Hello everyone, it’s been a while since I’ve suggested anything.

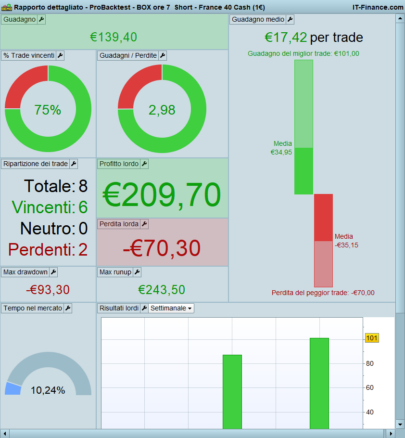

So I’m giving you an algo that is profitable to say the least: 113% gains in 1.5 months, from February 13, 2025 to March 28, 2025, from €1000 to €2132, who can beat that???

It can be improved, but it’s already a very good basis for those who like trading.

Don’t hesitate to ask me questions.

See you soon!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 |

rem algo réalisé par Yann du Nord de la France DEFPARAM cumulateOrders = False //defparam flatafter = 221500 timeframe (10 second) rem mettre capital disponible capital=1000 capital2=capital+STRATEGYPROFIT[0] taille=(capital2/(close*5.5/100)) if taille<1 then taille=1 endif n=taille if (time>=090800 and time<170000) then journee=1 else journee=0 endif rem les trend en timeframe if supertrend[4,4]<=close then trend10s=1 else trend10s=0 endif timeframe (1 minute) if supertrend[3,10]<=close then trend1m=1 else trend1m=0 endif timeframe (2 minute) if supertrend[3,10]<=close then trend2m=1 else trend2m=0 endif timeframe (3 minute) if supertrend[5,12]<=close then trend3m=1 else trend3m=0 endif timeframe (10 minute) if supertrend[3,10]<=close then trend10m=1 else trend10m=0 endif timeframe (21 minute) if supertrend[3,10]<=close then trend21m=1 else trend21m=0 endif timeframe (30 second) if (supertrend[2,2])=<close then trend30s=1 else trend30s=0 endif rem les conditions horaires et de prix pour vente conda=not onmarket or(shortonmarket and (tradeprice-close)>=-2) condav=not onmarket or (longonmarket and (close-tradeprice)>=-1) if (time>154000 and time<160000) or (time>112500 and time<120000) or (time>091800 and time<100000) or (dayofweek=1 and time>151500 and time<153500) or (dayofweek=2 and ((time>104500 and time<130000) or (time>132000 and time<133000) or (time>150000 and time<153500) or (time>160200 and time<161500))) or (dayofweek=1 and (time>100000 and time<111500) or (time>112500 and time<124500 and close<lowest[30][1]+8))or (dayofweek=2 and ((time<120000 or (time>144500 or time<150000)) and (close<lowest[10][1]+13 or trend2m=1))) or (dayofweek=4 and ((time>103000 and time<121500) or (time>=100000 and time=<103000 and close<lowest[10][1]+7) or (time>152500 and trend1m=1) or (time>133000 and time<=150000) or ((close<lowest[10][1]+10 or trend10m=1) and (time<100000 or time>151500) or (time>120000 and trend21m=1)))) or (dayofweek=5 and ((time>140000 and time<143000) or (time>144000 and time<153500) or (trend1m=1 and time<120000) or (time>091500 and time<100000 and close<lowest[10][1]+20) or (time>100000 and close<lowest[10][1]+18))) or (dayofweek=3 and ((trend21m=1 and time>092000)or (time>090500 and close<lowest[10][1]+1))) or (dayofweek=1 and trend21m=1) or (dayofweek=4 and time>091000) or (dayofweek=3 and ((time>100000 and time<120000) or (time>143000) or (time>090500 and time<093000))) or (time>132000 and time<144000) or (dayofweek=1 and time>150000 and time<155000) or (dayofweek=5 and time<092000) or (dayofweek=1 and (time>160000 or (time>120000 and time<133000))) or (dayofweek=3 and time>113000) then stopv=1 else stopv=0 endif rem les conditions horaires et de prix pour achat if (time>152000 and time<154500) or (time>165500 and time<171000) or (time>160000 and time<163000) or (time>091400 and time<092000) or (time>120000 and time<124500) or (dayofweek=1 and ((time>130000 and time<150000) or (trend2m=0 and time<110000)) or (close>highest[10][1]-12 and (time<103000 or time>150000))) or (dayofweek=2 and (time<120000 or (time>135700 and time<150000) or time>163000 )and close>highest[10][1]-20) or (dayofweek=4 and ((time>154500 and time<165500) or (time<094500) or (close>highest[10][1]-7))) or (dayofweek=5 and ((time>091500 and time<110000) or (time>124500 and time<134500) or trend3m=0 or close>highest[10][1]-10 or (time>143000 and time<145900 and trend21m=0))) or (dayofweek=3 and ((time>145000 and time<160500) or (time>092000 and close>highest[100][1]-23) or trend10m=0)) or (dayofweek=4 and ((time>104500 and time<133000) or (time>140000 and time<144000))) or (dayofweek=3 and time<113000) or (dayofweek=1 and time>150000 and time<155000) or (time>130000 and time<133000) or (dayofweek=2 and time>134500 and time<143000) then stopa=1 else stopa=0 endif rem partie execution timeframe (1 minute) if journee=1 and (AverageTrueRange[1](close) crosses over AverageTrueRange[6](close)) and (close<highest[5][1]-6) and trend3m=1 and conda and stopa=0 THEN BUY n contract at market set target profit 80 endif if journee=1 and (AverageTrueRange[1](close) crosses under AverageTrueRange[3](close)) and (close>lowest[10][1]+6) and trend3m=0 and condav and time<162000 and stopv=0 then sellshort n share at market set target profit 80 endif set stop loss 35 rem gerer les moments delicats et retournements de tendance if dayofweek=1 and longonmarket and time>=153000 and Stochastic[10,3](close) crosses over 80then sell at market endif if dayofweek=1 and shortonmarket then set target profit 5 endif if dayofweek=1 and longonmarket and time>110000 and time<133000 then set target profit 10 endif if dayofweek=1 and longonmarket and time<=110000 then set target profit 1 endif if dayofweek=1 and longonmarket and time>=133000 then set target profit 5 endif if (dayofweek=2 or dayofweek=5) and longonmarket and time>130000 and time<143000then set target profit 2 endif if dayofweek=2 and shortonmarket then set target profit 5 endif if close<tradeprice and (dayofweek=2) and shortonmarket and Stochastic[10,3](close) crosses under 20 then exitshort at market endif if close<tradeprice and (dayofweek=3) and time>160000 and shortonmarket and Stochastic[10,3](close) crosses under 20 then exitshort at market endif if dayofweek=1 and (time<094500 or time>160000) and shortonmarket then set target profit 1 endif if dayofweek=1 and time>130000 and time<150000 and longonmarket and Stochastic[10,3](close) crosses under 81 and close-tradeprice>40 then sell at market endif if dayofweek=4 and shortonmarket and time>101500 and time<133000 then set target profit 30 endif if dayofweek=3 and longonmarket and time>120000 and time<160000 then set target profit 10 endif if dayofweek=3 and longonmarket and time>=160000 then set target profit 10 endif if dayofweek=3 and shortonmarket then set target profit 1 endif if dayofweek=4 and longonmarket and time>110000 and time<150000 then set target profit 1 endif if dayofweek=4 and longonmarket and time>=150000 and time<163000 then set target profit 45 endif if dayofweek=4 and close>tradeprice and longonmarket and time>170000 and stochastic[10,3](close) crosses under 80 then sell at market endif if (dayofweek=5 or dayofweek=4)and time>100000 and time<143000 and longonmarket and (close-tradeprice>1) then sell at market endif if (dayofweek=5or dayofweek=3) and shortonmarket and time>160000 then set target profit 15 endif if dayofweek=5 and longonmarket and time>163000 then set target profit 20 endif if year=2024 and ((month=11 and day=29) or (month=12 and day=27)) and longonmarket then set target profit 50 endif if year=2025 and ((month=1 and day=31) or (month=2 and day=28)) and longonmarket then set target profit 50 endif if longonmarket and close-tradeprice>0 and RSI[14](close) crosses under 95 then sell at market endif if shortonmarket and tradeprice-close>0 and RSI[14](close) crosses over 13 then exitshort at market endif |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Salut ! Deja ta premiere proposition était tres novatrice et interessante, et à vue de nez, tu nous envoies du lourd avec le code ci. merci !

Salut David et merci. Il est perfectible sur 1 millions de période de 10 secondes mais bon à travailler et améliorer …

Hallo. Vielen Dank für die Innovation. Wie kann ich eine feste Positionsgröße festlegen ohne Reininvest?

Bonjour, il faut modifier la ligne 7 : capital2=capital

Hallo, Sie müssen Zeile 7 ändern : capital2=capital

Danke

hello merci pour le partage. Quand je veux mettre ta stratégie en backtest j ai un message comme quoi mon timefram n est pas bon pour le test. est ce que tu peux m aider?? merci a toi.

Hallo. Vielen Dank für die Innovation. Können Sie mir sagen wie ich eine feste Positionsgröße bestimmen kann ohne Re Invest? Gruß Maik

Hallo, Sie müssen Zeile 7 ändern : capital2=capital

On modifie la ligne 63 suite à mauvais trade lundi 31/03/2025 matin à la vente :

if (time>154000 and time112500 and time091800 and time151500 and time104500 and time132000 and time150000 and time160200 and time100000 and time112500 and time<124500 and close<lowest[30][1]+8))or (dayofweek=2 and ((time144500 or time<150000)) and (close103000 and time=100000 and time=133000 and time140000 and time144000 and time100000 and time143000) or (time>090500 and time132000 and time150000 and time120000 and time113000) or (dayofweek=1 and close>091000 and time<103000) then

stopv=1

else

stopv=0

endif

kann die Änderung leider nicht einfügen.erhalte immer eine Fehlermeldung.

merci pour le partage

Hello @fifi743, ça fait longtemps !! Toujours dans la programmation vectorielle ? Dax ? DJ ?

@Maik2404 en fait il s’agit des lignes de 63 à 67 que l’on remplace mais dans ma correction les lignes de 64 à 67 sont identiques mais tu ne dois pas les mettre en double

Stratégie suroptimisée – backtestée sur plusieurs périodes aléatoires les années précdentes – ne fonctionne pas du tout

Désolé…

Du musst im 10 sek Zeitrahmen und CAC testen. Dann funktioniert es auch 😉

Bonjour @greg2104, tu n’as pas à être désolé, ne sois pas triste ! Ici il n’ a jamais été le sujet de faire un algo robuste sur plusieurs années !!! Je ne sais même pas si c’est réalisable, même les banques ont plusieurs algos suivant les périodes. Quand tu as un algo qui va bien sur 1 mois, c’est déjà pas mal, ensuite c’est à toi de mettre à jour les variables suivant la volatilité du marché, sauf si tu as la solution pour automatiser. Je vois que tu es membre que depuis février 2025. Tu vas certainement déchanter si tu penses qu’on va te donner un algo robuste à vie ou qu’on va te faire un virement bancaire sur ce forum !!

Thank You Boss! let me try

Hallo. Leider kann ich die Zeile 63 wie besprochen nicht ändern. Es kommt immer die Meldung einer Doppelklammer. Kannst Du den Code noch einmal mit der Änderung zur Verfügung stellen. Danke Dir.

