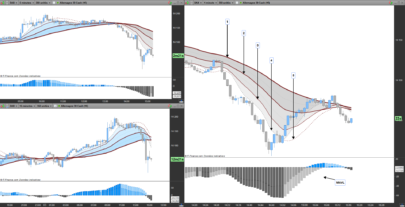

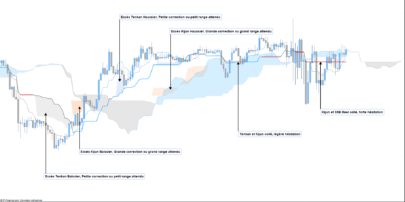

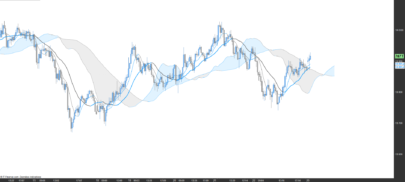

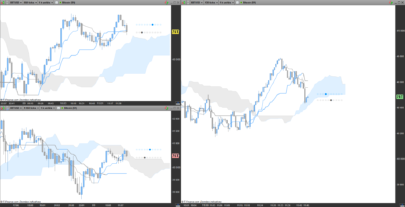

This strategy uses the “52-week-high entry point” indicator and the “Wilder’s ARC” stop and reverse. It works extremely well with stocks with high CSI or ADXR and using these stocks in portfolio.

When price breaks the last 52 weeks high, a new order is launched. After 10 bars, the Wilder ARC indicator act as a trailing stop. Initial stop loss is set to 15%.

To test and use this strategy, please download the Wilder’s ARC indicator also.

Blue skies!!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 |

DEFPARAM CumulateOrders = false cutbasso=(highest[254](high[1])-1.5*std[254](close[1])) // Entering long position c1 = (close crosses over cutbasso*1.03) IF c1 THEN BUY 3000 CASH AT MARKET count=barindex ENDIF // Exiting long position ARCstop = CALL "Wilder's ARC"[7, 3] c2=barindex-count>10 c3=close crosses under arcstop if ((close crosses under cutbasso*.97) and c2) or (c3) then//and close<=close[130] then//barindex-conto>hold then sell at market endif set stop %loss 15 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials