This follows the simple logic that during a downtrend, when we see a hammer follows by a bullish candle, then it could be a reversal. This screener includes the first check, for the first bullish candle after the hammer. It only checks 3 downtrend candles, you could add more if you want an even stronger sign of downtrend, however you can easily see the trend when opening the charts. Enjoy!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 |

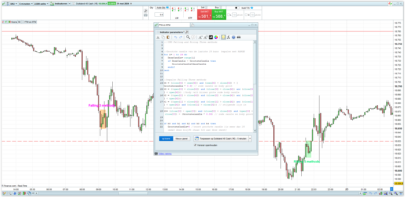

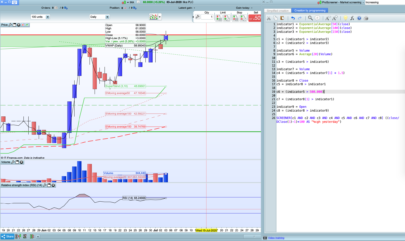

// Hammer Bullish is a downtrend follow by a hammer // that could indicate a reversal, // this screener includes a fairly good confirmation of that pattern // @Cristofer (= // V1, 20200708_01 currentHigh = High currentClose = Close currentOpen = Open // Bullish candle c1 = currentOpen < currentClose hammerHigh = High[1] hammerClose = Close[1] hammerOpen = Open[1] hammerLow = Low[1] // We check if it is a hammer (body < 30% of the range) and it closes extreamly close to the high bodyLessThan20OfRange = ABS((hammerClose - hammerOpen)/(hammerHigh - hammerLow)) <= 0.2 hammerClosesNearTheHigh = ((hammerClose / hammerHigh) > 0.90 OR (hammerHigh / hammerClose) > 0.90) itIsAHammer = (hammerClosesNearTheHigh AND bodyLessThan20OfRange) c2 = currentHigh > hammerHigh bearishHigh1 = High[2] bearishLow1 = Low[2] // It is a bearish candle, and it confirm a downtrend c3 = (bearishHigh1 > hammerHigh AND bearishLow1 > hammerLow) // We check that there is another candle that confirms downtrend, it could even be a bullish one bearishHigh2 = High[3] bearishLow2 = Low[3] // Lower highs, lower lows c4 = bearishHigh2 > bearishHigh1 c5 = bearishLow2 > bearishLow1 bearishHigh3 = High[4] bearishLow3 = Low[4] // Lower highs, lower lows c6 = bearishHigh3 > bearishHigh2 c7 = bearishLow3 > bearishLow2 SCREENER[itIsAHammer AND c1 AND c2 AND c3 AND c4 AND c5 AND c6 AND c7] |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Cristofer, thanks for sharing. Would it be possible to delete the confirmation candle after the hammer in the screener code? Only because many times the signal arrives late and it would be enough to exploit the candle immediately after the hammer to already make a gain of 2 or 3%.