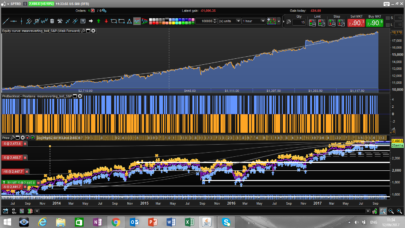

I found the baseline of this long only code online and did a few small changes to it.

It works as follow:

Entry rules:

- 2 periods moving average 1 day ago is greater than moving average of today.

- 2 periods moving average 10 days ago is greater than 11 days ago.

- Close above 7 periods moving average

Exit rule:

When the first entry rule is no longer true; exit.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 |

DEFPARAM CumulateOrders = False DEFPARAM PreloadBars = 200 //Position size positionsize = 10 //Indicators ma1 = average [2](close) ma2 = average [7](close) // Entry condition // b1 = moving average at close of one day ago is greater than the moving average of today // b2 = moving average at close 10 days ago is greater than the moving average of the close 11 days ago b1 = ma1[1]>ma1[0] b1 = b1 and ma1[10]>ma1[11] b1 = b1 and close > ma2 // Entry if b1 then buy positionsize contracts at market endif // Exit e1 = ma1[1]<=ma1[0] if e1 then sell at market endif // Stoploss set stop ploss 100 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

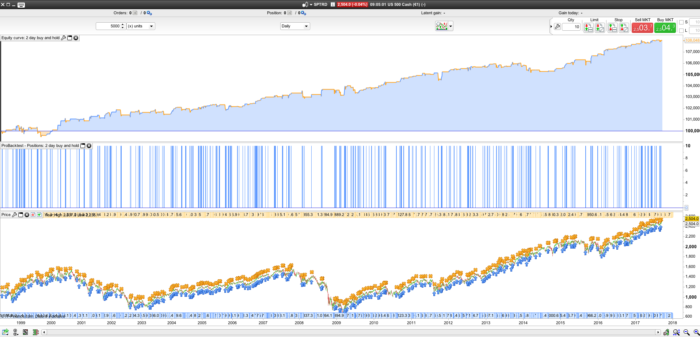

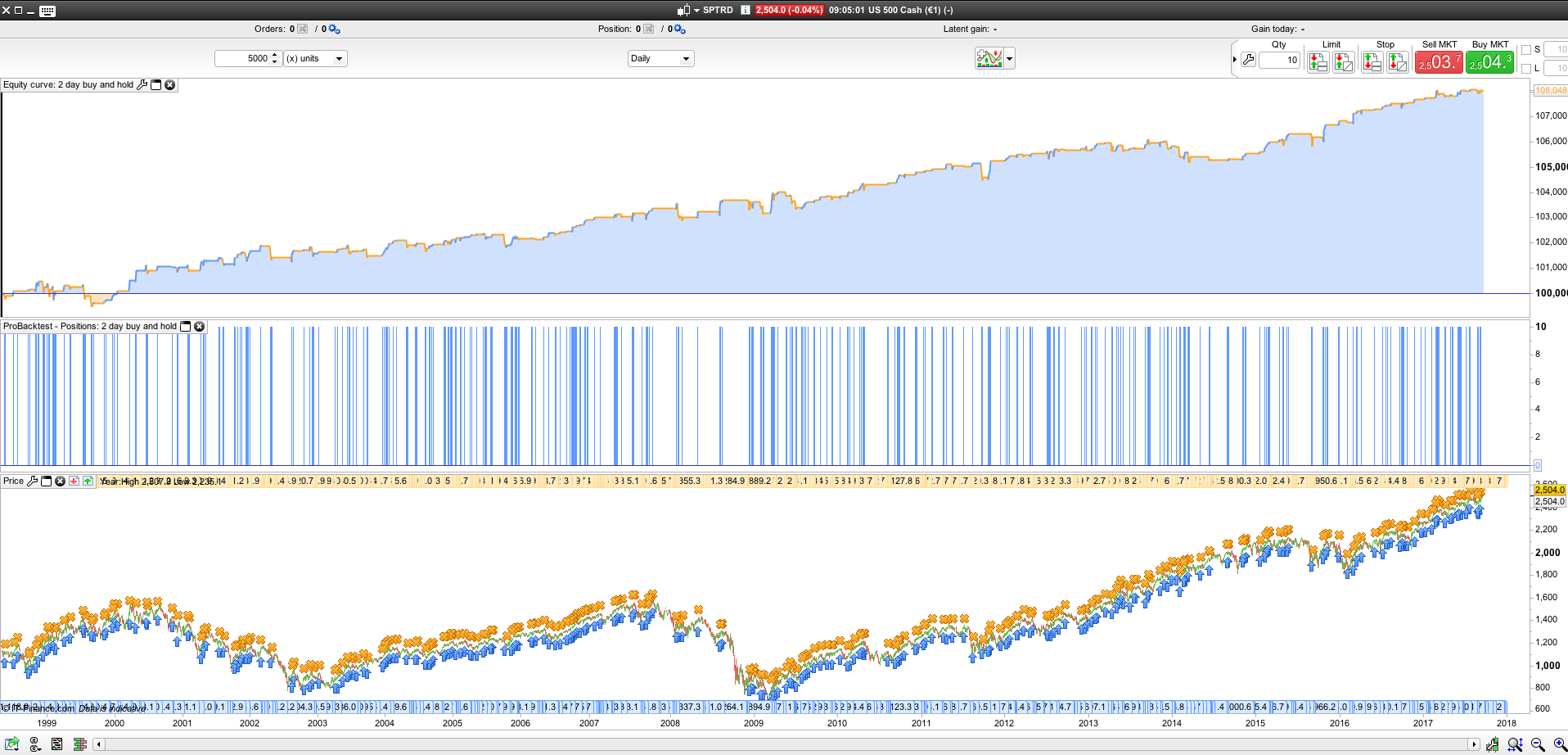

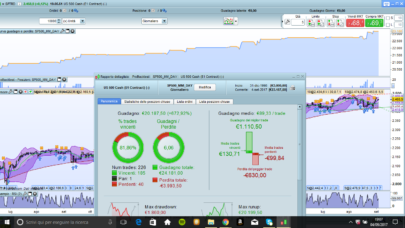

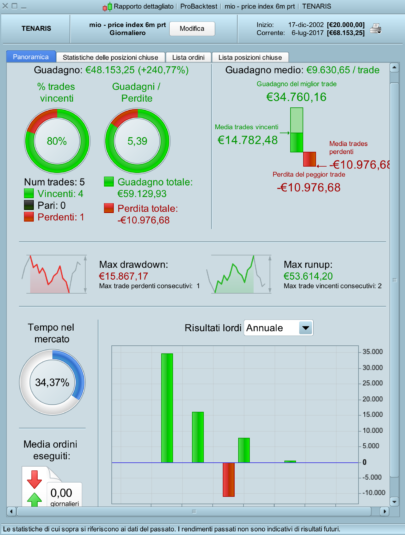

Thank you Victor, I added a full ‘buy and hold’ chart comparison as an attached file.

Thanks for the comparsion. This code would need some additional money management to take advantage of the steady equity curve in order to make sense. The selection of number of days to use for entry signal can also be optimised for a better return.

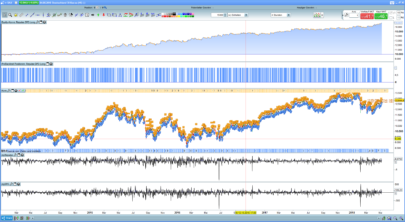

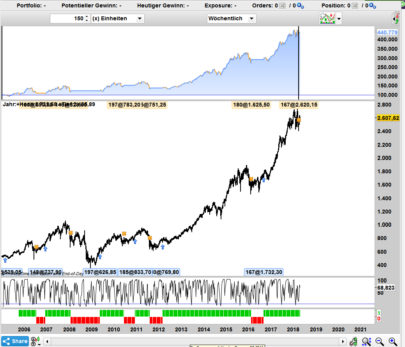

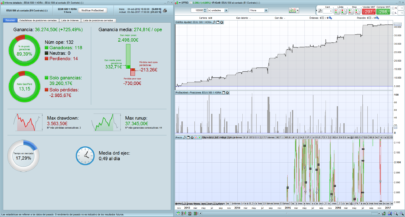

Hi victor, below “Buy Sell and Hold” code optimized with money management on DAX 4h. Thank’s

DEFPARAM CumulateOrders = False

DEFPARAM PreloadBars = 200

// Money Management

Equity = 500+(StrategyProfit*3)

Risk = 0.1

n = Max(1,Equity*Risk/51/PipValue)

// ————

Losses = positionperf(38)>0

Wins = positionperf(38)ma1[0]

b1 = b1 and ma1[10]>ma1[11]

b1 = b1 and close > ma2

b3 = ma1[1]<ma1[0]

b3 = b3 and ma1[10]<ma1[11]

b3 = b3 and close < ma2

// Entry

if b1 then

buy positionsize contracts at market

endif

if b3 then

sellshort positionsize contracts at market

endif

// Exit

e1 = ma1[1]ma1[0]

if e1 and longonmarket then

sell at market

endif

if e3 and shortonmarket then

exitshort at market

endif

// Stoploss and Profit

set stop %loss sl

set target %profit tp

thanks! works alright but I think something when wrong in the last part of the code you attached (from “b3” and down)? There is no command for entry.

thanks victor! below the original code modified with no errors.

//————————————————————————-

// Code principal : buy sell and hold DAX 4h

//————————————————————————-

DEFPARAM CumulateOrders = False

DEFPARAM PreloadBars = 200

// Money Management

Equity = 500+(StrategyProfit*3)

Risk = 0.1

n = Max(1,Equity*Risk/51/PipValue)

// ————

Losses = positionperf(38)>0

Wins = positionperf(38)ma1[0]

b1 = b1 and ma1[10]>ma1[11]

b1 = b1 and close > ma2

b3 = ma1[1]<ma1[0]

b3 = b3 and ma1[10]<ma1[11]

b3 = b3 and close < ma2

// Entry

if b1 then

buy positionsize contracts at market

endif

if b3 then

sellshort positionsize contracts at market

endif

// Exit

e1 = ma1[1]ma1[0]

if e1 and longonmarket then

sell at market

endif

if e3 and shortonmarket then

exitshort at market

endif

// Stoploss and Profit

set stop %loss sl

set target %profit tp

Hi! it’s still incorrect. There’s something wrong when you copy codes to this comment section. I’ve had this problem here too. If you don’t mind could you pls put the code in a new forum topic?

Hi! replace the code at the line 43 by the code below. Thank’s

b3 = ma1[1]<ma1[0]

b3 = b3 and ma1[10]<ma1[11]

b3 = b3 and close < ma2

// Entry

if b1 then

buy positionsize contracts at market

endif

if b3 then

sellshort positionsize contracts at market

endif

// Exit

e1 = ma1[1]ma1[0]

@Nicolas do you think you can solve the issue with copy paste code into this comment field? Thanks

I’m sorry but it impossible to post the original true code. May be, Nicolas can solve this problem.

I’m aware of this comment engine issue. Would you mind send me the code as I could try to fix the problem, probably due to the codes’characters.. Please use the contact form: https://www.prorealcode.com/contact/

Thanks a lot for your help!

I don’t send the original code by the contact form:https://www.prorealcode.com/contact/. The contact form don’t run when i push on the button “send”.

Send me the code with email: nicolas[at]prorealcode.com

The problem is that the markup is assuming you’re writing. markup 🙂

Try the code tags, might do the trick, e.g.

b3 = ma1[1]<ma1[0]

Well that didn’t work. Next attempt:

b3 = ma1[1]<ma1[0]

https://www.freeformatter.com/html-escape.html#ad-output (Try this site)

Sorry for the problem. It should be fixed now. Post code and refresh the page, then codes should no longer been truncated.

Since 2018 this strategy leads to bankruptcy)))))))

You do not HAVE to run it

As an exersize in writing code its fine but as a tool to make money not so much . If you happy with less than treasury bond returns this is for you .