Hello everyone,

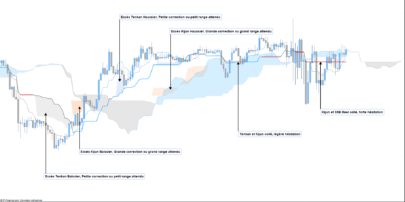

At the request of one of us, I wrote this code, the translation of this strategy exposed by IG :

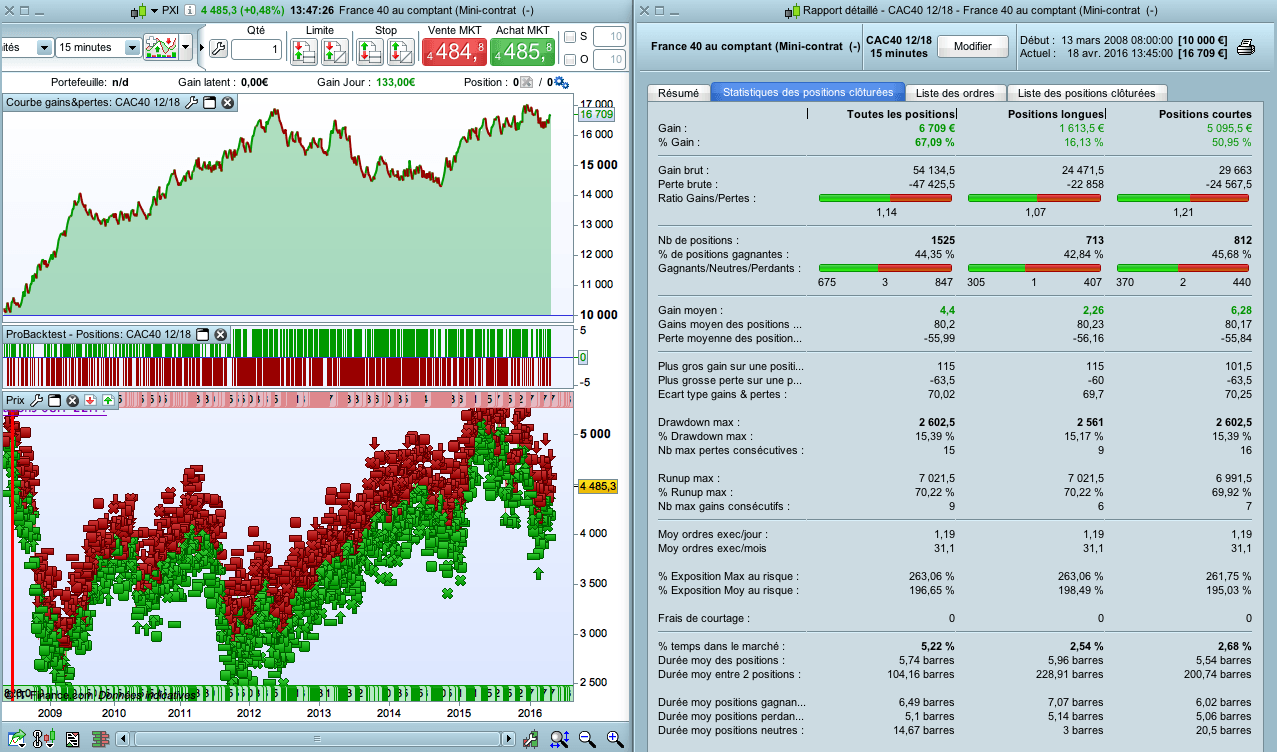

CAC40, M15.

Actually, I put both positions “long” and “short” (the video only shows « long » trades).

Although the strategy is positive WITHOUT spread, I am surprised and disappointed by the results.

WITH SPREAD, we’re just negative on all tested data !

I still publish this strategy, which unfortunately is therefore not profitable with the spread.

With some improvement from you, it could be positive.

Good trades to all !

