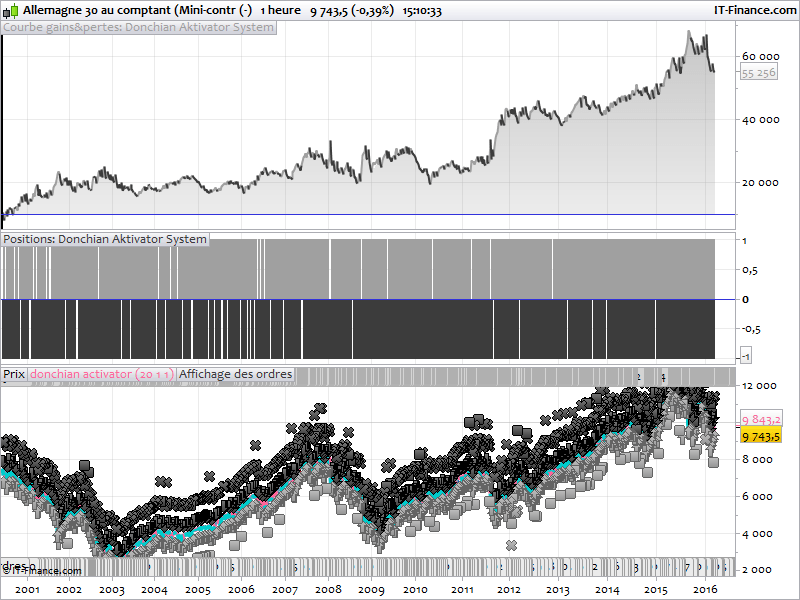

This automatic trading strategy on DAX GER30 is made of the indicator “Donchian Channel Activator Factor” available in the Library here : http://www.prorealcode.com/prorealtime-indicators/donchian-channel-activator-factor/

This system is a simple one, based on breakout of the recent highest or lowest on a 1 hour timeframe. Each trade has a stoploss made of the difference from the current close to last indicator value (upper or lower channel).

Test were made with 1 point spread, on mini-DAX CFD from ProRealTime-Trading.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 |

//parameters pd = 20 Factor = 1 ot = 1 //indicators hi = HIGHEST[pd](high)[ot] lo = LOWEST[pd](low)[ot] DUpper=hi+Factor*AverageTrueRange[pd](close) DLower=lo-Factor*AverageTrueRange[pd](close) // case BUY IF NOT LongOnMarket AND Close>hi AND Close[1]<hi THEN BUY 1 CONTRACTS AT MARKET stoploss = close-DLower ENDIF // exit BUY position If LongOnMarket AND Close<lo THEN SELL AT MARKET ENDIF //case SELL IF NOT ShortOnMarket AND Close<lo AND Close[1]>lo THEN SELLSHORT 1 CONTRACTS AT MARKET stoploss = DUpper-close ENDIF // exit SELL position IF ShortOnMarket AND Close>hi THEN EXITSHORT AT MARKET ENDIF SET STOP LOSS stoploss |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bonjour,

merci à Nicolas de proposer ces systèmes de trading sous PRT. Une question : est-ce-que le backtest prend en compte les frais overnight et si oui de quelle manière?

Ne penses-tu pas que les frais overnight ne peuvent pas annihiler les résultats du backtest sur d’aussi longues périodes (ici depuis 15 ans!!)?

FR/Bonjour Steftonio, non pas de frais overnight calculé sur la durée du backtest, c’est une bonne remarque.

Le backtest est réalisé sur 15 ans parce qu’il démontre que si cette stratégie intraday ne ruine pas le compte durant toute cette période (hors frais annexes donc), c’est parce qu’elle semble avoir du sens et qu’elle mérite qu’on s’y attarde : un breakout des derniers plus haut/plus bas semblent avoir fonctionné durant 15 ans (!). Les codes de la library sont fournis “as is / telle quelle” et ne sont pas un encouragement à les trader les yeux fermés, que ce soit un indicateur ou une stratégie. Bref j’ai trouvé une stratégie “sympa” que j’ai partagé, “go on next one!” Merci de ton inscription.

EN/ Hello Steftonio, not overnight fee calculated on the duration of the backtest, it’s a good point.

The backtest is conducted over 15 years because it demonstrates that if the intraday strategy does not ruin the account during this period (excluding charges so), it is because it seems to make sense and deserves that ‘further attention: a recent breakout above / below seem to have worked for 15 years (!). the library of codes are provided “as is / as is” and are not an encouragement to the trader eyes closed, either an indicator or strategy. In short I found a “nice” strategy that I shared, “we go next one!” Thank you for your registration.

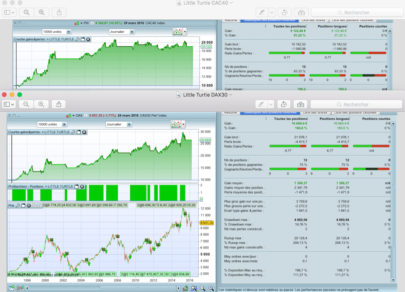

Any reason why in 2016 this system is doing very bad respect the previous years?

“very bad” is relative to the account equity. I do not forward test this strategy since I posted it. How is it bad?