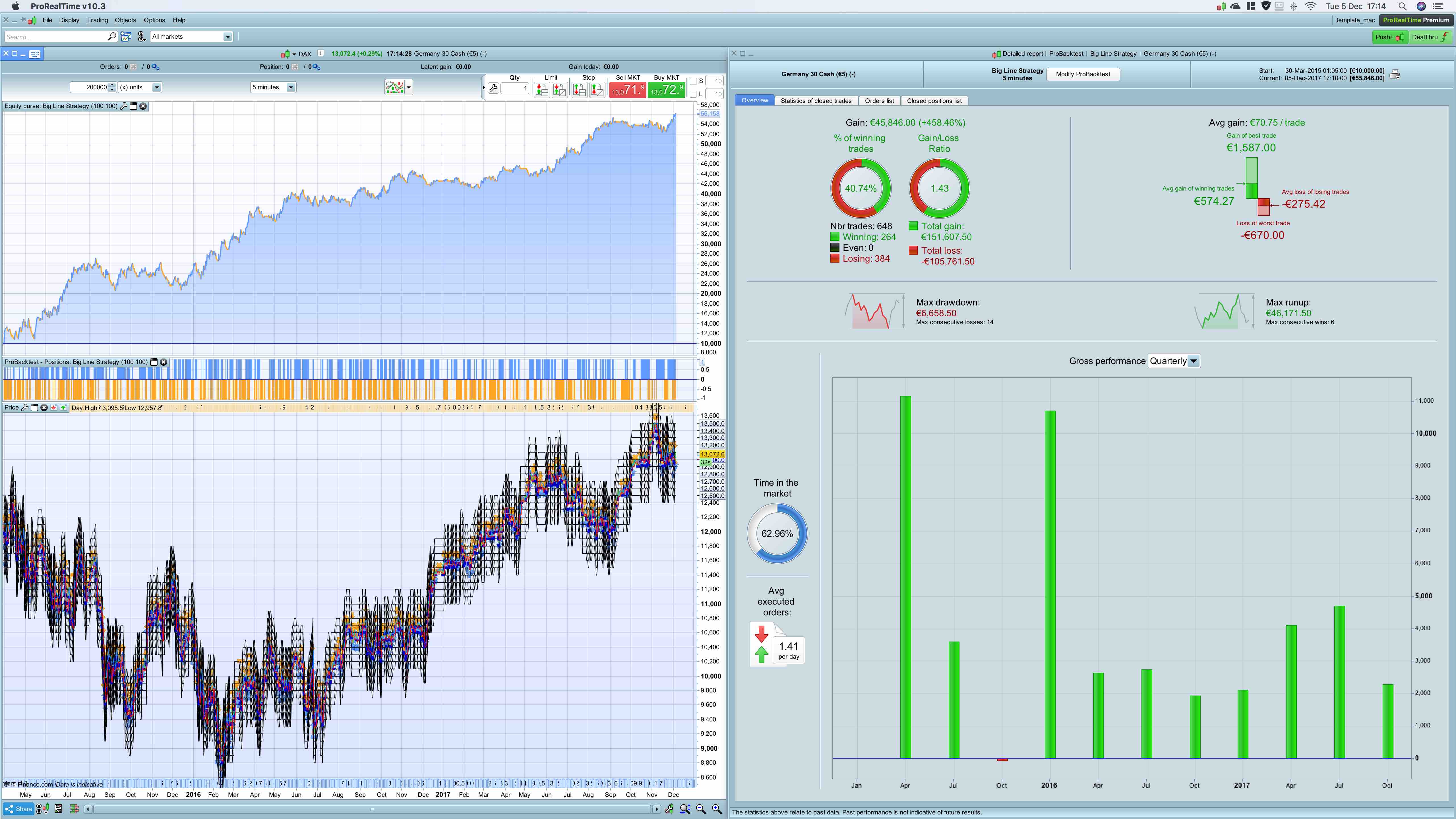

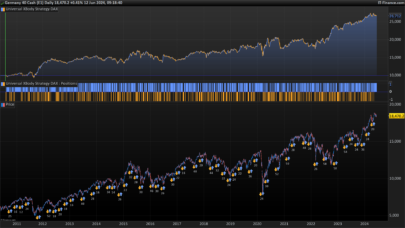

a Big Line Strategy

Just played around with the idea to enter a trade around a big line because it could have more potential. I focussed on the DAX.

- dax 5 minutes

- 200k bars

- spread 1

- stoploss 1, trailing stop 1.5, profit target 2.5

- trading times 9-18h

- keeps positions overnight, but closes at Friday 18h

One extra criteria was needed and it looks back at high/low max 2 days

Included is a Big Line indicator which should be added to the price-chart. This makes sure you set the correct lines. The values can be used then in the strategy.

tip: in the price-chart, set settings on : vertical autoscaling; use price only

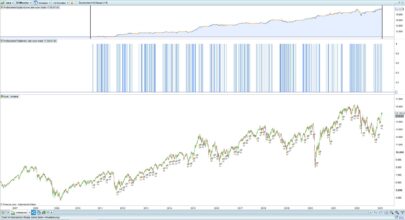

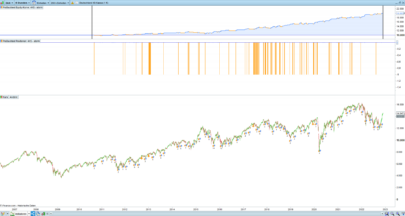

M=100 F=100 causes the DAX to enter around the 100 lines if criteria are met.

If you set M=100 and F=50 it enters on the 50 lines. By adjusting it should be flexible for other markets. It’s not meant to optimise.

