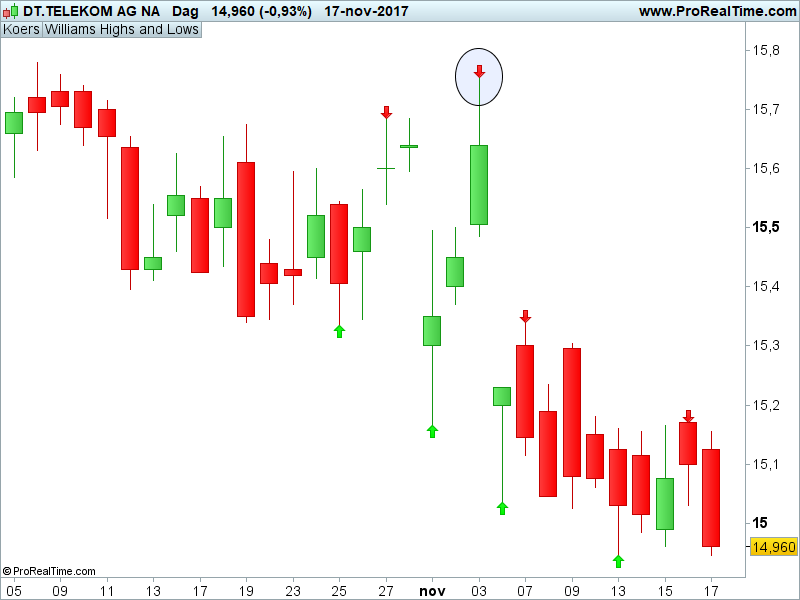

Stock screener based on Williams Highs and Lows indicator made by @gabri

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 |

//Williams SwingPoints // 20-11-2017 // Violet, extension of on Gabri's algo //Test for insidebar insidebar = high < high[1] and low > low[1] if not insidebar and high > alto[1] then alto = high basso = low markup = barindex markhigh = high endif if not insidebar and low < basso[1] then alto = high basso = low markdown = barindex marklow = low endif if alto < alto[1] and trend = 1 then trend = 0 thisbar = markup mediummarkup = shortmarkup shortmarkup = markup longmarkhigh = mediummarkhigh mediummarkhigh = shortmarkhigh shortmarkhigh = markhigh if longmarkhigh < mediummarkhigh and mediummarkhigh > shortmarkhigh then longmarkUpset = 1 thisbar = mediummarkup else longmarkUpset = 0 endif endif if basso > basso[1] and trend = 0 then trend = 1 thisbar = markdown mediummarkdown = shortmarkdown shortmarkdown = markdown longmarklow = mediummarklow mediummarklow = shortmarklow shortmarklow = marklow if longmarklow > mediummarklow and mediummarklow < shortmarklow then longmarkDownset = 1 thisbar = mediummarkdown else longmarkDownset = 0 endif endif whichbar = barindex - thisbar LookbackPeriods = 1 signalUP1 = trend = 1 and not longmarkUPset and whichbar <= LookbackPeriods signalUp2 = trend = 1 and longmarkUpset and whichbar <= LookbackPeriods signalDn1 = trend = 0 and not longmarkDownset and whichbar <= LookbackPeriods signalDn2 = trend = 0 and longmarkDownset and whichbar <= LookbackPeriods if signalup1 then type = 1 // arrowup elsif signalup2 then type = 2 // ellipse at bottom elsif signalDn1 then type = -1 // arrowdown elsif signalDn2 then type = -2 // ellipse at top endif signal = SignalUP1 OR signalUP2 or SignalDn1 OR signalDn2 screener [ signal ] sort by type |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks Violet,

You can try also this version (for long only)

if (high>alto[1]) and not (highlow[1]) then

alto=high

basso=low

markup=barindex

markhigh=high

endif

if (low<basso[1]) and not (highlow[1]) then

alto=high

basso=low

markdown=barindex

marklow=low

endif

if alto<alto[1] and trend=1 then

trend=0

mediummarkup=shortmarkup

shortmarkup=markup

longmarkhigh=mediummarkhigh

mediummarkhigh=shortmarkhigh

shortmarkhigh=markhigh

//intermediate high swing points

if longmarkhighshortmarkhigh then

imhighold=imhighnew

imhighnew=mediummarkhigh

//refhigh=shortmarkup

endif

if imhighold>imhighnew then

refhigh=mediummarkup

endif

endif

if basso>basso[1] and trend=0 then

trend=1

mediummarkdown=shortmarkdown

shortmarkdown=markdown

longmarklow=mediummarklow

mediummarklow=shortmarklow

shortmarklow=marklow

//intermediate low swing points

if longmarklow>mediummarklow and mediummarklow<shortmarklow then

imlowold=imlownew

imlownew=mediummarklow

//reflow=shortmarkdown

endif

if imlowold<imlownew then

reflow=mediummarkdown

endif

endif

//long conditions

c1=imlowold=mediummarklow

//short conditions

c2=imhighold>imhighnew and (highest[barindex-refhigh+1](high))<=mediummarkhigh

screener[c1 and not c2] (c1)

Bonjour .

il faudrait créer un screener qui détecte toutes les actions avec une flêche plus ellipse a l’ achat .

Bonjour Gabri ton screener ne marche pas .

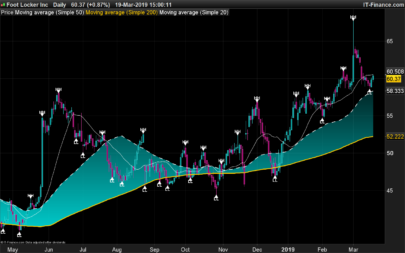

tu peux créer un screener à l’ achat, avec avec flêche plus ellipse et MM50 > MM200 .

Cordialement .

Try also Violet screener, it seems really good.

BZH22, i don’t understand why the indicators and the screeners are not working on your computer. Try to check the settings because on mine it runs smoothly. For you can add:

c3=average[50](close)>average[200](close)

screener[c1 and c3 and not c2] (c1)

BZH22, i don’t understand why the indicators and the screeners are not working on your computer. Try to check the settings because on mine it runs smoothly. For you can add:

c3=average[50](close)>average[200](close)

screener[c1 and c3 and not c2] (c1)

Merci Gabri pour les MM50 et MM200

Violet , when trying to automate this my trades are not opening at the same entry point as where this circle are drawn, have you tried that?

Abz, the arrows and circles are only the *first part* of a trade setup. If certain conditions are met (as defined in the algorithm), then the signal comes on the bar/candle immediately following the arrow/circle, which forms the *second part* of the setup.

Please carefully read the comments/discussions on the “Wlliams’ Highs And Lows” indicator, presented by Gabri, on which this screener is based. It is by design that the actual trade signal (entry or exit point) can only come on the following bar/candle. The two bars/candles work in tandem to produce the signal.

Mind you, never use indicators and screeners if you do not know exactly what conditions they are searching for.

Violet,

you did an excellent job. I attached here

https://www.prorealcode.com/prorealtime-indicators/williams-highs-lows/

also my version of the screener.

HI GABRI, if the cirled arrow is the intermediate point in which You can define your entry and stop loss what is the meaning of the other arrows (without circle)?