rem algo réalisé par Yann du Nord de la France

DEFPARAM cumulateOrders = False

//defparam flatafter = 221500

timeframe (10 second)

rem mettre capital disponible

capital=1000

capital2=capital+STRATEGYPROFIT[0]

taille=(capital2/(close*5.5/100))

if taille<1 then

taille=1

endif

n=taille

if (time>=090800 and time<170000) then

journee=1

else

journee=0

endif

rem les trend en timeframe

if supertrend[4,4]<=close then

trend10s=1

else

trend10s=0

endif

timeframe (1 minute)

if supertrend[3,10]<=close then

trend1m=1

else

trend1m=0

endif

timeframe (2 minute)

if supertrend[3,10]<=close then

trend2m=1

else

trend2m=0

endif

timeframe (3 minute)

if supertrend[5,12]<=close then

trend3m=1

else

trend3m=0

endif

timeframe (10 minute)

if supertrend[3,10]<=close then

trend10m=1

else

trend10m=0

endif

timeframe (21 minute)

if supertrend[3,10]<=close then

trend21m=1

else

trend21m=0

endif

timeframe (30 second)

if (supertrend[2,2])=<close then

trend30s=1

else

trend30s=0

endif

rem les conditions horaires et de prix pour vente

conda=not onmarket or(shortonmarket and (tradeprice-close)>=-2)

condav=not onmarket or (longonmarket and (close-tradeprice)>=-1)

if (time>154000 and time<160000) or (time>112500 and time<120000) or (time>091800 and time<100000) or (dayofweek=1 and time>151500 and time<153500) or (dayofweek=2 and ((time>104500 and time<130000) or (time>132000 and time<133000) or (time>150000 and time<153500) or (time>160200 and time<161500))) or (dayofweek=1 and (time>100000 and time<111500) or (time>112500 and time<124500 and close<lowest[30][1]+8)) or (dayofweek=2 and ((time<120000 or (time>144500 or time<150000)) and (close<lowest[10][1]+13 or trend2m=1))) or (dayofweek=4 and ((time>103000 and time<121500) or (time>=100000 and time=<103000 and close<lowest[10][1]+7) or (time>152500 and trend1m=1) or (time>133000 and time<=150000) or ((close<lowest[10][1]+10 or trend10m=1) and (time<100000 or time>151500) or (time>120000 and trend21m=1)))) or (dayofweek=5 and ((time>140000 and time<143000) or (time>144000 and time<153500) or (trend1m=1 and time<120000) or (time>091500 and time<100000 and close<lowest[10][1]+20) or (time>100000 and close<lowest[10][1]+18))) or (dayofweek=3 and ((trend21m=1 and time>092000)or (time>090500 and close<lowest[10][1]+1))) or (dayofweek=1 and trend21m=1) or (dayofweek=4 and time>091000) or (dayofweek=3 and ((time>100000 and time<120000) or (time>143000) or (time>090500 and time<093000))) or (time>132000 and time<144000) or (dayofweek=1 and time>150000 and time<155000) or (dayofweek=5 and time<092000) or (dayofweek=1 and (time>160000 or (time>120000 and time<133000))) or (dayofweek=3 and time>113000) or (dayofweek=1 and close<lowest[10][1]+10 and time>091000 and time<103000) then

stopv=1

else

stopv=0

endif

rem les conditions horaires et de prix pour achat

if (time>152000 and time<154500) or (time>165500 and time<171000) or (time>160000 and time<163000) or (time>091400 and time<092000) or (time>120000 and time<124500) or (dayofweek=1 and ((time>130000 and time<150000) or (trend2m=0 and time<110000)) or (close>highest[10][1]-12 and (time<103000 or time>150000))) or (dayofweek=2 and (time<120000 or (time>135700 and time<150000) or time>163000 )and close>highest[10][1]-20) or (dayofweek=4 and ((time>154500 and time<165500) or (time<094500) or (close>highest[10][1]-7))) or (dayofweek=5 and ((time>091500 and time<110000) or (time>124500 and time<134500) or trend3m=0 or close>highest[10][1]-10 or (time>143000 and time<145900 and trend21m=0))) or (dayofweek=3 and ((time>145000 and time<160500) or (time>092000 and close>highest[100][1]-23) or trend10m=0)) or (dayofweek=4 and ((time>104500 and time<133000) or (time>140000 and time<144000))) or (dayofweek=3 and time<113000) or (dayofweek=1 and time>150000 and time<155000) or (time>130000 and time<133000) or (dayofweek=2 and time>134500 and time<143000) then

stopa=1

else

stopa=0

endif

rem partie execution

timeframe (1 minute)

if journee=1 and (AverageTrueRange[1](close) crosses over AverageTrueRange[6](close)) and (close<highest[5][1]-6) and trend3m=1 and conda and stopa=0 THEN

BUY n contract at market

set target profit 80

endif

if journee=1 and (AverageTrueRange[1](close) crosses under AverageTrueRange[3](close)) and (close>lowest[10][1]+6) and trend3m=0 and condav and time<162000 and stopv=0 then

sellshort n share at market

set target profit 80

endif

set stop loss 35

rem gerer les moments delicats et retournements de tendance

if dayofweek=1 and longonmarket and time>=153000 and Stochastic[10,3](close) crosses over 80then

sell at market

endif

if dayofweek=1 and shortonmarket then

set target profit 5

endif

if dayofweek=1 and longonmarket and time>110000 and time<133000 then

set target profit 10

endif

if dayofweek=1 and longonmarket and time<=110000 then

set target profit 1

endif

if dayofweek=1 and longonmarket and time>=133000 then

set target profit 5

endif

if (dayofweek=2 or dayofweek=5) and longonmarket and time>130000 and time<143000then

set target profit 2

endif

if dayofweek=2 and shortonmarket then

set target profit 5

endif

if close<tradeprice and (dayofweek=2) and shortonmarket and Stochastic[10,3](close) crosses under 20 then

exitshort at market

endif

if close<tradeprice and (dayofweek=3) and time>160000 and shortonmarket and Stochastic[10,3](close) crosses under 20 then

exitshort at market

endif

if dayofweek=1 and (time<094500 or time>160000) and shortonmarket then

set target profit 1

endif

if dayofweek=1 and time>130000 and time<150000 and longonmarket and Stochastic[10,3](close) crosses under 81 and close-tradeprice>40 then

sell at market

endif

if dayofweek=4 and shortonmarket and time>101500 and time<133000 then

set target profit 30

endif

if dayofweek=3 and longonmarket and time>120000 and time<160000 then

set target profit 10

endif

if dayofweek=3 and longonmarket and time>=160000 then

set target profit 10

endif

if dayofweek=3 and shortonmarket then

set target profit 1

endif

if dayofweek=4 and longonmarket and time>110000 and time<150000 then

set target profit 1

endif

if dayofweek=4 and longonmarket and time>=150000 and time<163000 then

set target profit 45

endif

if dayofweek=4 and close>tradeprice and longonmarket and time>170000 and stochastic[10,3](close) crosses under 80 then

sell at market

endif

if (dayofweek=5 or dayofweek=4)and time>100000 and time<143000 and longonmarket and (close-tradeprice>1) then

sell at market

endif

if (dayofweek=5or dayofweek=3) and shortonmarket and time>160000 then

set target profit 15

endif

if dayofweek=5 and longonmarket and time>163000 then

set target profit 20

endif

if year=2024 and ((month=11 and day=29) or (month=12 and day=27)) and longonmarket then

set target profit 50

endif

if year=2025 and ((month=1 and day=31) or (month=2 and day=28)) and longonmarket then

set target profit 50

endif

if longonmarket and close-tradeprice>0 and RSI[14](close) crosses under 95 then

sell at market

endif

if shortonmarket and tradeprice-close>0 and RSI[14](close) crosses over 13 then

exitshort at market

endif

Bonjour WE ARE SOCIETY, ce sont en fait les conditions horaires et de prix pour achat qu’on change dans le programme afin essayer d’avoir un gain, c’est ça ?

D’une semaine à l’autre c’est ça ?

Qu’est ce qui fait que l’on puisse connaitre à l’avance comment réagira le CAC ?

Merci

@Maik2404 it’s Done !

ich bekomme immer noch einen Fehler. Jetzt in Zeile 22 endif timeframe. könntest du vielleicht die itf. Datei zur Verfügung stellen.

hab eigentlich nur ich das Problem?

Hallo, vielleicht hast du eine eingeschränkte oder limitierte Version, dieser Code funktioniert normalerweise

deine oben eingestellte itf Datei funktioniert. Ich bekomme nur den Fehler beim ersetzen deiner Zeile 63. ich habe die vollversion von Prorealtime v 12