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 |

// CAC40 12-18 // PARAMETRES Defparam cumulateorders = false Defparam flatafter = 173000 // TAILLE DES POSITIONS n = 5 // VARIABLES iMACDline = MACDline[12,26,9](close) iEAMACD = ExponentialAverage[9](MACDline[12,26,9](close)) iRSI = RSI[14](close) iSuperTrend = SuperTrend[3,10] // CONDITIONS ACHAT ctime = time > 090000 and time < 171500 c1a = iMACDline crosses over iEAMACD c2a = iRSI < 65 c3a = close > iSuperTrend IF ctime AND c1a AND c2a AND c3a THEN Buy n shares at market ENDIF // CONDITIONS VENTE ctime = time > 090000 and time < 171500 c1a = iMACDline crosses under iEAMACD c2a = iRSI > 35 c3a = close < iSuperTrend IF ctime AND c1a AND c2a AND c3a THEN Sellshort n shares at market ENDIF // STOP & OBJECTIF Set stop pLoss 12 Set target pProfit 18 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi

I have seen the video and was present during the “nuit du trading” where cristophe presented it, you’re not completely fair, that’s sad because i like your strategies and presentations very much, because originaly the IG strategy is ONLY long, not short. If you add short, then you change the code, and the result. And spread was included in the demonstration, but with LONG only, not SHORT as you add it.

Thanks

Sam

Hello Samsam13,

You’re right, I made long AND short.

I will post the results for the backtest with long ONLY, very soon.Best Regards,

Cool, thanks for this ! As usual very reactive !

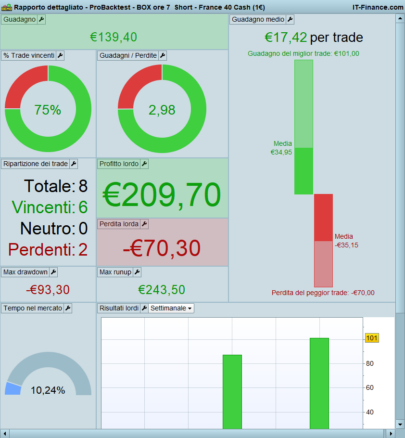

Testing i with only LONG positions.

It’s still… unprofitable. And even worse.Sorry.

Hi

Don’t be sorry 🙂 I just wanted to have the real strategy and it’s real outcome, now i do

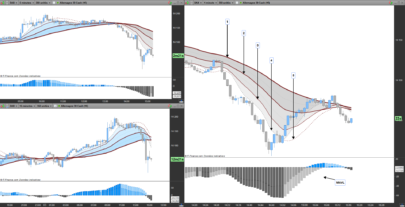

Bonjour, pour ma part le code marche dans les 2 sens sur le DAX 1H dans une recherche de tous les mois au vert en tick par tick au 200K avec ExponentialAverage[10] RSI[13] SuperTrend[2,10] les heures en time >090000 and time 36 pour finir en stop ploss 30 et enlever Set target pProfit 18. Spread 1.2 mais bon 35% et ratio 1.21, c’est pas l’eldorado non plus si on reste avec Dax 1€…

Le post précédent est incomplet ? : les heures en time >090000 and time 36 pour finir en stop ploss 30 …

Le post précédent est incomplet ? : les heures en time >090000 and time 36 pour finir en stop ploss 30 … aussi correctif, tous les ans au vert…

C’est étrange, je note donc à nouveau les deux horaires achat et vente =9H/17H, le iRSI de la vente : > 36. Bon j’espère que cette fois la note passe entière (à savoir de avril 2006 à ce jour, en mode sans tick par tick 2008 serait perdant vers -455 et 2021 accuse -30€ pour l’instant).

Merci à Doctrading pour cette trame de code super et qui marche sur d’autres supports aussi. Au top !

Bonsoir à tous

Juste pour vous informer que j’ai enlever les conditions short et que cela est passé à 67% de rentabilité

3 trades

2 gagnant

1 perdant

Et vous cela donne quoi ?