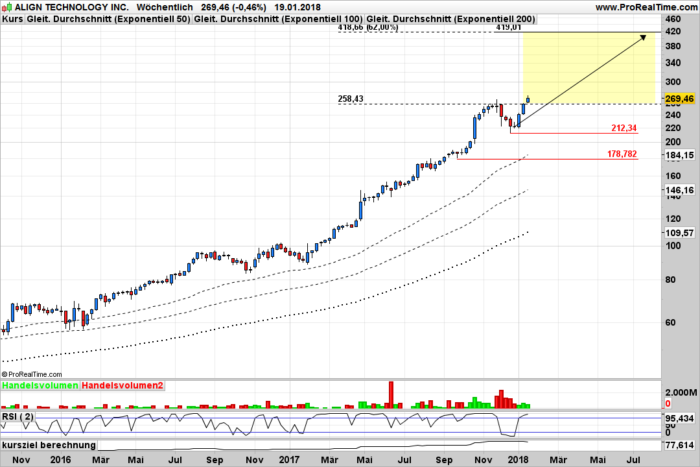

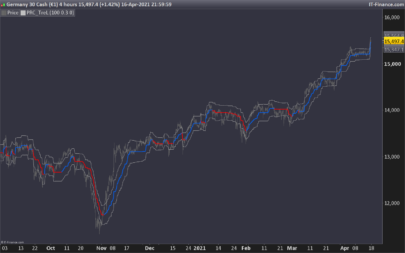

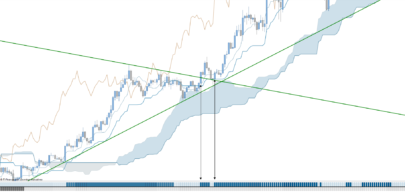

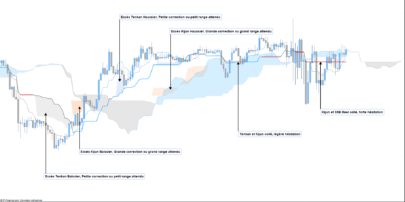

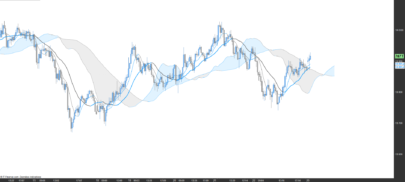

With this Screener you can find Stocks on Weekly Chart from 100 to 200 Weeks with a Stable Trend.

= System Quality Number ist over 2.5

And the RSI2 is under 10 – so you can find a great Entry in a strong UpTrend.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 |

