hi,

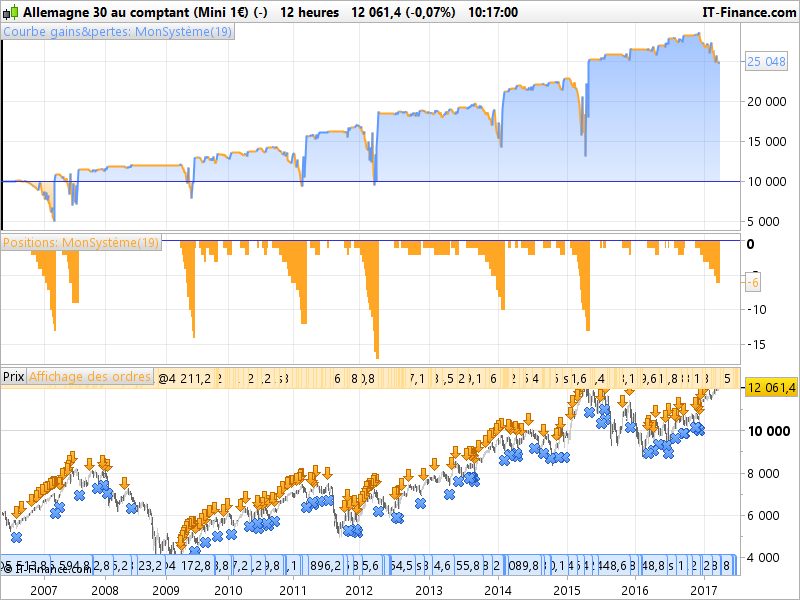

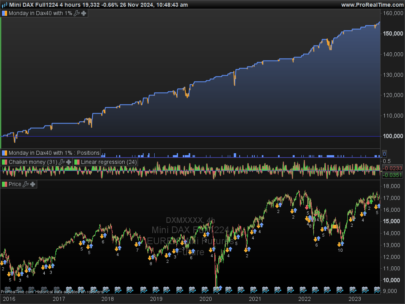

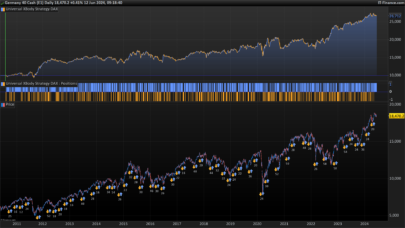

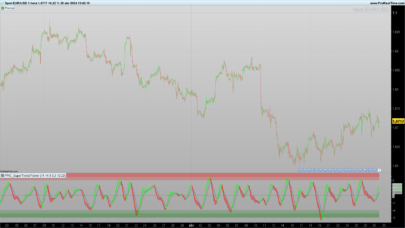

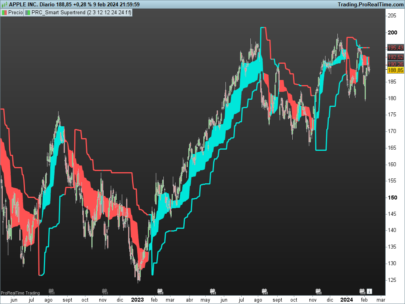

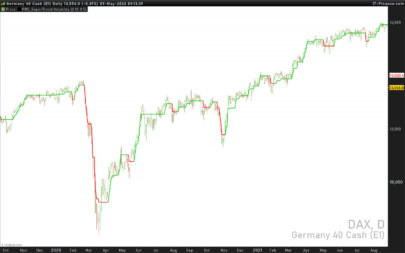

I am a new user and wanted to post a very simple strategy which wait and accumulate, based on a supertrend indicator (but this is the less important aspect… you can use any other indicator you like).

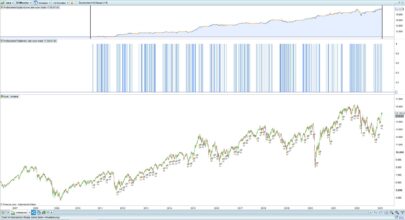

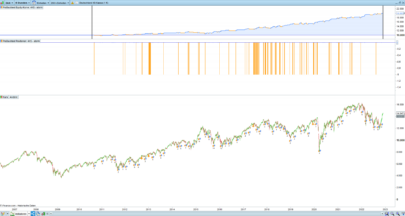

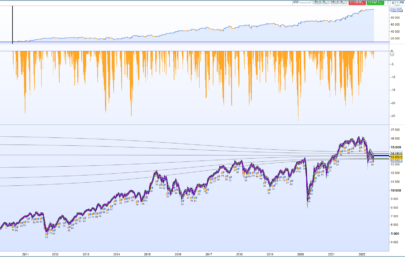

The system accumulate when the performance is less then 6% and take profit when greater than 0.6%.

Obviously the results seems to be great….. but it’s risky (high potential drawdown).

I set the system to work at lunch time (because it’s comfortable for my needs).

You can change the time frame according to take profit/accumulate parameters and you can obtain various results….

If you want can turn the same strategy using “buy”.

No moneyManagement applied.

I would like to know your opinion about the strategy, but remember that I am at first experience….

🙂

code

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 |

//--------------------------------- //TF a 12 h //dax min 1 Eur. //--------------------------------- DEFPARAM cumulateorders = true //margine = (close * 0.5 * POINTVALUE) /100 TIMEWORK = 070000 TIMESTOP = 210000 tp = 0.6 acc = 6 size = 1 IF TIME > TIMEWORK AND TIME < TIMESTOP THEN st = supertrend[3,5] st1 = supertrend[5,10] condopen = st > st1 if not onmarket then if condopen then sellshort SIZE SHARES AT MARKET endif endif if shortonmarket then perf = (-close + POSITIONPRICE)/POSITIONPRICE * 100 if perf > tp then exitshort at market perfc = (-close + POSITIONPRICE) * POINTVALUE * COUNTOFPOSITION *-1 capitale = capitale + PERFC ELSE if perf < -acc then sellshort SIZE SHARES AT MARKET endif ENDIF ENDIF ENDIF |

thx to all

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Indeed, if you are not willing to loose, you will always win. Averaging down losers can carry your account to disaster, so I must warn everyone willing to trade this strategy in live environment. The fact that you are using a 12 hours timeframe resolve in part the problem of contrarian orders accumulation to get back to their average opened price: you don’t often open new trade. Sometimes price get back to its mean sufficiently (like it always do), to close the basket in profit. Your post passed the pending review test to be part of the library, because even if the strategy is very risky, the way you coded it can be useful to a lot of people. I have also wrote an article, weeks ago, about averaging down and this strategy illustrate it: https://www.prorealcode.com/blog/trading/averaging-techniques-automated-trading/

You’re always safer going Long especially with averaging down on an index as the probability of it going to ZERO is almost ZERO but conversely you never know how high the index will go especially in a major bull run which will wipe you out 100%. Consider revising this for Long system but it’s still risky.

I noted Davids and Nicolas remarks. Could it be possible to make an indicator for contrarian orders, or will it be the same as an existing indicator maybe?