Trend following – Swing trading entry, screening of VZ

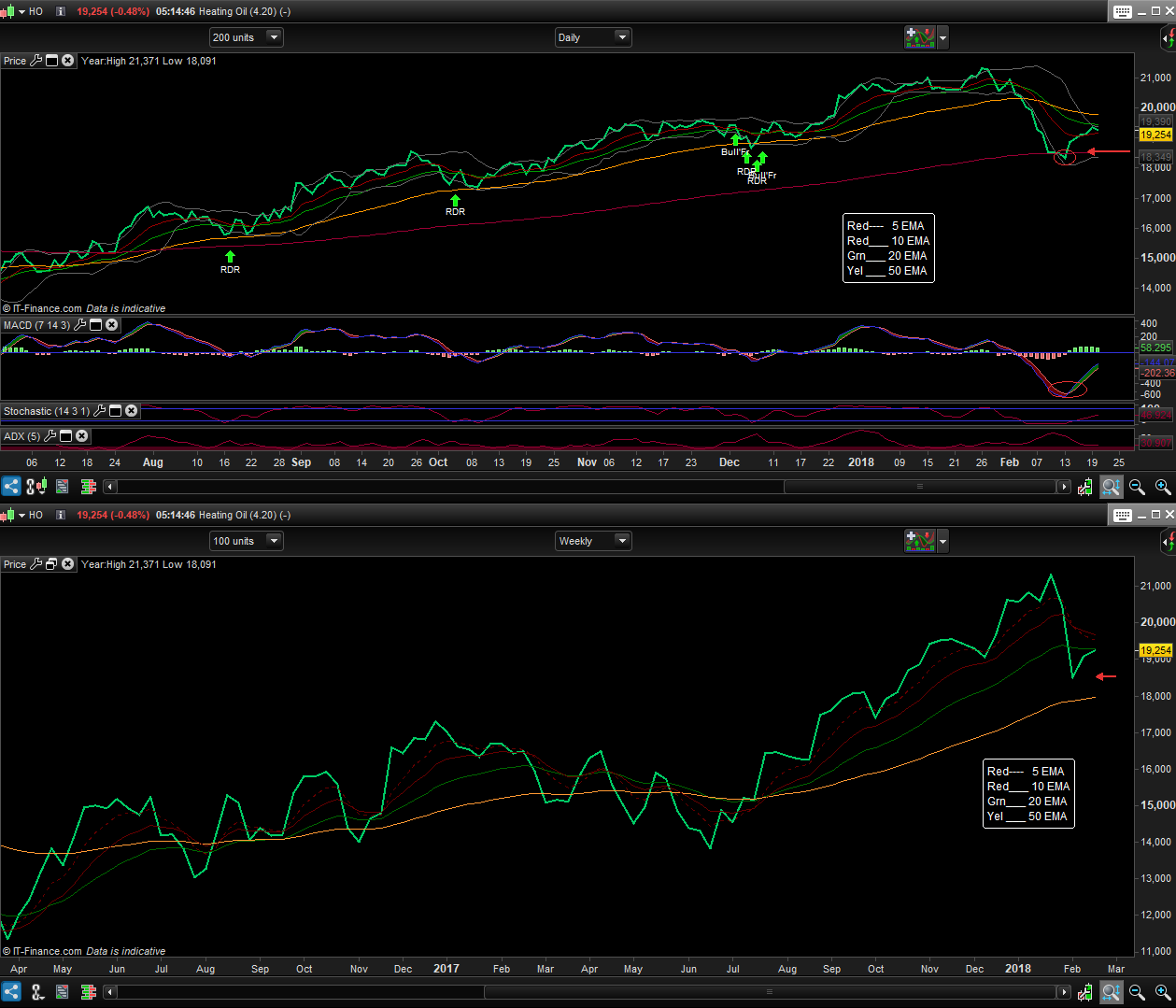

- W(Weekly tf): Screening for trend 10 vs. 20W EMA (can be optimized by 5, 10, 20, 50..).

- W(Weekly tf): Screening for price (close) crossing 20W EMA (can be optimized by 5, 10, 20..).

- D(Daily tf): Screening for MACD (close) crossing the Signal line (X-over in Up / X-under in Dn. -trends)

- Cherry picking: Copy the best results to a Hot-list that is observed in 4H + 1H charts, pending an entry trigger

Next step:

- create a screener for the entry trigger in 4H+1H

- Backtesting trading system based on the trigger

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 |

TIMEFRAME(Weekly) // //-Indicators indicator0 = ExponentialAverage[10](close) indicator1 = ExponentialAverage[50](close) // //-Trend: DnTrendW = ( indicator0[5] < indicator1[5] ) UpTrendW = (indicator0[5] > indicator1[5]) // //Value-Zone, price retracement (Zone-level = Indicator20) indicator13 = ExponentialAverage[20](close) VZinDnTrendW = (close[0] >= indicator13[0]) VZinUpTrendW = (close[0] <= indicator13[0]) // TIMEFRAME(Daily) // //-A trending trend[W], correction[W])MACD-line crossing Signal-line[D] // indicator10 = MACDline[7,14,3](close) indicator11 = ExponentialAverage[3](indicator10) VZinUpTrendD = indicator10 >= indicator11 VZinDnTrendD = indicator10 <= indicator11 // TIMEFRAME(DEFAULT) // DnTrendSummary = DnTrendW AND VZinDnTrendW AND VZinDnTrendD UpTrendSummary = UpTrendW AND VZinUpTrendW AND VZinUpTrendD // //-DnTrend // If DnTrendSummary then myTrend = -1 else myTrend = 0 Endif // //-UpTrend // If UpTrendSummary then myTrend = 1 else myTrend = 0 Endif // //-Summary // If mytrend = 1 then Filter = 1 Elsif myTrend = -1 then Filter = 1 else Filter = 0 endif SCREENER[Filter] (myTrend AS "Lng.1|Sht.-1") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thank you for this valuable stock screener. However, I can’t get bearish signals with the code (mytrend=-1)?

To “backtest” the signals, we could compare the actual Close with the Close when the signal occurred X bars ago in ProScreener.

Thanks for your advice, that is useful and I will study that option. I found that problem as well, and have developed it further. Are there any way that I can edit it online at this time ? (Or, alternatively how do I proceed ? )

You can send me updates through the form on the contact page: https://www.prorealcode.com/contact/

Thank you very much for your contribution!

Thank you ! Have you realised your “next step” ?

guten Tag, gibt es bereits die Aktualisierte Datei?

Gents – An update – I have been studying various trading approaches, as this one that is based on the moves in a trend, detecting triggers on the variations within. I was not able to find satisfactory repeatable and predictive outcome. As you know, here is where the money management kick in and the end-result comes form the balance between. If i may suggest a way forward, tweak the parameters on for example an instrument that by observations moves less random than often seen by forex and if successful in no less than 4 out of 10 triggers – the rest is done by money management. (I have moved over to more trend following on longer timeframes W and M to mitigate the stress of the trading “robots” as it took too much an effort to deal with it.) P