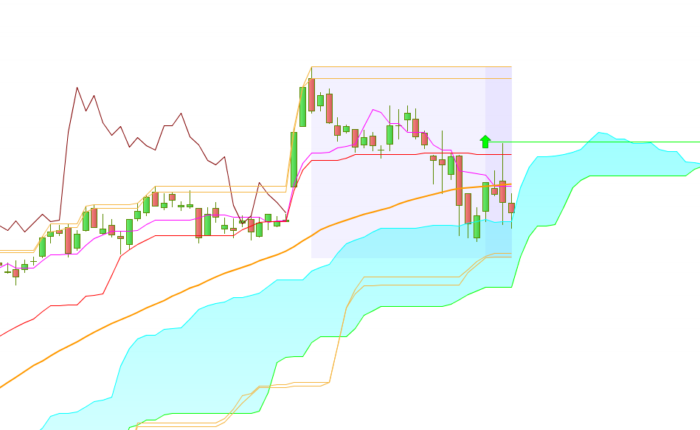

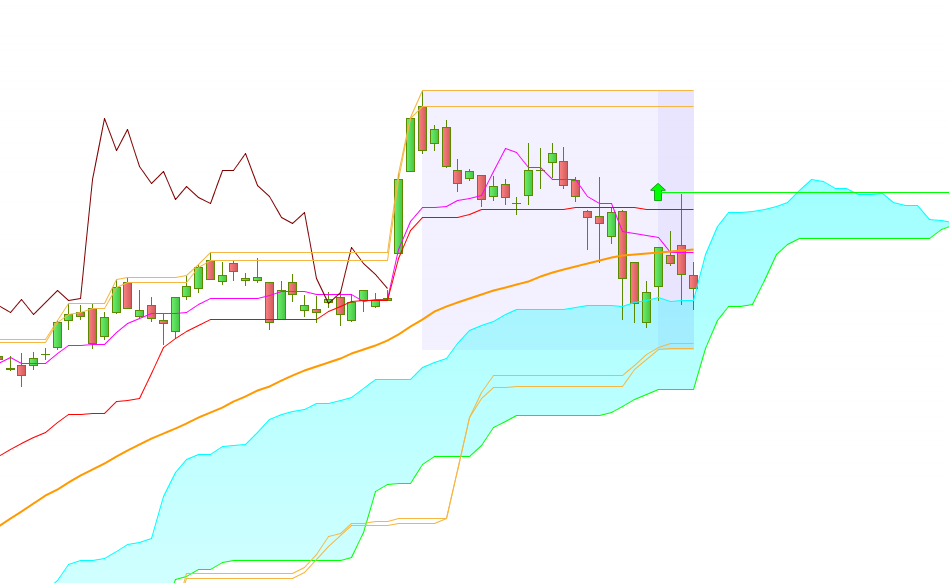

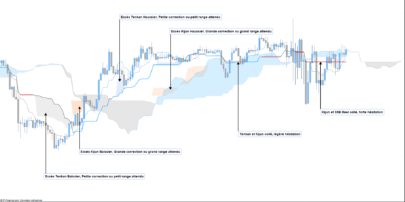

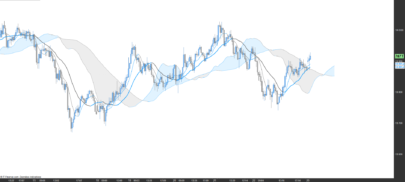

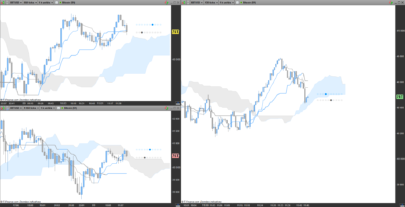

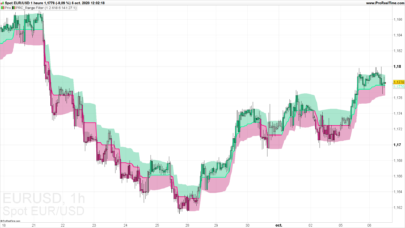

Still using Ichimoku, here is a screener for those who want to target neutral troughs. Nevertheless, it will be advisable to place oneself in an uptrend on the two upper timeframe in order not to engage in a risky trade (Weekly > Daily > 4H > 1H > 15M).

The stoploss can be placed slightly below the range, as the exit will invalidate the neutral trend. The criteria you will find on this screener is the ratio between the potential gain (high price distance of the range) and the risk (low price distance of the range). Be careful to check that the upper timeframe is bullish (above the cloud or Kumo).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 |

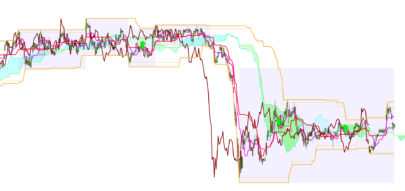

Tenkan = (highest[9](high)+lowest[9](low))/2 Kijun = (highest[26](high)+lowest[26](low))/2 SSpanA = (Tenkan+Kijun)/2 SSpanB = (highest[52](high)+lowest[52](low))/2 TWIST=(SSpanA[1] < SSpanB[1] and SSpanA > SSpanB) or (SSpanA[1] > SSpanB[1] and SSpanA < SSpanB) if inRange = 1 and (BorneSup < close or BorneInf > close) then inRange=0 endif if twist then if inRange <> 1 then inRange=1 BorneSup=highest[52](high) BorneInf=lowest[52](low) endif endif Chikou = close VALIDATECHIKOU=Chikou > SSpanA[26] and Chikou > SSpanB[26] RangeTop=highest[52](high) RangeFloor=lowest[52](low) LowestFloorProximity=(RangeTop - close)/(close - RangeFloor) screener[VALIDATECHIKOU and INRANGE](LowestFloorProximity) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials