Hi everyone,

First I’d like to thank you all for your contribution on this website. It’s been a goldmine for me so far 😉

You all found good names for your strategies but to be honest I haven’t find mine yet..

Anyway, here is the thing:

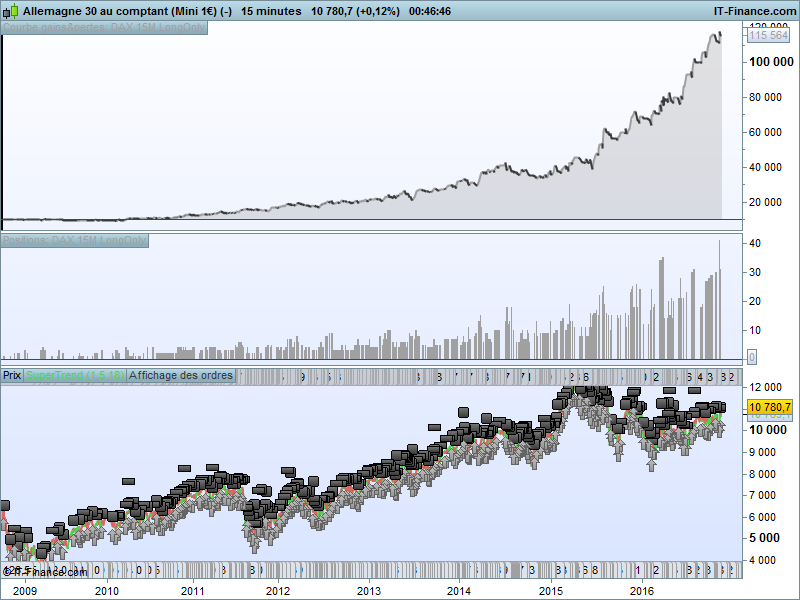

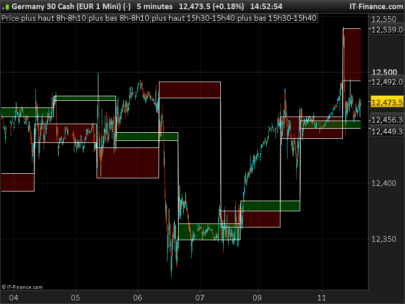

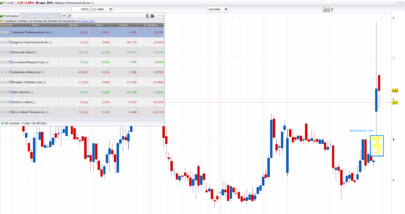

- Index: Dax 1€

- TF: 15M

- $Risk: You choose ! 😉 – 1.5% of capital per trade in my backtest. Up to 3.7% due to seasonality (Thanks ALE for your piece of code about seasonality)

- Spread: 2 pips

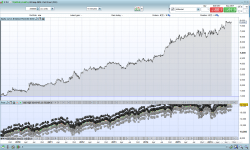

Variables were optimized different ways. Optimization from the beggining of PRT datas to 31/12/13 shows substantially the same trend. I hope my curve remains not so fitted..

Drawbacks:

- Not so many trades

- Several trades could last a very long time

- Time between trades is also too long

- The reverse short strategy does not lead to gains..

Thus, if you have any comments, ideas or anything that could improve this strategy, it would be really appreciated ! 😉

Thank you all and keep posting interesting things here, I like it !

Maxime

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 |

DEFPARAM CumulateOrders = false //DAX - 15M sl=80 tp=150 p=18 d=20 m=1.5 Rg = 0.5 ONCE Januaryl = 1 ONCE Februaryl = 2 ONCE Marchl = 3 ONCE Aprill = 1 ONCE Mayl = 1 ONCE Junel = 2 ONCE Julyl = 3 ONCE Augustl = 1 ONCE Septemberl = 1 ONCE Octoberl = 1 ONCE Novemberl =2 ONCE Decemberl = 2 ONCE Monday = 2 ONCE Tuesday = 2 ONCE Wednesday = 1 Once Thursday = 1 Once Friday = 1 Once Saturday = 1 Once Sunday = 1 If Opendayofweek = 1 then DayMult = Monday ElsIf Opendayofweek = 2 then DayMult = Tuesday ElsIf Opendayofweek = 3 then DayMult = Wednesday ElsIf Opendayofweek = 4 then DayMult = Thursday ElsIf Opendayofweek = 5 then DayMult = Friday ElsIf Opendayofweek = 6 then DayMult = Saturday ElsIf Opendayofweek = 7 then DayMult = Sunday Endif // saisonal pattern long position IF CurrentMonth = 1 THEN saisonalPatternMultiplierl = Januaryl ELSIF CurrentMonth = 2 THEN saisonalPatternMultiplierl = Februaryl ELSIF CurrentMonth = 3 THEN saisonalPatternMultiplierl = Marchl ELSIF CurrentMonth = 4 THEN saisonalPatternMultiplierl = Aprill ELSIF CurrentMonth = 5 THEN saisonalPatternMultiplierl = Mayl ELSIF CurrentMonth = 6 THEN saisonalPatternMultiplierl = Junel ELSIF CurrentMonth = 7 THEN saisonalPatternMultiplierl = Julyl ELSIF CurrentMonth = 8 THEN saisonalPatternMultiplierl = Augustl ELSIF CurrentMonth = 9 THEN saisonalPatternMultiplierl = Septemberl ELSIF CurrentMonth = 10 THEN saisonalPatternMultiplierl = Octoberl ELSIF CurrentMonth = 11 THEN saisonalPatternMultiplierl = Novemberl ELSIF CurrentMonth = 12 THEN saisonalPatternMultiplierl = Decemberl ENDIF aMax = Highest[d](High) aMin = Lowest[d](Low) SupTnd = SuperTrend[m,p] RngOk = (High-Low)/(aMax-aMin)<Rg Equity = 10000+StrategyProfit Risk = 0.015 n = Max(1,Equity*Risk/Sl/PipValue*SQRT(DayMult*saisonalPatternMultiplierl)) //n=1 cBuy = aMin[1]<aMin[2] And High<aMax[1] And Close>Open And RngOk And Close>SupTnd If cBuy Then Buy n Shares at Market EndIf SET STOP ploss sl SET TARGET pPROFIT tp |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Good Morning Descouma

Thank you so much for your code.

I will get back on here if I come up with any improvements.

Cheers

GraHal

The code dose not work

Syntax error: line 2, character 12One of the following characters would be more suitable than “CumulateOrders”:– “,”– “

Why?

Thank you for your new ideas, it’ very good.. !! seasonalty is reiner’s idea..but thank you for your Credit!!

Hi!

Thanks for your comments and thanks Reiner for your syntax on seasonality.

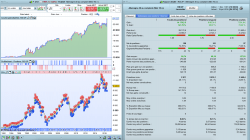

I did some walk forward testing and found quite good results particularly in the recent period (see attached .xlsx file).

In my testing, I just managed to solve for the tp and sl (changed from pips to percentages in this study) which give me the best Return/Drawdown ratio using a 2 years period. Then I used those parameters for the next 6 months. And again, and again !

Here is my last version of the code used for this test:

DEFPARAM CumulateOrders = false

//DAX - 15M

ONCE p=18

ONCE d=20

ONCE m=1.5

ONCE Rg = 0.5

ONCE Risk = 0.015

ONCE Monday =2

ONCE Tuesday = 2

ONCE Wednesday = 1

Once Thursday = 1

Once Friday = 1

If Opendayofweek = 1 then

DayMult = Monday

ElsIf Opendayofweek = 2 then

DayMult = Tuesday

ElsIf Opendayofweek = 3 then

DayMult = Wednesday

ElsIf Opendayofweek = 4 then

DayMult = Thursday

ElsIf Opendayofweek = 5 then

DayMult = Friday

Endif

aMax = Highest[d](High)

aMin = Lowest[d](Low)

SupTnd = SuperTrend[m,p]

RngOk = (High-Low)/(aMax-aMin)<Rg

sl=0.5

tp=1.5

Reinv = 1

Coef = 0

Balance = 23827.1

If Reinv = 1 Then

Equity = Balance+StrategyProfit

Else

Equity = 10000

EndIf

If Coef<>1 Then

DayMult=1

EndIf

n = Max(1,Equity*Risk/(Close*Sl/100)*SQRT(DayMult))

cBuy = aMin[1]<aMin[2] And High<aMax[1] And Close>Open And RngOk And Close>SupTnd

If cBuy Then

Buy n Shares at Market

EndIf

SET STOP %loss sl

SET TARGET %PROFIT tp

Maxime

Great work in trying to avoid curve fitting and walk forward test. Good to know that you have done this as gives some confidence moving forward to demo/live test. Are you planning running this on demo, live with minimum stakes or the code posted?

Hi Cosmic! What is meant by curve fitting and walk forward test?

Yes. I’ll probably give it a try with 1% $risk / no reinvestment until I find a way to reduce the drawdown.

This is very cool. Thank you very much.

I’ve been playing a bit with it. How did you get your m, p and d values? m and p relate to the Supertrend indicator….as I’m new to this indicator can you tell me if these are pretty standard variables? d = 20 seems reasonable to me.

I have just started paper trading the strategy. Adjusted the variables slightly to make a little more conservative: Rg = 0.4, Risk = 0.01, No reinvest. I’ve also optimised the p and d to 26 and 21 respectively (hence my question above).

Back tested in tick mode from Sept 2012 which is just 60,000 units back (round number, nothing scientific there however thought it appropriate to base test from period post Draghi saying that ECB would do anything to stop Euro failing in July 2012 and then subsequent quieting down of volatility / market).

I can’t attach my results (is this as I’m a Junior Member?)

% winning trades = 40%

Gain / Loss: 2.01

I still want to get the loss of the worse trade down (-3,752) and the size of the Maxdrawdown is too large (-19,291 with 8 consecutive losses).

I’ll look further into it however anyone looked at the poor performance in Q2 2013 and last quarter of this year? Down periods are to be expected but just wondering whether there was anything macro going on that we should bear in mind going forward.

I’ll let you know how my trades go with this. Looking forward to hearing from any other of you guys paper trading this.

Cheers

Have you backtested using tick data?

Yes. Well I think I am. I’m running v. 10.3 and I ticked “ProBacktest in tick by tick mode”

Hi,

Thanks for your comments and sorry for my late answer 🙂

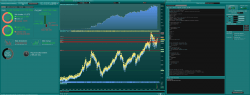

m, d & p are optimized variables which I chose to maximize the Profit/Drawdown Ratio. Hence, since September 2012 using my last settings (0.5 %Loss / 1.5 %Profit / No reinvestment / No multipliers) it gives a worst loss of 1.77%, a DD of 12.8% and a profit of 94.17% with gain/loss = 1.51 and 33.21 winning trades.

As all except 1 of the winning trades came after more than 5 candles in this last backtest, my guess is that tick mode or not it won’t change many things.

Maxime

Thanks Maxime. Appreciate it.

I’ll let you know how it goes. I’ve been running it in demo in the background whilst I have been focusing on other strategies. No trades yet though so I’ll take another look at the code probably next week.

Cheers

Jonjon, do you have screenshoot of this strategy in tick by tick mode?

Hi Kenneth. I can’t attach the screenshot I’m afraid. Unless I’m doing something stupid. I pasted the screenshot into Word and tried to attach the file.

Try sniptool/snippingtool?

http://www.capture-screenshot.org/snipping-tool/

why do I get error ond line whit DAX? Eihter cod works. Can you chare the file?

Hi Triss. the File is in the post for download. There is nothing wrong with the code. Your error describes 2 line- but it empty- perhaps some character sneaked in yours? . Please check that you code is correct copied. or download the file dax-15m-longonly.itf

Cheers Kasper

Hi

I am tryong to figure out how trist strategy works. I am new to pro real time.

Can someone explain the entry and exit method? Many thanks

Hello,Thank you for sharing this beautiful strategy.Is it possible to indicate the code for short positions?Best Regard.

Thank you very much for this fascinating trading system. It is still proving to be extremely effective in 2024. It illustrates once again how valuable individual trading systems can be.