Dear all

I have elaborated a little over an idea originally posted in the forum by Bjoern posted as True Range Breakout EUR/USD.

I applied to the Dax with the additional feature of switching from a breakout to a mean reversion strategy depending on some optimized value of the ADX indicator.

The strategy is a breakout strategy when the adx is above a certain value and a mean reverting strategy when ADX value is below that same value.

I have optimized it on several time frame and the results look quite promising, it would be great if someone think of a better way of discriminate between range trading vs trending phases. I have used the popular ADX indicator, but I am sure there are more efficient way to look at phase transitions in market.

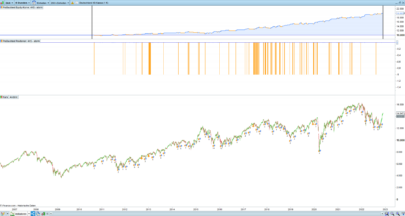

The results for different time frames are attached, together with the 30minutes code.

Best Regards

Francesco

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 |

DEFPARAM CumulateOrders = False DEFPARAM FLATBEFORE =080000 DEFPARAM FLATAFTER =210000 adxval = 20 ATRperiod = 12 adxperiod = 15 indicator1 = adx[adxperiod] atr = AverageTrueRange[ATRperiod] m = 3 n = 2 c1 = indicator1 <adxval c2 = indicator1 >adxval if c1 then // short IF (abs(open-close) > (atr*m) and close > open) THEN sellshort 1 CONTRACTS AT MARKET //SET STOP pLOSS losses //SET TARGET pPROFIT profits ENDIF //long IF (abs(open-close) > (atr*m) and close < open) THEN buy 1 CONTRACTS AT MARKET //SET STOP pLOSS losses //SET TARGET pPROFIT profits ENDIF endif if c2 then // long IF (abs(open-close) > (atr*n) and close > open and close> Dhigh(1)) THEN buy 1 CONTRACTS AT MARKET //SET STOP pLOSS losses //SET TARGET pPROFIT profits ENDIF //short IF (abs(open-close) > (atr*n) and close < open and close< Dlow(1)) THEN sellshort 1 CONTRACTS AT MARKET //SET STOP pLOSS losses //SET TARGET pPROFIT profits ENDIF endif |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

You could try integrating DAX’s seasonality from the Pathfinder System. It may improve results considerably.

https://www.prorealcode.com/prorealtime-trading-strategies/pathfinder-dax-4h/

Cheers!!

Thank you Enrique for your precious suggestion!

Ill try to incorporate it for sure (once I understand it :)))

Best Regards

Francesco

Enrique, I have added the Dax Seasonality on the 1hr TF and did some positioning modification.

I attach the code and the picture with the comparison.

Best Regards

Fr

// EUR/USD(mini) - IG MARKETS

// TIME FRAME 1H

// SPREAD 2.0 PIPS

DEFPARAM CumulateOrders = False

DEFPARAM FLATBEFORE =090000

DEFPARAM FLATAFTER =210000

// define saisonal position multiplier for each month 1-15 / 16-31 (>0 - long / <0 - short / 0 no trade)

ONCE January1 = 3 //0 risk(3)

ONCE January2 = 0 //3 ok

ONCE February1 = 3 //3 ok

ONCE February2 = 3 //0 risk(3)

ONCE March1 = 3 //0 risk(3)

ONCE March2 = 2 //3 ok

ONCE April1 = 3 //3 ok

ONCE April2 = 3 //3 ok

ONCE May1 = 1 //0 risk(1)

ONCE May2 = 1 //0 risk(1)

ONCE June1 = 1 //1 ok 2

ONCE June2 = 2 //3 ok

ONCE July1 = 3 //1 chance

ONCE July2 = 2 //3 ok

ONCE August1 = 2 //1 chance 1

ONCE August2 = 3 //3 ok

ONCE September1 = 3 //0 risk(3)

ONCE September2 = 0 //0 ok

ONCE October1 = 3 //0 risk(3)

ONCE October2 = 2 //3 ok

ONCE November1 = 1 //1 ok

ONCE November2 = 3 //3 ok

ONCE December1 = 3 // 1 chance

ONCE December2 = 2 //3 ok

// set saisonal multiplier

currentDayOfTheMonth = Day

midOfMonth = 15

IF CurrentMonth = 1 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = January1

