicolas, I want t use this screener, but only results for uptrend. Is there a possibillity to ad a condition like “the ll has to be older than the hh? I tried something with barindex but I couldn´t code it.

Thank you for help.

Ahh yes of course, 61.8 one way, 38.2 the other. Any ideas on how to display graphically which candles were used for the retracement or plot the fib?

Yes of course, just write a short indicator with this code in it:

hh = highest[65](high)

ll = lowest[65](low)

RETURN hh,ll

Hola, Nicolas

Sigo intentando emplear este indicador para hacer un screener, y su ayuda me puede venir muy bien.

¿Se podría programar el indicador para que únicamente obtenga resultados cuando el máximo se produce después del mínimo? (para así detectar correcciones en tendencias alcistas; o todo lo contrario para las tendencias bajistas…).

Estaría bien que Nicolás ayudara en esto..

Saludos

Hi Nicolas.

Why the number of periods of 65?

The answer could be : “why not?” 🙂 There is no real reason for taking 65 or 72 periods..

Bonjour Nicolas,

Merci pour ce screener. Si je visualise bien son fonctionnement pour une tendance à la hausse, j’ai plus de mal à la baisse. Saurais-tu comment coder l’équivalent dans une tendance baissière ?

Je pense que cela a été fait dans le forum il y a quelques temps, il faudrait le retrouver toutefois.

Hello, I want t use this screener, but only results for uptrend. Is there a possibillity to ad a condition like “the ll has to be older than the hh? I tried something with barindex but I couldn´t code it.

Thank you for helb.