Hi all,

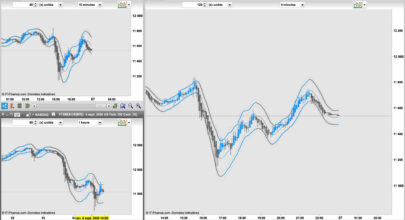

This strategy can be applied on any timeframe.

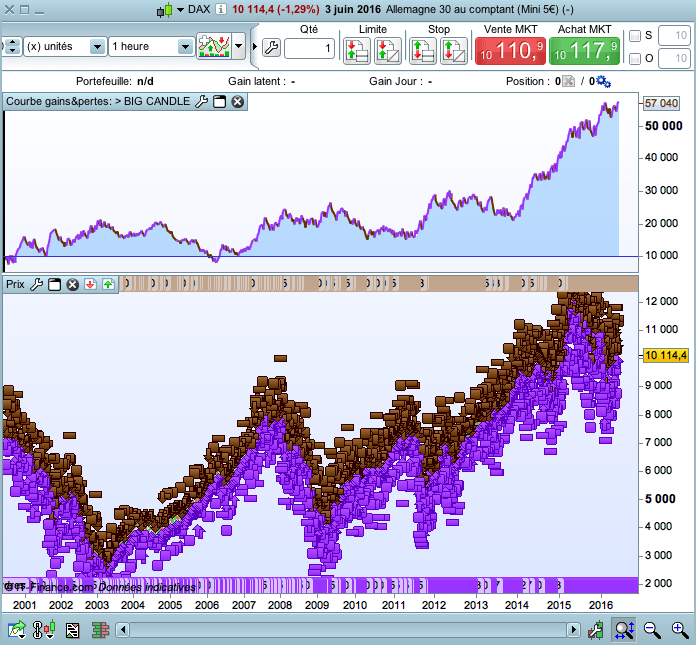

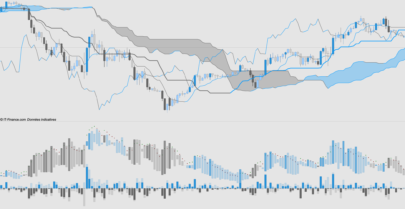

It seems to be very very profitable on M15 timeframe on the DAX. But because of the spread, it’s not really winning.

So you must test it on > H1 timeframe.

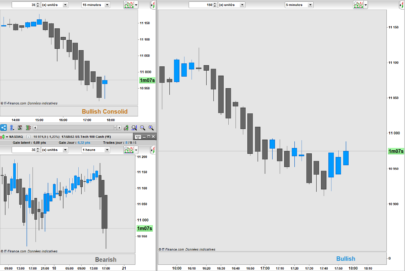

The strategy takes position with a “big candle”, which breaks the highest(8) or lowest(8), and with an amplitude > ATR(24).

The take profit is same to the stop loss * 1.5

The backtest is made with 1 point spread on the DAX (trades taken from 09AM to 5PM).

Maybe someone could improve it.

Best regards,

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 |

DEFPARAM CumulateOrders = False n = 1 Haut = highest[8](high[1]) Bas = lowest[8](low[1]) amplitude = abs(close - open) Ctime = time >= 090000 and time <= 170000 // CONDITIONS ACHAT c1a = close > open c2a = close > Haut c3a = amplitude > AverageTrueRange[24] IF c1a AND c2a AND c3a AND Ctime THEN BUY n shares AT MARKET ENDIF // CONDITIONS VENTE c1v = close < open c2v = close < Bas c3v = amplitude > AverageTrueRange[24] IF c1v AND c2v AND c3v AND Ctime THEN sellshort n shares AT MARKET ENDIF // STOP LOSS & TAKE PROFIT sl = 20 // 20 en M15 75 en H1 set stop loss sl set target profit sl*2 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

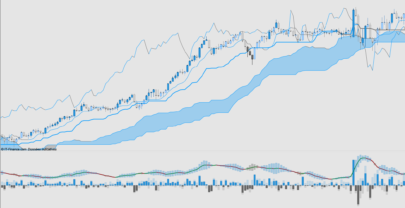

Thanks for sharing. This strategy is flat for 11 years and winning afterwards. Don’t you think it might be overfited?

Did you tried with variable take profit including volatility ( such as ATR ratio or the size of the candle detected with fibonacci extension)

Hello,

As I usually say, strategies are exposed to be improved 🙂

So yes, I think there must be good ways to improve this one.

We could set an ATR ratio as a stop loss / take profit, it could be done.