ELSE

saisonalPatternMultiplier = January2

ENDIF

ELSIF CurrentMonth = 2 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = February1

ELSE

saisonalPatternMultiplier = February2

ENDIF

ELSIF CurrentMonth = 3 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = March1

ELSE

saisonalPatternMultiplier = March2

ENDIF

ELSIF CurrentMonth = 4 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = April1

ELSE

saisonalPatternMultiplier = April2

ENDIF

ELSIF CurrentMonth = 5 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = May1

ELSE

saisonalPatternMultiplier = May2

ENDIF

ELSIF CurrentMonth = 6 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = June1

ELSE

saisonalPatternMultiplier = June2

ENDIF

ELSIF CurrentMonth = 7 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = July1

ELSE

saisonalPatternMultiplier = July2

ENDIF

ELSIF CurrentMonth = 8 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = August1

ELSE

saisonalPatternMultiplier = August2

ENDIF

ELSIF CurrentMonth = 9 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = September1

ELSE

saisonalPatternMultiplier = September2

ENDIF

ELSIF CurrentMonth = 10 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = October1

ELSE

saisonalPatternMultiplier = October2

ENDIF

ELSIF CurrentMonth = 11 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = November1

ELSE

saisonalPatternMultiplier = November2

ENDIF

ELSIF CurrentMonth = 12 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = December1

ELSE

saisonalPatternMultiplier = December2

ENDIF

endif

adxperiod = 14

atrperiod = 14

indicator1 = adx[adxperiod]

atr = AverageTrueRange[atrperiod]

//exitafternbars = 1

adxval = 19

atrmin = 25

position = round(100/atr/2.1666)

//a=5

m = 3

n = 2

m1 = m-1

n1 = n

if atr>atrmin then

c1 = indicator1 <adxval

c2 = indicator1 >adxval

if c1 then

// short

IF (abs(open-close) > (atr*m) and close > open) THEN

sellshort position CONTRACTS AT MARKET

ENDIF

//long

IF (abs(open-close) > (atr*m) and close < open) THEN

buy position*saisonalPatternMultiplier CONTRACTS AT MARKET

ENDIF

endif

if c2 then

// long

IF (abs(open-close) > (atr*n) and close > open and close> DOPEN(1)) THEN

buy position*saisonalPatternMultiplier CONTRACTS AT MARKET

ENDIF

//short

IF (abs(open-close) > (atr*n) and close < open and close< DOPEN(1)) THEN

sellshort position CONTRACTS AT MARKET

ENDIF

endif

endif

if atr<atrmin then

c1 = indicator1 <adxval

c2 = indicator1 >adxval

if c1 then

// short

IF (abs(open-close) > (atr*m1) and close > open) THEN

sellshort position CONTRACTS AT MARKET

ENDIF

//long

IF (abs(open-close) > (atr*m1) and close < open) THEN

buy position*saisonalPatternMultiplier CONTRACTS AT MARKET

ENDIF

endif

if c2 then

// long

IF (abs(open-close) > (atr*n1) and close > open ) THEN

buy position*saisonalPatternMultiplier CONTRACTS AT MARKET

ENDIF

//short

IF (abs(open-close) > (atr*n1) and close < open) THEN

sellshort position CONTRACTS AT MARKET

ENDIF

endif

endif

//if exitafternbars then

//IF longonmarket and BarIndex - TradeIndex = a Then

//sell position contracts at Market

//EndIF

//IF shortonmarket and BarIndex - TradeIndex = a Then

//exitshort position contracts at Market

//EndIF

//endif

ancesco

I have done some more work on this code, I noticed that the strategy was poor when ATR (or VOl) was low, so I thought to make a position sizing inversely proportional to the ATR.

Further more I created 2 scenarios,

1 ATR is bigger than x

2 ATR is smaller than x

Now the curve in the 1hr case looks steeper and smoother.

I attach the results.

Regards

Enrique, I have added the Dax Seasonality on the 1hr TF and did some positioning modification.

I attach the code and the picture with the comparison.

Best Regards

Fr

// EUR/USD(mini) - IG MARKETS

// TIME FRAME 1H

// SPREAD 2.0 PIPS

DEFPARAM CumulateOrders = False

DEFPARAM FLATBEFORE =090000

DEFPARAM FLATAFTER =210000

// define saisonal position multiplier for each month 1-15 / 16-31 (>0 - long / <0 - short / 0 no trade)

ONCE January1 = 3 //0 risk(3)

ONCE January2 = 0 //3 ok

ONCE February1 = 3 //3 ok

ONCE February2 = 3 //0 risk(3)

ONCE March1 = 3 //0 risk(3)

ONCE March2 = 2 //3 ok

ONCE April1 = 3 //3 ok

ONCE April2 = 3 //3 ok

ONCE May1 = 1 //0 risk(1)

ONCE May2 = 1 //0 risk(1)

ONCE June1 = 1 //1 ok 2

ONCE June2 = 2 //3 ok

ONCE July1 = 3 //1 chance

ONCE July2 = 2 //3 ok

ONCE August1 = 2 //1 chance 1

ONCE August2 = 3 //3 ok

ONCE September1 = 3 //0 risk(3)

ONCE September2 = 0 //0 ok

ONCE October1 = 3 //0 risk(3)

ONCE October2 = 2 //3 ok

ONCE November1 = 1 //1 ok

ONCE November2 = 3 //3 ok

ONCE December1 = 3 // 1 chance

ONCE December2 = 2 //3 ok

// set saisonal multiplier

currentDayOfTheMonth = Day

midOfMonth = 15

IF CurrentMonth = 1 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = January1

ELSE

saisonalPatternMultiplier = January2

ENDIF

ELSIF CurrentMonth = 2 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = February1

ELSE

saisonalPatternMultiplier = February2

ENDIF

ELSIF CurrentMonth = 3 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = March1

ELSE

saisonalPatternMultiplier = March2

ENDIF

ELSIF CurrentMonth = 4 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = April1

ELSE

saisonalPatternMultiplier = April2

ENDIF

ELSIF CurrentMonth = 5 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = May1

ELSE

saisonalPatternMultiplier = May2

ENDIF

ELSIF CurrentMonth = 6 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = June1

ELSE

saisonalPatternMultiplier = June2

ENDIF

ELSIF CurrentMonth = 7 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = July1

ELSE

saisonalPatternMultiplier = July2

ENDIF

ELSIF CurrentMonth = 8 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = August1

ELSE

saisonalPatternMultiplier = August2

ENDIF

ELSIF CurrentMonth = 9 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = September1

ELSE

saisonalPatternMultiplier = September2

ENDIF

ELSIF CurrentMonth = 10 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = October1

ELSE

saisonalPatternMultiplier = October2

ENDIF

ELSIF CurrentMonth = 11 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = November1

ELSE

saisonalPatternMultiplier = November2

ENDIF

ELSIF CurrentMonth = 12 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = December1

ELSE

saisonalPatternMultiplier = December2

ENDIF

endif

adxperiod = 14

atrperiod = 14

indicator1 = adx[adxperiod]

atr = AverageTrueRange[atrperiod]

//exitafternbars = 1

adxval = 19

atrmin = 25

position = round(100/atr/2.1666)

