Good evening,

this is my first article in this beautiful community, so I hope you will appreciate the content and contribute by giving me suggestions for improvement in my trading!

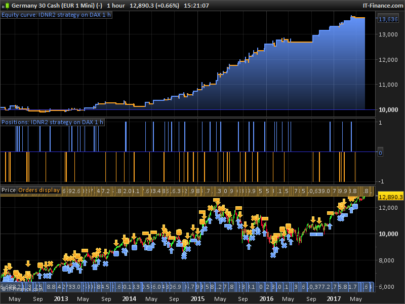

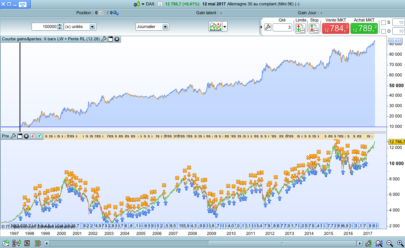

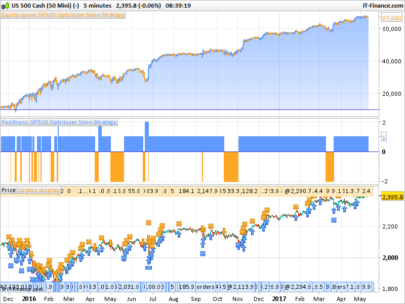

The strategy based on the 5 min DAX is not mine but comes from a webinar of the famous Andrea Unger; It is based on the breakdown of the maximum or minimum of the first hour of trading (08: 00-09: 00 AM).

The strategy needs the “Dfactor” indicator which is attached at the end of the current post too.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 |

DEFPARAM cumulateorders = false DEFPARAM Flatbefore = 090000 DEFPARAM Flatafter = 220000 ncontr=2 //n contratti da comprare o vendere per posizione x=1 //moltiplicatore della barra della prima ora y=0.5 //dailyfactor da utilizzare z=2 //percentuale guadagno da proteggere con stop in trailing dailyfact, dayofw = CALL "Dfactor" //mytrailstop=Supertrend[5,20] //fiso valore moltiplicatore per determinare il livello di ingresso e del massimo/minimo della prima ora moltipl=x //individuo maz e minimo prima ora if time = 080000 then maxprimaora=High minprimaora=Low endif if time > 080000 and time <= 090000 then if High > maxprimaora then maxprimaora = High endif if Low < minprimaora then minprimaora = Low endif endif // determino i valori di ingresso Long e Short delta = moltipl*(maxprimaora-minprimaora) ingressolong=maxprimaora+delta ingressoshort=minprimaora-delta // determino i valori di STOP LOSS sia long che short stoplong = maxprimaora stopshort = minprimaora //verifico innanzitutto che il daily Factor sia minore di 0,75 e che non sia venerdì if time <= 100000 then if dailyfact < y and dayofw <> 5 then // verifico se ho rotto max o min della prima ora if High > ingressolong and not onmarket then stopl=stoplong buy ncontr contract at market SET STOP LOSS stopl elsif Low < ingressoshort and not onmarket then stopl=stopshort sellshort ncontr contract at market SET STOP LOSS stopl endif endif // se sono a mercato e sono in guadagno calcolo lo stop di protezione della percentuale di guadagno accumulato if longonmarket and close > ingressolong then ptiguadagno=ABS(Close-ingressolong) guadagno=ptiguadagno*pointvalue percguad=z*guadagno/100 elsif shortonmarket then ptiguadagno=ABS(Close-ingressoshort) guadagno=ptiguadagno*pointvalue percguad=z*guadagno/100 endif if onmarket then SET STOP $TRAILING percguad endif endif |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hello and thanks for your article. As i have an import problem on my platform, could you copy/paste the dfactor.itf code in txt here ? So i can create the indicator.

Hi sofitech, thanks for your question, here is the code for the Dfactor indicator (really simple)

Dfact=0

dayofw=0

Dfact=(ABS(Dclose(1)-Dopen(1)))/(ABS(DHigh(1)-Dlow(1)))

dayofw=Dayofweek

Return Dfact as \"df\", dayofw as \"dayofw\"

great code…

also on Cac40 it works very well during the last month…but if you increase the time horizon tends to lose efficacy.I noticed that works well in the bullish phases, so with a filter as a short moving average could improve.

maybe during weekend I do some testing

Ciaooo

Thanks Gianpiero for your comment,

I’ll wait for your improvement !

Have a nice Week End

Ciao

Andrea

Grande Andrea

Hi. For some reason I do not get the same trades as you when I test this. What is your timezone set at as this would impact it dramatically?

Hi davidp13,

I don’t know for wich reason your backtest is so different from that one I posted here; the Time zone I used for this code is CET (Rome).

Ciao, ma capita anche a voi che sul 5minuti si interrompe spesso e bisogna farlo ripartire?

Ciao Alfredo, il problema è nel codice di gestione del trailing stop , ti posto il codice che uso senza tale funzionalità (il backtest non cambia)

DEFPARAM cumulateorders = false

DEFPARAM Flatbefore = 090000

DEFPARAM Flatafter = 220000

ncontr=2 //n contratti da comprare o vendere per posizione

x=1 //moltiplicatore della barra della prima ora

y=0.5 //dailyfactor da utilizzare

dailyfact, dayofw = CALL \"Dfactor\"

//mytrailstop=Supertrend[5,20]

//fiso valore moltiplicatore per determinare il livello di ingresso e del massimo/minimo della prima ora

moltipl=x

//individuo maz e minimo prima ora

if time = 080000 then

maxprimaora=High

minprimaora=Low

endif

if time > 080000 and time <= 090000 then

if High > maxprimaora then

maxprimaora = High

endif

if Low < minprimaora then

minprimaora = Low

endif

endif

// determino i valori di ingresso Long e Short

delta = moltipl*(maxprimaora-minprimaora)

ingressolong=maxprimaora+delta

ingressoshort=minprimaora-delta

// determino i valori di STOP LOSS sia long che short

stoplong = maxprimaora

stopshort = minprimaora

//verifico innanzitutto che il daily Factor sia minore di 0,75 e che non sia venerdì

if time <= 100000 then

if dailyfact < y and dayofw <> 5 then

// verifico se ho rotto max o min della prima ora

if High > ingressolong and not onmarket then

stopl=stoplong

buy ncontr contract at market

SET STOP LOSS stopl

elsif Low < ingressoshort and not onmarket then

stopl=stopshort

sellshort ncontr contract at market

SET STOP LOSS stopl

endif

endif

endif

….

Grazie Andrea

Ciao Andrea, l’ho fatto partire con le modifiche che hai fatto ma mi ha aperto una posizione short oggi con uno stop loss a oltre 7000 punti di distanza, possibile?

Ciao Alfredo, purtroppo ho notato anche io questo comportamento anomalo che in fase di backtest non mi risultava, devo verificare il motivo ….

il codice ha dato buoni risultati di guadagno in reale sul 4 ore .

Ciao Miguel,

si il codice è buono, ma soprattutto la strategia di Unger è molto robusta, purtroppo non ho molto tempo per dedicarmi alla programmazione, e ci sono ancora delle inesattezze nel posizionamento degli stop loss (i valori sono del tutto sballati) …..

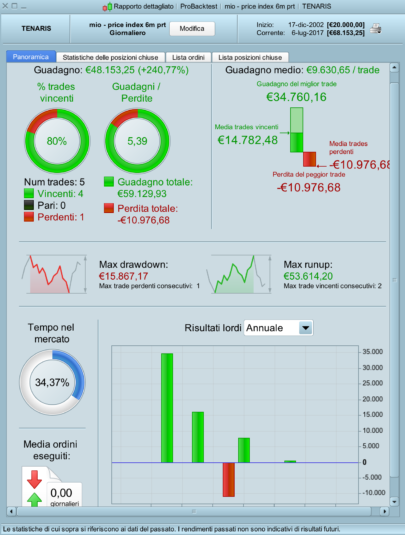

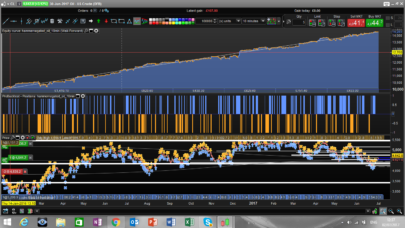

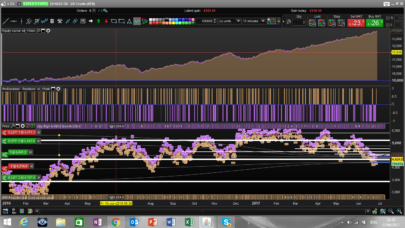

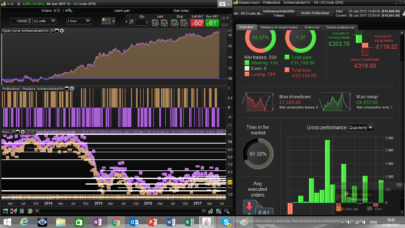

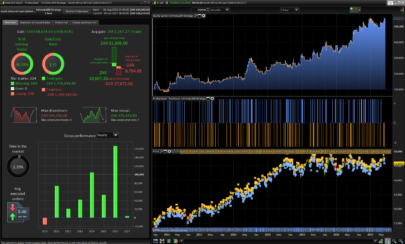

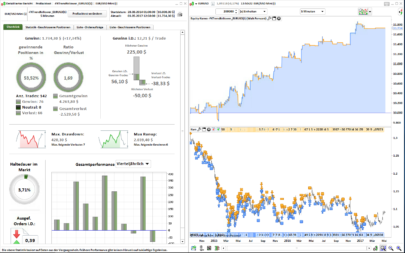

Si come strategia è da approfondire per migliorarla . In reale per ora mi ha dato ottimi ritorni di gain ma può avere margini di miglioramento straordinari . Anche se mi ha fatto solo trade long . Allego risultato da quando l’ho inserita in reale.

Cerchiamo di migliorarla insieme.

Buon lavoro

miguel

PS- non riesco a inserire foto .

Salve a tutti, mi è stato segnalato questo post e ringrazio l’autore per il lavoro fatto sulla mia strategia. Ero già in contatto con PRT per avere una versione da far girare sulla loro piattaforma ed allego la versione da loro prodotta che corrisponde quasi in tutto ai risultati che ho con il mio codice originale (ci sono solo un paio di punti da verificare su cui i tecnici di PRT stanno lavorando). Per un utilizzo appropriato della strategia vi consiglierei di prendere visione del webinar gratuito dove viene spiegato il processo attraverso il cui è stato creato quel codice:

versione italiana: http://bit.ly/PRTIT-1

Versione Inglese http://bit.ly/PRTEN-1

Grazie, ciao

Hi all, this post was notified to me and I thank its author for the work done on my strategy. I was already in touch with PRT to get a version to use on their platform and I attach last version they produced which corresponds nearly completely with my original code (there are only some minor issues on which PRT experts are currently working). To use the strategy properly I would suggest to attend the free webinar where the process to get to that code is explained:

Italian version http://bit.ly/PRTIT-1

English version: http://bit.ly/PRTEN-1

Thanks

Cheers

Andrea Unger

DEFPARAM FLATAFTER=215500 // replace closetime condition

RangeMultiplier=0.95

BegTime=090000

EndTime=095500

MyContracts=1

SkipDay=dayofweek<>5

if intradaybarindex=0 then

maxSetup = 0

minSetup = 0

dailyfactor = abs(dOpen(1)-dClose(1))<0.75*(dHigh(1)-dLow(1))

tradethisday=0

else

if barindex=tradeindex then

tradethisday=1

endif

endif

If dailyfactor and Time >= BegTime and Time <= EndTime and SkipDay and tradethisday=0 then

if maxSetup=0 then

maxSetup = dHigh(0) + RangeMultiplier * (dHigh(0) - dLow(0))

slLong=dHigh(0)

endif

if minsetup=0 then

minSetup = dLow(0) - RangeMultiplier * (dHigh(0) - dLow(0))

slShort = dLow(0)

endif

Buy mycontracts contract at maxSetup stop

Sell at slLong stop

SellShort mycontracts contract at minSetup stop

ExitShort at slShort stop

endif

If LongOnMarket then

Sell at slLong stop

elsif ShortOnMarket then

ExitShort at slShort stop

endif

set stop loss 1000

Grazie Ing. Unger per il suo commento e per il suo post, il codice che ho caricato, un po’ più “elaborato” del suo :-)), in effetti nasce dalla visualizzazione del webinar free relativo alla sua strategia; purtroppo non sono un programmatore professionista pertanto ho qualche difficoltà a tradurre fedelmente le indicazioni da lei fornite in righe di codice per Pro Real Time …. il backtest mi da però dei buoni dati in termini di prestazioni; la sto infatti testando in demo …..

Buona serata

Andrea B.

Non mi sembra migliore il codice , anzi in backtest dal giugno 2012 mentre il precedente ha un guadagno del 122 % questa ha una perdita del 58% . Cosa mi sfugge se leggo che sono simili ?

Ho tentato ieri di collegarmi al webinar dell’ ing Unger ma non è stato possibile.

Grazie e buona giornata .

miguel

Su quale strumento testi il tutto? A me sul future dicembre (ovviamente non dal 2012) da trade corrispondenti al modello originale

Ho fatto il backtest sul DAX cash mini

purtroppo con l’ipad non mi da la possibilità di inserire le foto dei test

dott. Unger e’ possibile avere il codice per la MT4 ?

Grazie .

Dott. Unger, ma la versione pubblicata della strategia è quella corretta o i tecnici in seguito alle verifiche hanno apportato delle modifiche?

Grazie

Ciao a tutti, qualcuno sta ancora usando questa strategia? la ho appena testata e mi pare che da Agosto 2016 non stia performando…

Pare anche a me che non vada un granchè

gira sull 1hr non sul 5 minuti

Salve,

ho scaricato la strategia e ho provato a fare un test ma come risultato da 0, devo cambiare qualche impostazione?

Someone still using this strategy? Are there any results available?

Andrea, are you still using expert advisor?