The detection of high volumes may be part of the arsenal strategy of many traders, especially swing traders .

This screener detects shares (or others) with high volume in the previous 3 days.

A volume is defined as high if it exceeds 3 times the average of the last 20 volumes .

The actions must have a volume of at least 10,000

The ” freshness signal ” means the age of the signal (from 1 to 3 days).

You are free to change these settings.

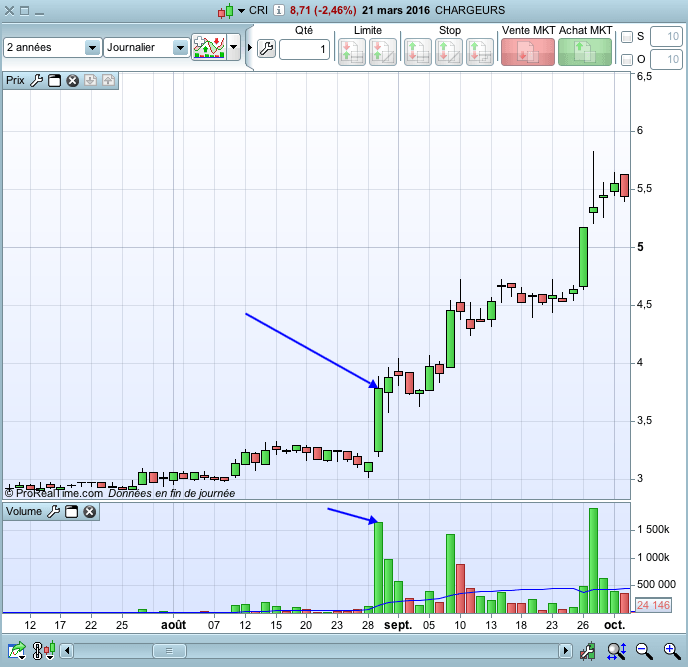

I used this screener to detect among other actions “CHARGEURS” , who introduced all the conditions for a nice increase : a bullish gap and a large green candle, with a very strong volume.

Here is the code of the screener. Remember to select the desired market (ie ” Euronext ” ) and timeframe ( for example, ” Daily” ) . In theory, the daily timeframe is best for this type of strategy (swing trading).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 |

fraicheursignal = -1 volumeminimum = 10000 IF fraicheursignal=-1 AND Volume > 3*(Average[20](Volume)) AND volume > volumeminimum THEN fraicheursignal = 0 ENDIF IF fraicheursignal=-1 AND Volume[1] > 3*(Average[20](Volume)[1]) AND volume > volumeminimum THEN fraicheursignal = 1 ENDIF IF fraicheursignal=-1 AND Volume[2] > 3*(Average[20](Volume)[2]) AND volume > volumeminimum THEN fraicheursignal = 2 ENDIF IF fraicheursignal=-1 AND Volume[3] > 3*(Average[20](Volume)[3]) AND volume > volumeminimum THEN fraicheursignal = 3 ENDIF c1 = (fraicheursignal>-1) SCREENER[c1](fraicheursignal AS "Fraîcheur du signal") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Merci pour ce Proscreener que je conte essayer des que j’aurais ouvert un compte chez un broker action à moins que les CFD fonctionne aussi sur ce screen?

Bonjour,

La détection de volumes élevés est surtout valable pour le marché actions.Par exemple, sur le forex ce n’est pas la même chose, c’est le nombre de fois où la valeur change.

Pour les CFD je ne sais pas, je pense que c’est comme pour le forex, car les données des CFD sont détenues par le broker.Cordialement,

Bonjour, oui certains brokers CFD ne “pricent” pas les cours actions, mais reprennent les cours officiels des places d’échanges (et MTF), et donc donnent les volumes.

Pour les autres je ne sais pas, mais c’est le cas pour IG, et donc pour ProrealTimeCFD, les volumes sont dispo. Sont-ils toujours corrects ? Il faudrait leur demander directement

Bonjour Doctrading,

Super code, merci.

Thanks for this screener. I would like the tool removed the shares that have been on the list very short time. Otherwise, these are displayed with the screener every day. Example least 200 days backwards, have tried but not succeeded. Could someone help me? / Thanks Robert

hello doctor!!

amazing job. I would like to ask u if it is possible to create an indicator like this in order to screen shares that have negotiated their maximum volumen of shares per week in THEIR WHOLE HISTORY.

Best regards!

bonjour, je voudrais utiliser ce screener pour trouver les titres qui, à l’ouverture de la journée ont des volumes croissants avec un délai de 10 minutes. Merci de votre aide