Optional is the Big Line Indicator EC for the price chart. It shows visually the extra criteria.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 |

//------------------------------------------------------------------------- // Main code : Big Line Strategy //------------------------------------------------------------------------- // common rules DEFPARAM CUMULATEORDERS = false DEFPARAM PRELOADBARS = 10000 // time rules ONCE entertime = 090000 ONCE lasttime = 180000 ONCE closetime = 240000 // greater then 23.59 means it continues position overnight ONCE closetimefriday=180000 tt1 = time >= entertime tt2 = time <= lasttime tradetime = tt1 and tt2 // positionsize and stops positionsize=1 sl=1 // % stoploss ts=1.5 // % trailing stop pt=2.5 // % profit target // setup number of trades intraday if IntradayBarIndex = 0 then longtradecounter = 0 Shorttradecounter = 0 endif // trade criteria lc = tradetime and countoflongshares < 1 and longtradecounter < 1 sc = tradetime and countofshortshares < 1 and shorttradecounter < 1 // line criteria CurrentPrice = round(dclose(1)) MPmod = M Factor = F // defines lines AboveLevel0 = CurrentPrice mod MPmod StartLevel = CurrentPrice - AboveLevel0 Level00Up = Startlevel Level10Up = StartLevel + (1*Factor) Level20Up = StartLevel + (2*Factor) Level30Up = StartLevel + (3*Factor) Level40Up = StartLevel + (4*Factor) Level50Up = StartLevel + (5*Factor) Level60Up = StartLevel + (6*Factor) Level70Up = StartLevel + (7*Factor) Level80Up = StartLevel + (8*Factor) Level90Up = StartLevel + (9*Factor) Level00Down = Startlevel Levell0Down = StartLevel - (1*Factor) Level20Down = StartLevel - (2*Factor) Level30Down = StartLevel - (3*Factor) Level40Down = StartLevel - (4*Factor) Level50Down = StartLevel - (5*Factor) Level60Down = StartLevel - (6*Factor) Level70Down = StartLevel - (7*Factor) Level80Down = StartLevel - (8*Factor) Level90Down = StartLevel - (9*Factor) l0= close crosses over Level00Up or close crosses over Level00Down l1= close crosses over Level10Up or close crosses over Levell0Down l2= close crosses over Level20Up or close crosses over Level20Down l3= close crosses over Level30Up or close crosses over Level30Down l4= close crosses over Level40Up or close crosses over Level40Down l5= close crosses over Level50Up or close crosses over Level50Down l6= close crosses over Level60Up or close crosses over Level60Down l7= close crosses over Level70Up or close crosses over Level70Down l8= close crosses over Level80Up or close crosses over Level80Down l9= close crosses over Level90Up or close crosses over Level90Down s0= close crosses under Level00Down or close crosses under Level00Up s1= close crosses under Levell0Down or close crosses under Level10Up s2= close crosses under Level20Down or close crosses under Level20Up s3= close crosses under Level30Down or close crosses under Level30Up s4= close crosses under Level40Down or close crosses under Level40Up s5= close crosses under Level50Down or close crosses under Level50Up s6= close crosses under Level60Down or close crosses under Level60Up s7= close crosses under Level70Down or close crosses under Level70Up s8= close crosses under Level80Down or close crosses under Level80Up s9= close crosses under Level90Down or close crosses under Level90Up // extra criteria elc=high < MIN(dhigh(1),dhigh(2)) esc=low > MAX(dlow(1),dlow(2)) // long entry If lc and elc and (l0 or l1 or l2 or l3 or l4 or l5 or l6 or l7 or l8 or l9) then buy positionsize contract at market longtradecounter=longtradecounter + 1 endif // short entry if sc and esc and (s0 or s1 or s2 or s3 or s4 or s5 or s6 or s7 or s8 or s9) then sellshort positionsize contract at market shorttradecounter=shorttradecounter + 1 endif // exit all If onmarket and time >= closetime then sell at market exitshort at market endif // exit friday at set closetime if onmarket and (CurrentDayOfWeek=5 and time>=closetimefriday) then sell at market exitshort at market endif // build-in exit SET STOP %LOSS sl %TRAILING ts SET TARGET %PROFIT pt |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hello, when I enter the code, it responds that I have to change the variables and the system does not start

Dosen’t work “Modifiy your code for automatic trading”

Thank you Paul. We perhaps have try if it is more efficient with only 1 trade/day for each level.

there is a problem with the %trailing stop. Doesn´t work in ProOrder.

Please remove the parameters and set values M and F to 100 in this code.

In the code add manually a trailing stop posted in the library. My purpose was for backtesting first.

@noisette. Thnx for the idea! I will have a quick test. Right now it has too many trades, but it’s a good platform to build on.

I have some ideas how to proceed to reduce those but more idea’s are welcome !

ps. To get a complete result including January 2015. Set timeframe for i.e. 10 minutes and switch back to 5min. January is now included which makes long and short gains more equal and profitable.

Hi Poul, it still does not work. Can you post the correct code again?

Hello

There is a mistake in trailing stop code, I think that this should fix the problem

sl=1 // % stoploss

ts=1.5 // % trailing stop

pt=2.5 // % profit target

tsconvert=ts*close/100

// build-in exit

SET STOP %LOSS sl

SET STOP TRAILING tsconvert // trailing % doesn’t work , value must be written in points

SET TARGET %PROFIT pt

I will run in demo

About the trailing-stop the way it’s coded. That works for backtesting only, just look at the chart and the detailed rapport, tap “order list”. It says for some closed positions “trailing”.

sorry paul, but system says that is not possible to put many stop order combined…what have to do?

thanks