// Suche einen stabilen Trend von 100 Wochen bis 200 Wochen ProfitSer = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA = Average[200](ProfitSer) sqn = sqrt(100) * ProfitSMA / STD[100](ProfitSer) ProfitSer1 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA1 = Average[104](ProfitSer1) sqn1 = sqrt(104) * ProfitSMA1 / STD[104](ProfitSer1) ProfitSer2 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA2 = Average[108](ProfitSer2) sqn2 = sqrt(108) * ProfitSMA2 / STD[108](ProfitSer2) ProfitSer3 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA3 = Average[112](ProfitSer3) sqn3 = sqrt(112) * ProfitSMA3 / STD[112](ProfitSer3) ProfitSer4 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA4 = Average[116](ProfitSer4) sqn4 = sqrt(116) * ProfitSMA4 / STD[116](ProfitSer4) ProfitSer5 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA5 = Average[120](ProfitSer5) sqn5 = sqrt(120) * ProfitSMA5 / STD[120](ProfitSer5) ProfitSer6 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA6 = Average[124](ProfitSer6) sqn6 = sqrt(124) * ProfitSMA6 / STD[124](ProfitSer6) ProfitSer7 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA7 = Average[128](ProfitSer7) sqn7 = sqrt(100) * ProfitSMA7 / STD[128](ProfitSer7) ProfitSer8 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA8 = Average[132](ProfitSer8) sqn8 = sqrt(100) * ProfitSMA8 / STD[132](ProfitSer8) ProfitSer9 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA9 = Average[136](ProfitSer9) sqn9 = sqrt(136) * ProfitSMA9 / STD[136](ProfitSer9) ProfitSer10 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA10 = Average[140](ProfitSer10) sqn10 = sqrt(140) * ProfitSMA10 / STD[140](ProfitSer10) ProfitSer11 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA11 = Average[144](ProfitSer11) sqn11 = sqrt(144) * ProfitSMA11 / STD[144](ProfitSer11) ProfitSer12 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA12 = Average[148](ProfitSer12) sqn12 = sqrt(148) * ProfitSMA12 / STD[148](ProfitSer12) ProfitSer13 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA13 = Average[152](ProfitSer13) sqn13 = sqrt(152) * ProfitSMA13 / STD[152](ProfitSer13) ProfitSer14 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA14 = Average[156](ProfitSer14) sqn14 = sqrt(156) * ProfitSMA14 / STD[156](ProfitSer14) ProfitSer15 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA15 = Average[160](ProfitSer15) sqn15 = sqrt(160) * ProfitSMA15 / STD[160](ProfitSer15) ProfitSer16 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA16 = Average[164](ProfitSer16) sqn16 = sqrt(164) * ProfitSMA16 / STD[164](ProfitSer16) ProfitSer17 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA17 = Average[168](ProfitSer17) sqn17 = sqrt(168) * ProfitSMA17 / STD[168](ProfitSer17) ProfitSer18 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA18 = Average[172](ProfitSer18) sqn18 = sqrt(172) * ProfitSMA18 / STD[172](ProfitSer18) ProfitSer19 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA19 = Average[176](ProfitSer19) sqn19 = sqrt(176) * ProfitSMA19 / STD[176](ProfitSer19) ProfitSer20 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA20 = Average[180](ProfitSer20) sqn20 = sqrt(180) * ProfitSMA20 / STD[1180](ProfitSer20) ProfitSer21 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA21 = Average[184](ProfitSer21) sqn21 = sqrt(184) * ProfitSMA21 / STD[184](ProfitSer21) ProfitSer22 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA22 = Average[188](ProfitSer22) sqn22 = sqrt(188) * ProfitSMA22 / STD[188](ProfitSer22) ProfitSer23 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA23 = Average[192](ProfitSer23) sqn23 = sqrt(192) * ProfitSMA23 / STD[192](ProfitSer23) ProfitSer24 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA24 = Average[196](ProfitSer24) sqn24 = sqrt(196) * ProfitSMA24 / STD[196](ProfitSer24) ProfitSer25 = ROC[1](Close) //Bar = Barindex - 1 ProfitSMA25 = Average[200](ProfitSer12) sqn25 = sqrt(200) * ProfitSMA25 / STD[200](ProfitSer25) // 25 Variablen werden nach einem SQN über 2.5 abgetastet c0 = sqn > 2.5 c1 = sqn1 > 2.5 c2 = sqn2 > 2.5 c3 = sqn3 > 2.5 c4 = sqn4 > 2.5 c5 = sqn5 > 2.5 c6 = sqn6 > 2.5 c7 = sqn7 > 2.5 c8 = sqn8 > 2.5 c9 = sqn9 > 2.5 c10 = sqn10 > 2.5 c11 = sqn11 > 2.5 c12 = sqn12 > 2.5 c13 = sqn13 > 2.5 c14 = sqn14 > 2.5 c15 = sqn15 > 2.5 c16 = sqn16 > 2.5 c17 = sqn17 > 2.5 c18 = sqn18 > 2.5 c19 = sqn19 > 2.5 c20 = sqn20 > 2.5 c21 = sqn21 > 2.5 c22 = sqn22 > 2.5 c23 = sqn23 > 2.5 c24 = sqn24 > 2.5 c25 = sqn25 > 2.5 // Einer der 25 Variablen musst über 2.5 liegen c25 = c0 or c1 or c2 or c3 or c4 or c5 or c6 or c7 or c8 or c9 or c10 or c11 or c12 or c13 or c14 or c15 or c16 or c17 or c18 or c19 or c20 or c21 or c22 or c23 or c24 or c25 // Penny Stock Filter c26 = close > 5.0 // Ausverkauf c27 = RSI[2](close) < 10 //Ausverkauf muss heute oder gestern stattgefunden haben // Volumenfilter 3 Mio Handelsvolumen eines S-Dax Wertes c29 = ExponentialAverage[52](volume*close) > 3000000 SCREENER[c25 and c26 and c27 and c29] sort by volume*close |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

thank you very nice screener