The Volatility Compression Breakout screener is designed to identify periods of low volatility followed by potential market breakout opportunities. It aims to capture moments when the price consolidates within a narrow range, indicating a decrease in volatility, and anticipates a subsequent expansion in price movement. This indicator can be applied to any financial instrument and period.

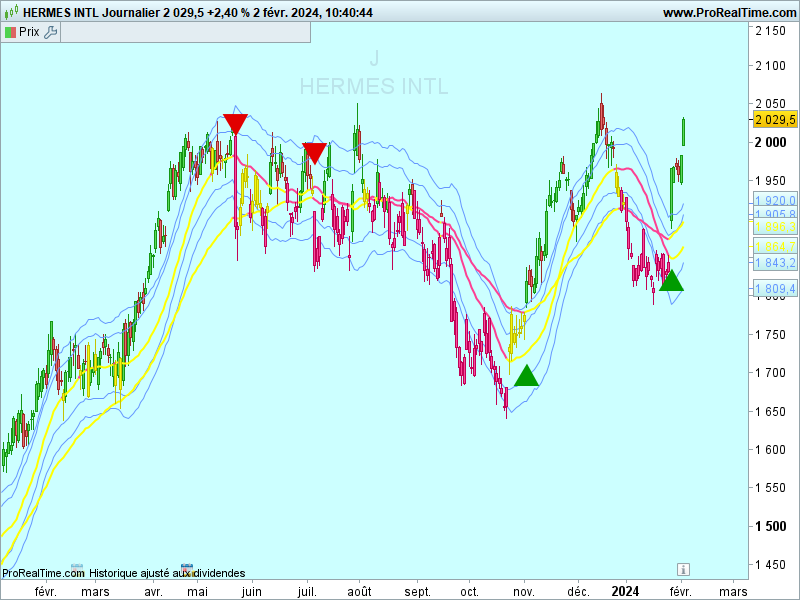

You can also use the indicator to display the breakout on your price chart: VOLATILITY COMPRESSION BREAKOUT

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 |

compressionPeriod =20 compressionMultiplier = 1.5 emaPeriod = 50 signal=0 atr =AverageTrueRange[14] keltnerMiddle = KeltnerBandCenter[compressionPeriod] keltnerUpper = keltnerMiddle + (compressionMultiplier * atr) keltnerLower = keltnerMiddle - (compressionMultiplier * atr) // Calculer l'écart type stdDev = STD[compressionPeriod](close) // Calculer le filtre de tendance ema = ExponentialAverage[emaPeriod](close) // Déterminer les conditions de rupture breakoutUp =(high > (keltnerUpper + stdDev)) and close > ema and close[1] <= ema[1] breakoutDown = (low < (keltnerLower - stdDev)) and close < ema and close[1] >= ema[1] // Tracer des formes de répartition if breakoutUp THEN signal=1 endif if breakoutDown THEN signal=2 endif F=signal=1 or signal=2 SCREENER[F] (signal as "signal") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials