Hi ProRealCoders,

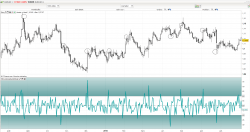

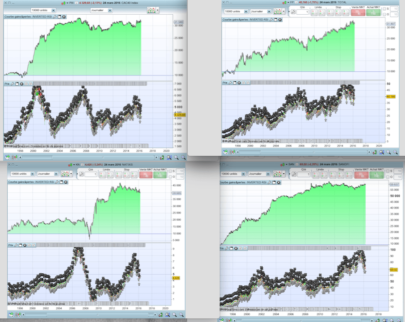

following my previous post about RSI Divergences Indicator, here is the Screener.

As described in my last post, you can adjust the screener by change ist parameters values.

While “RSI Divergences Indicator” has explicit parameters, in this case parameters must be set inside the code.

Ciao!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 |

//RSI Divergences Screener By Frank (Francesco) //Variables: //number of bars to calculare RSI value RsiPeriod = 10 //Oversold Level RsiOverSold = 30 //OverBought Level RsiOverBought = 70 //Minimum distance from two consecutive RSI Highs or RSI Lows MinBarRange = 3 MyRSI = rsi[RsiPeriod](Close) RsiMax = MyRSI < MyRSI[1] and MyRSI[1] > MyRSI[2] and MyRSI[1] > RsiOverBought RsiMin = MyRSI > MyRSI[1] and MyRSI[1] < MyRSI[2] and MyRSI[1] < RsiOverSold if RsiMax then RSIMax1 = MyRSI[1] High1 = High[1] for I = MinBarRange to 80 if RsiMax[I] then RSIMax2 = MyRSI[I + 1] High2 = High[I + 1] break endif next endif CondRibassista = RsiMax and ((High1 > High2 and RSIMax1 < RSIMax2) or (High1 < High2 and RSIMax1 > RSIMax2)) if RsiMin then RSIMin1 = MyRSI[1] Low1 = Low[1] for I = MinBarRange to 80 if RSIMin[I] then RSIMin2 = MyRSI[I + 1] Low2 = Low[I + 1] break endif next endif CondRialzista = RsiMin and ((Low1 < Low2 and RSIMin1 > RSIMin2) or (Low1 > Low2 and RSIMin1 < RSIMin2)) if CondRibassista then Result = -1 endif if CondRialzista then Result = 1 endif SCREENER[CondRibassista or CondRialzista] (Result as "Go") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Ciao Francesco. First of all thanks for the indicator and also fro the screener. I do have a question. Is there any chance to add another variable to the screener? For example if I want to exclude from the results those with a very low volume or price under 1€??? I’ve tried myself, but programming is not my strength and pro realtime “help”, doesn’t help much for such a case…

Grazie ancora.

Ciao to you all,

I also have a question and would be very happy for a helpful comment.

I am looking for a screener that shows me stocks of high relative strength according to Levy. That is not the RSI which is more common.

Has anybody found or coded such a screener?

All the best

!

PS: Thanks for your work!