//a=5

m = 3

n = 2

m1 = m-1

n1 = n

if atr>atrmin then

c1 = indicator1 <adxval

c2 = indicator1 >adxval

if c1 then

// short

IF (abs(open-close) > (atr*m) and close > open) THEN

sellshort position CONTRACTS AT MARKET

ENDIF

//long

IF (abs(open-close) > (atr*m) and close < open) THEN

buy position*saisonalPatternMultiplier CONTRACTS AT MARKET

ENDIF

endif

if c2 then

// long

IF (abs(open-close) > (atr*n) and close > open and close> DOPEN(1)) THEN

buy position*saisonalPatternMultiplier CONTRACTS AT MARKET

ENDIF

//short

IF (abs(open-close) > (atr*n) and close < open and close< DOPEN(1)) THEN

sellshort position CONTRACTS AT MARKET

ENDIF

endif

endif

if atr<atrmin then

c1 = indicator1 <adxval

c2 = indicator1 >adxval

if c1 then

// short

IF (abs(open-close) > (atr*m1) and close > open) THEN

sellshort position CONTRACTS AT MARKET

ENDIF

//long

IF (abs(open-close) > (atr*m1) and close < open) THEN

buy position*saisonalPatternMultiplier CONTRACTS AT MARKET

ENDIF

endif

if c2 then

// long

IF (abs(open-close) > (atr*n1) and close > open ) THEN

buy position*saisonalPatternMultiplier CONTRACTS AT MARKET

ENDIF

//short

IF (abs(open-close) > (atr*n1) and close < open) THEN

sellshort position CONTRACTS AT MARKET

ENDIF

endif

endif

//if exitafternbars then

//IF longonmarket and BarIndex - TradeIndex = a Then

//sell position contracts at Market

//EndIF

//IF shortonmarket and BarIndex - TradeIndex = a Then

//exitshort position contracts at Market

//EndIF

//endif

ancesco

Hi Francesco,

I tried on 200k units but results were not good. Flat until your optimisation period then it gets going, which of course means curve fitted and little chance of success going forward. I’m not saying it can’t work but it needs some IN/OUT sampling and WF testing to have a chance of success. If you need help with any of this then let me know. If you want me to test any other than 30min then let me know. Happy to help 🙂

https://ibb.co/bvrLGQ

Hi Cosmic1

Thank you for the time you have devoted to the strategy I posted first of all.

I was aware of the fact that the original code did not give nice results on a 200k bars backtest, as someone did the test in the section on the forum dedicated to this strategy. https://www.prorealcode.com/topic/dax-adaptable-strategy-breackoutmean-reversion/

What I think could be would interesting peraps would be to try the 1hr version of the code whereby I have also added the seasonalities parameter used in pathfinder and navigator system. I have also rewritten the code in a way that maybe could be more understandable .

Maybe the fact that the strategy performs only from 2014 is structural or maybe some changes in the code can be made in order to make it simpler and less dependandt by optimization.

// dax - IG MARKETS

// TIME FRAME 1H

// SPREAD 1.0 PIPS

DEFPARAM CumulateOrders = False

DEFPARAM FLATBEFORE =090000

DEFPARAM FLATAFTER =210000

//highvolume = average[30](volume)<=volume//

//lowvolume = average[30](volume)>=volume

adxperiod = 14

atrperiod = 14

indicator1 = adx[adxperiod]

atr = AverageTrueRange[atrperiod]

//exitafternbars = 1

//// OPTIMIZED VARIABLES/////

adxval = 19

atrmin = 25

m = 3 // high vol coefficient for mean reversion

n = 2 //high vol coefficient for brekout

m1 = m-1 // low vol coefficient for mean reversion

n1 = n// low vol coefficient for breakout

///////////////////////////////////////

positionlong = saisonalpatternmultiplier*round(100/atr/2.1666)//define sixe of long trades

positionshort = round(100/atr)// define size of short trade

//a=5

lowvolenvironment = atr<atrmin //define lowvol environment use m1 and n1 as coefficient of movement

highvolenvironment = atr> atrmin //define highvol environment use m and n as coefficient of movement

meanrevertingenv = indicator1< adxval //define meanreverting environment

trendenv = indicator1 > adxval// define trendy environment

//////description of the possible combinations

sellhighvolmeanreverting = abs(open-close) > (atr*m) and close > open and meanrevertingenv and highvolenvironment

buyhighvolmeanreverting = abs(open-close) > (atr*m) and close < open and meanrevertingenv and highvolenvironment

buyhighvoltrendy = abs(open-close) > (atr*n) and close > open and close> DOPEN(1) and trendenv and highvolenvironment

sellhighvoltrendy = abs(open-close) > (atr*n) and close < open and close< DOPEN(1) and trendenv and highvolenvironment

selllowvolmeanreverting = abs(open-close) > (atr*m1) and close > open and meanrevertingenv and lowvolenvironment

buylowvolmeanreverting = abs(open-close) > (atr*m1) and close < open and meanrevertingenv and lowvolenvironment

buylowvoltrendy = abs(open-close) > (atr*n1) and close > open and trendenv and lowvolenvironment

selllowvoltrendy = abs(open-close) > (atr*n1) and close < open and trendenv and lowvolenvironment

////////////////////////////////////////////////////////

// define saisonal position multiplier for each month 1-15 / 16-31 (>0 - long / <0 - short / 0 no trade)

ONCE January1 = 3 //0 risk(3)

ONCE January2 = 0 //3 ok

ONCE February1 = 3 //3 ok

ONCE February2 = 3 //0 risk(3)

ONCE March1 = 3 //0 risk(3)

ONCE March2 = 2 //3 ok

ONCE April1 = 3 //3 ok

ONCE April2 = 3 //3 ok

ONCE May1 = 1 //0 risk(1)

ONCE May2 = 1 //0 risk(1)

ONCE June1 = 1 //1 ok 2

ONCE June2 = 2 //3 ok

ONCE July1 = 3 //1 chance

ONCE July2 = 2 //3 ok

ONCE August1 = 2 //1 chance 1

ONCE August2 = 3 //3 ok

ONCE September1 = 3 //0 risk(3)

ONCE September2 = 0 //0 ok

ONCE October1 = 3 //0 risk(3)

ONCE October2 = 2 //3 ok

ONCE November1 = 1 //1 ok

ONCE November2 = 3 //3 ok

ONCE December1 = 3 // 1 chance

ONCE December2 = 2 //3 ok

// set saisonal multiplier

currentDayOfTheMonth = Day

midOfMonth = 15

IF CurrentMonth = 1 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = January1

ELSE

saisonalPatternMultiplier = January2

ENDIF

ELSIF CurrentMonth = 2 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = February1

ELSE

saisonalPatternMultiplier = February2

ENDIF

ELSIF CurrentMonth = 3 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = March1

ELSE

saisonalPatternMultiplier = March2

ENDIF

ELSIF CurrentMonth = 4 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = April1

ELSE

saisonalPatternMultiplier = April2

ENDIF

ELSIF CurrentMonth = 5 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = May1

ELSE

saisonalPatternMultiplier = May2

ENDIF

ELSIF CurrentMonth = 6 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = June1

ELSE

saisonalPatternMultiplier = June2

ENDIF

ELSIF CurrentMonth = 7 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = July1

ELSE

saisonalPatternMultiplier = July2

ENDIF

ELSIF CurrentMonth = 8 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = August1

ELSE

saisonalPatternMultiplier = August2

ENDIF

ELSIF CurrentMonth = 9 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = September1

ELSE

saisonalPatternMultiplier = September2

ENDIF

ELSIF CurrentMonth = 10 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = October1

ELSE

saisonalPatternMultiplier = October2

ENDIF

ELSIF CurrentMonth = 11 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = November1

ELSE

saisonalPatternMultiplier = November2

ENDIF

ELSIF CurrentMonth = 12 THEN

IF currentDayOfTheMonth <= midOfMonth THEN

saisonalPatternMultiplier = December1

ELSE

saisonalPatternMultiplier = December2

ENDIF

endif

//long

IF (buyhighvolmeanreverting or buyhighvoltrendy or buylowvolmeanreverting or buylowvoltrendy ) THEN

buy positionlong CONTRACTS AT MARKET

ENDIF

// short

IF (sellhighvolmeanreverting or sellhighvoltrendy or selllowvolmeanreverting or selllowvoltrendy) THEN

sellshort positionshort CONTRACTS AT MARKET

endif

//if exitafternbars then

//IF longonmarket and BarIndex - TradeIndex = a Then

//sell position contracts at Market

//EndIF

//IF shortonmarket and BarIndex - TradeIndex = a Then

//exitshort position contracts at Market

//EndIF

//endif

hello Francesco, are you still working on this strategy?

Will post in your forum thread.

Buon pomeriggio ALe,

ho notato che posticipando la parte di codice che esegue il breakout alle 9.00 anziche alle 8.00 , si eliminano alcuni trade e il drawdown diminuisce notevolmente , sarebbe interessante verificare con un backtest più ampio ( io arrivo solo fino a maggio 2016

ecco il codice che ne pensi ?

DEFPARAM CumulateOrders = false//DEFPARAM FLATBEFORE =080000 original//DEFPARAM FLATBEFORE =090000 // TF 30 min IT’s better starting at 9 o clockDEFPARAM FLATAFTER =210000startbreak = 90000startrevert = 80000

adxval = 20//adxval = 25ATRperiod = 12//adxperiod = 15adxperiod = 15indicator1 = adx[adxperiod]atr = AverageTrueRange[ATRperiod]

//m = 3//n = 2m = 3n = 2c1 = indicator1 <adxvalc2 = indicator1 >adxval

if time >= startrevert thenif c1 then// shortIF (abs(open-close) > (atr*m) and close > open) THENsellshort 1 CONTRACTS AT market//trading = 0//SET STOP pLOSS losses//SET TARGET pPROFIT profitsENDIF

//longIF (abs(open-close) > (atr*m) and close < open) THENbuy 1 CONTRACTS AT market//SET STOP pLOSS losses//SET TARGET pPROFIT profitsENDIFendifendif

// new//MM100 = Average[200](CLose)///testIf time >= startbreak thenif c2 then// longIF (abs(open-close) > (atr*n) and close > open and close> Dhigh(1)) THENbuy 1 CONTRACTS AT market//trading = 0//SET STOP pLOSS losses//SET TARGET pPROFIT profitsENDIF

//short//if DCLose(1) < MM100 thenIF (abs(open-close) > (atr*n) and close < open and close< Dlow(1)) THENsellshort 1 CONTRACTS AT market//SET STOP pLOSS losses//trading = 1endifendifendif

set stop ploss 250//IF shortonmarket and trading = 1 and close<tradeprice – 20 then//exitshort at market//endif

Ciao JR

Francesco here not Ale :))

thanks so much for checking the code, I will have a look, unfortunately me too I dont have 200k backtest

Ciao JR

Francesco here not Ale :))

thanks so much for checking the code, I will have a look, unfortunately me too I dont have 200k backtest.

In any case check the forum as I posted few variations of the code

Thank you!

Ok sorry Francesco 🙂

These are the comparison with my lates version and yours, I think it improves by all the measures. So great! thank you again

Hi Francesco,

First of all, congratulations for your work and thanks for your contributions. I am one of your strategies’ most devoted follower.

As a beginner, it may seems a simple question. I am studying this code (Seasonal, nor Adaptable) and I can see that the number of positions are depending on the ATR and the Seasonal Index you give to the different months.

The thing is than when I place the strategy in the ProRealOrder, automatically it asks you how many contracts I want to place/order (example: 1), so when the strategy is triggered I can see that I just have one contract open.

Probably there is a logical answer that because, I am a beginner, don’t reach to see, so I would appreciate it if you or anyone in this Forum could enlighten me about it.

Thanks in advance,

Juan

Hi Juan Salas and thank you very much for your undeserved compliments.

I’m not sure if I undertand correctly your question, if you refer to the fact that the sistem ask you the max position allowed before running the code live, it is just a form of extra security the system adopt.

For this strategy, run a backtest and see how much is the max position that is taken in history, alternatively you can modify the code to a fixed size.

When it ask the question of max position, input what you think is your max tolerable size, if you instead decide to run the code with a fix position, just put this fix position in the system when it asks.

Hop that helps

Hi Francesco,

Yes, this is pretty much the question. The system ask me a number of contracts the moment I go live. I have checked the backtest history and it match with the number of contracts I am putting in the box.

Bottomline, right now with my limited capital, I will stick to your Hammernegated and MeanReverting for oil, which it is more “understandable” for me, and I can place Stops Losses and control the number of contracts. The Seasonable Breakout is for “big boys” 🙂 :), but I will try to come back to it later.

In any case, thanks so much for your answer and in the name of all those members who can’t produce/code a decent equity curve yet.

Best,

Juan

ok sounds good, you can put min size = 1 and go for the seasonable breakout too, also you can get rid of the seasonals to avoid variable position

HI all ,

anyone test 200k bar for this great code ?

Thank you for the coding, it seems promising.

FTSE gives for the short term (5 min) promising results, but as always reliability is the key, not sure about that.

21.04.2019: I retested the strategy for the DAX 5 minutes , it works fine for 10.000 bars, but gives sloppy results for 100.000 bars. . . the gold is to find the additional setting where it better fits all market slopes for the DAX . . . .