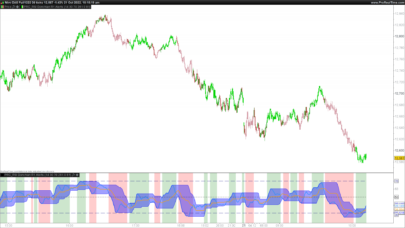

It is just one version of the 2RSI strategy originated by Connors. It is tested and optimized by me to work on the weekly timeframe. It gives good results on major indexes without changing any parameter.

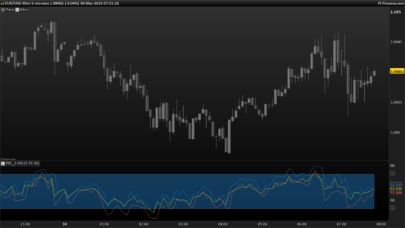

This weekly strategy can be used both for automatic trading and advisor for manual entry during the weekdays while the strategy gives an entry signal (I use also an indicator replying the strategy).

Any suggestion or improvement is welcome.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 |

// PRT-RSI-10/6e90/94-week // Author: Superfalcio //Applicable assets: //China A50 //EU Stoxx //Fra40 //FTSE100 //Ger40 //Ita40 //Japan //US500 //US Tech //WS //Time Frame: Weekly Defparam cumulateorders = true //Size plan LONG L1=1 L2=1 // Size plan SHORT S1=1 S2=1 // INDICATORS indicator0 = average[50](close) indicator1 = RSI[2](close) ONCE posA = 0 ONCE posV = 0 // LONG PLAN 1 CL1 = close >indicator0 CL2 = indicator1<=10 IF posA = 0 and CL1 and CL2 THEN buy L1 shares at market tradeprice1 = close barencours = barindex posA = 1 ENDIF // LONG PLAN 2 IF posA = 1 and barindex - barencours>= 1 THEN IF indicator1<=6 THEN buy L2 shares at market tradeprice2 = close barencours = barindex posA = 2 ENDIF ENDIF // EXIT LONG IF posA>0 and indicator1>70 THEN Sell at market posA = 0 ENDIF // SHORT PLAN 1 CS1 = close <indicator0 CS2 = indicator1>=90 IF posV = 0 and CS1 and CS2 THEN sellshort S1 shares at market tradeprice1 = close barencours = barindex posV = -1 ENDIF // SHORT PLAN 2 IF posV = -1 and barindex - barencours>= 1 THEN IF indicator1>=94 THEN sellshort S2 shares at market tradeprice2 = close barencours = barindex posV = -2 ENDIF ENDIF // EXIT SHORT IF posV<0 and indicator1<30 THEN exitshort at market posV = 0 ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

A courtesy, you can also post the indicator you use for manual operations? Thank you

I need to fix it a little bit before to post…

Since today, you can find the indicator in the Indicator section.

It is named:

Indicator to support the strategy: “A based on 2RSI weekly strategy working on indexes”.

Hi Superfalcio, can you explain, in short, the Connor’s 2Rsi strategy?

The original one is based on 1 day timeframe and for stocks/indexes. Buy setup: price >SMA200 and 2-RSI < 10 (the concept is to have a retracement in a stable trend). Sell setup: the opposite.

You can find tons of variants in internet and also in Prorelacode there are same example, for istance:

https://www.prorealcode.com/prorealtime-trading-strategies/rsi-2-strategy-larry-connors/

Since today, you can find the indicator in the Indicator section.

It is named:

Indicator to support the strategy: “A based on 2RSI weekly strategy working on indexes”.

@luxrun

Hey! Has this system been running live for anytime before you posted?

I kind of…. as it is weekly, it is running demo, and manually I decide if operate or not. You have time even during the weekdays after the signal. 🙂

Alright, did you create the system on any in-sample data and what period was that compared to the Out of sample data? Or what method did you use to test it’s robustness?

Just created the system with in-sample data. To support its robustness e can take into consideration that the same system is working well, with comparable performances also with the most part of main indexes and with diferent timeframe (anyway close to 1 week).

I will try to make further simulations with out of sample data as your question is suggesting me. Any simulations from your side is welcome!

Hi, thank you for the this. Is it possible to create a screener from this indicator, so that we can filter those who are in buy/short signal at the moment?

Brs

Hi Guys. This looks very interesting but don’t overnight fees kill the profit when trading on IG ?

Yes, you cannot use CFDs on IG for Weekly strats you need to use their Index Futures, they have wider spreads but no overnight cost.

Thanks. I did not know IG had Futures. I am always missing an info or a detail. I used to think: Futures = IB and IG = CFD . Learning goes on !!

Last very good gain of the system: positions on Eurostoxx50 closed yesterday friday 06/12/2024.