Description

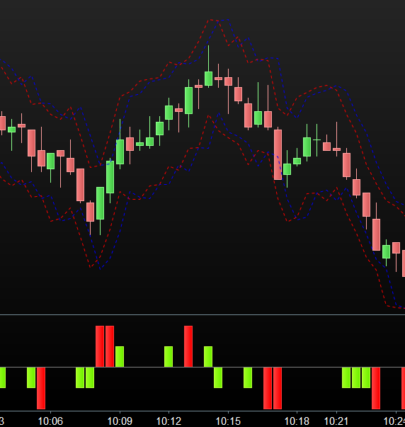

Screener that finds the larger market movements using relative volume and price.

Tips

Set the parameters while set-up your timeframe that you want to use.

The default ones are:

- 80 bars for volume and 10 for price

- filter tickers with 5% change in price versus the average and 5 times increased in volume versus the average(500%).

It is useful for scalping large volume – price movements

Comments

- Share your timeframe and paraments that works for you

- I did not want use average, but median. Unfortunately, median is not a build in function and I am not sure if we can use build-in functions.

my first shared code – so happy to hear improvements and meet-up

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 |

//------------------------------------------------------------------------------------------ // Prorealtime Screener: "Price Volume Ratio" //----------------------------------------------------------------------------------------- // Author: Ioannis Kyriakos // //------------------------------------------------------------------------------------------ // Description: // returns the ticks with the highest price and volume movements // with custom imported parameters // //------------------------------------------------------------------------------------------ // Parameters: // // @LookBackVolume: // number of bars to look back for volume // @LookBackPrice: // number of bars to look back for price // @DifPrice: // the minimum percent of price movement to look for // i.e. 5 is 5%, returns the ticks with price movement more than 5% or less than 5% // than the average // @DifVolume: // the minimum volume ratio to look for // .e. 5, returns the ticks with current volume ratio movement more than 5 times // versus the average one //----------------------------------------------------------------------------------------- // Set screener's parameters--------------------------------------------------------------- LookBackVolume = 80 LookBackPrice = 10 DifPrice = 5 DifVolume = 5 // Average price and volume AvgPrice = Average[LookBackPrice](close) AvgVolume = Average[LookBackVolume](volume) // Conditions for price and volume Upside = (close > AvgPrice * (100 + DifPrice) / 100) Downsize = (close < AvgPrice * (100 - DifPrice) / 100) PriceCondition = (Upside OR Downsize) VolumeCondition = (volume > AvgVolume * DifVolume) // Screener Output ------------------------------------------------------------------------- PriceDif = abs(100 * (1 - (close / AvgPrice))) // Screener -------------------------------------------------------------------------------- SCREENER[PriceCondition and VolumeCondition](PriceDif as "Price %") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials