Hello Guys,

In 2013, I did see a strategy of Mark Larsen on Youtube. I was very happy to see this video, and decided to use this strategy with real money.

Guess what ?

I did loose much !

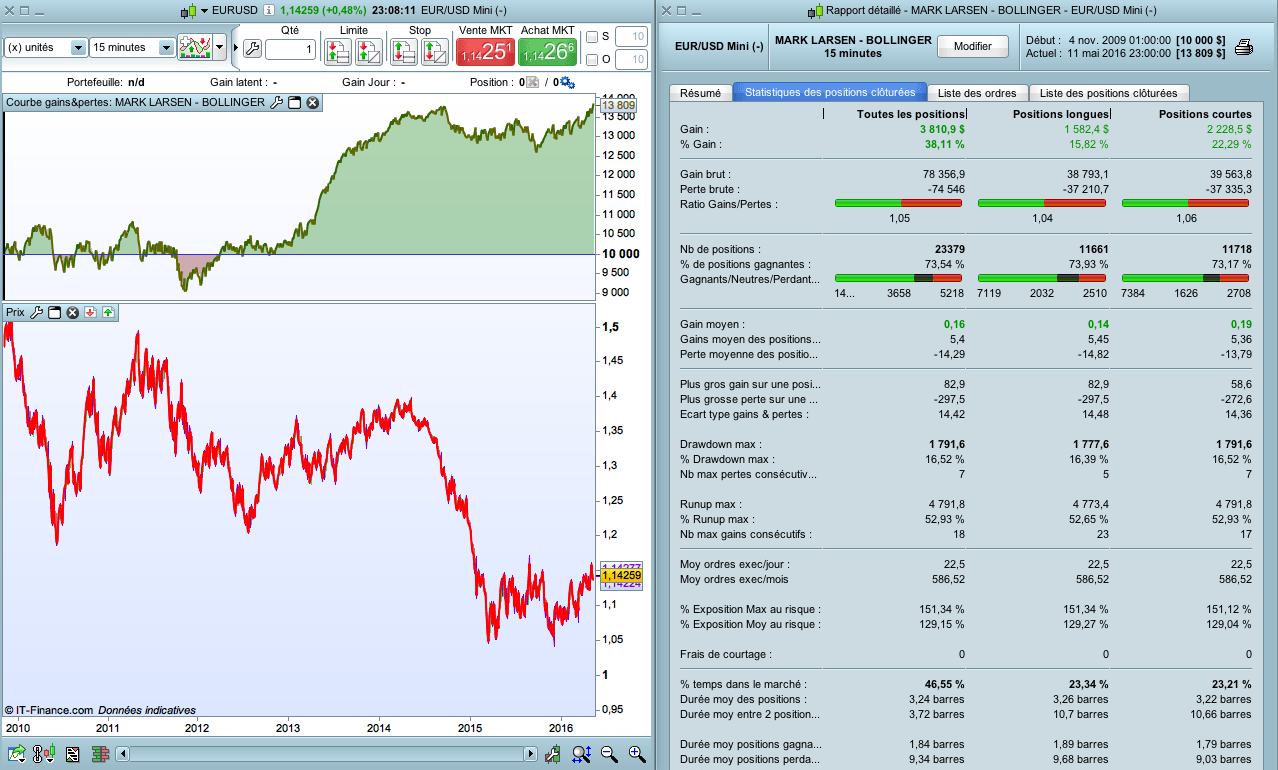

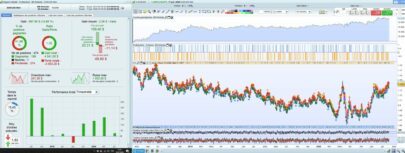

Now I can backtest it. The result isn’t so sexy (EUR/USD, timeframe M15).

Maybe I did wrong with some entry rules ?

Here is the code :

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 |

DEFPARAM CumulateOrders = False n = 1 BollUP = BollingerUp[10](close) BollDown = BollingerDown[10](close) // ACHAT ca = close > BollDown and low < BollDown IF ca THEN Buy n shares at market ENDIF // VENTE cv = close < BollUp and high > BollUp IF cv THEN Sellshort n shares at market ENDIF // SORTIE Sell at Average[14](close) limit Exitshort at Average[14](close)limit |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

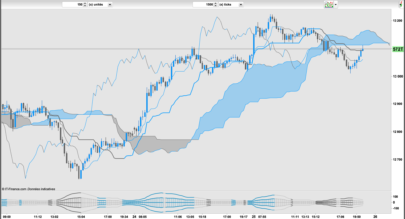

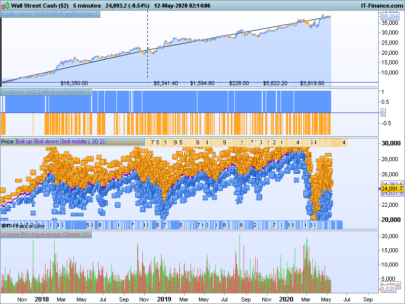

It’s a classical mean reverting strategy used by many people with many variants. It makes sense in ranging market, when price has derivated from 2 standard deviation from its mean, it would come back to it. While market is trending, you loose because this strategy is contrarian.

I have recently reverse engineered an averaging down strategy that were popular at mql5 with the same kind of entries, the guy re-entered each time close were within the bollinger bands with a step from the average price of the basket, then close the whole orders on the opposite bands. While it were making huge profit if opposite band was above the average price, it could also be dangerous to accumulate orders in a long run.

My thought is that there are a lot to explore in mean reversion theory but the loss must be cut quickly as the ‘mean revert signal’ given at last bar is already false on the next one, because average of price has already changed since that information..

Thanks for contribution.

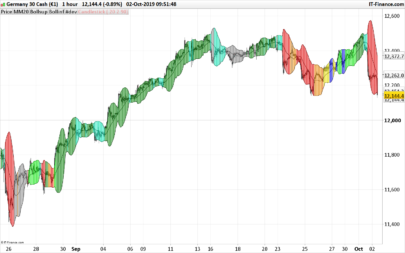

Cette stratégie est quasi similaire de celle publiée sous le titre “nice price strategy”. Sauf que l’auteur de mémoire avait ajouté un indicateur (DI+ et DI-). Pour ma part, je l’ai un peu retouché en utilisant les bandes de Kellner et le STO mais bon il faut rester vigilant. Bonne soirée.

At least there should be some moving average that has also reverted into the opposite direction, before a position is opened. Otherwise a cumulation of wrong positions will be opened, when the market goes strongly into one direction and never reverts back on the short-term scale.

In addition to the moving average, wait until at least one bar is completely back inside the Bollinger band. Otherwise, you may open a position in the wrong direction exactly at the start of a huge trend.

This works excellent on range bound I tried , give 90% win rates on dax , 3 min chart. can some one try to throw some light on this to avoid a sell or buy or when big trend started . in other word we need to one or more condition to not place order when range is broken big trend started