Dear All,

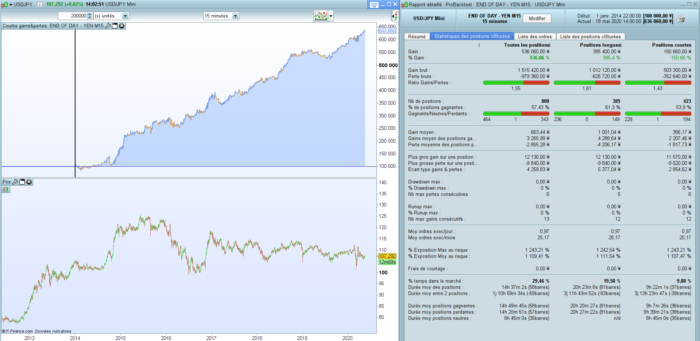

Here is a simple strategy, a slight improvement of my “End of Day USD/JPY“.

The timeframe is M15.

The strategy is so simple that it doesn’t need explanations (see in the code).

You can adapt the parameters, so that you can use it on USD/JPY (the best), AUD/JPY, EUR/JPY, GBP/JPY.

Regards,

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 |

// END OF DAY - YEN // www.doctrading.fr Defparam cumulateorders = false // TAILLE DES POSITIONS n = 1 // PARAMETRES // high ratio = few positions // AUD/JPY : ratio = 0.5 / SL = 0.8 / TP = 1.2 / Period = 12 // EUR/JPY : ratio = 0.6 / SL = 1 / TP = 0.8 / Period = 8 // GBP/JPY : ratio = 0.5 / SL = 0.6 / TP = 1 / Period = 8 // USD/JPY : ratio = 0.5 / SL = 1 / TP = 0.8 / Period = 12 ratio = 0.5 // HORAIRES startTime = 210000 endTime = 231500 exitLongTime = 210000 exitShortTime = 80000 // STOP LOSS & TAKE PROFIT (%) SL = 1 TP = 0.8 Period = 12 // BOUGIE REFERENCE à StartTime if time = startTime THEN amplitude = highest[Period](high) - lowest[Period](low) ouverture = close endif // LONGS & SHORTS : every day except Fridays // entre StartTime et EndTime if time >= startTime and time <= endTime and dayOfWeek <> 5 then buy n shares at ouverture - amplitude*ratio limit sellshort n shares at ouverture + amplitude*ratio limit endif // Stop Loss & Take Profit set stop %loss SL set target %profit TP // Exit Time if time = exitLongTime then sell at market endif if time = exitShortTime then exitshort at market endif |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Here is a improvement with MOMENTUM.

For M15 TIMEFRAME

Thanks to a friend, “Calvin”.

The performance is better :

Ciao doctrading, grazie per il tuo contributo. Volevo chiederti se hai tenuto in osservazione il tuo sistema (sono passati 3 anni …). Ho provato a ritestare FINE GIORNATA ed attualmente ho riscontrato risultati molto interessanti anche con timeframe a 1 minuto anche introducendo il bel programma KAMA di Roberto Gozzi per gestire la posizione. Vorrei, se vuoi, proporre il codice.

// END OF DAY – YEN

// http://www.doctrading.fr

// + MOMENTUM (Calvin)

Defparam cumulateorders = false

// TAILLE DES POSITIONS

n = 1

// PARAMÈTRES

// Plus le “ratio” monte, moins il y a de positions

// USD/JPY : ratio = 0.4 / SL = 1 / TP = 0.8 / Period = 10

ratio = 0.4

// HORAIRES

startTime = 210000

endTime = 231500

exitLongTime = 210000

exitShortTime = 80000

// INDICATEUR MOMENTUM

OTa = Momentum[26]

c1a = OTa > OTa[11]

MLTa = Momentum[280]

c2a = MLTa > MLTa[20]

OTv = Momentum[4]

c1v = OTv < OTv[5]

MLTv = Momentum[180]

c2v = MLTv = startTime and time <= endTime and dayOfWeek 5 and CONDBUY then

buy n shares at ouverture – amplitude*ratio limit

ENDIF

if time >= startTime and time <= endTime and dayOfWeek 5 and CONDSELL THEN

sellshort n shares at ouverture + amplitude*ratio limit

endif

// Stop Loss & Take Profit

set stop %loss SL

set target %profit TP

// Exit Time

if time = exitLongTime then

sell at market

endif

if time = exitShortTime then

exitshort at market

endif

Peut-être un poil sur-optimisé ? Une idée de la performance OOS ?

Hello,

Problème de copié collé ici : c2v = MLTv = startTime

Si je comprend bien on devrait pluto avoir c2v = MLTv > OTv ?

Hello doctrading.

Thank you for you sharing.

I try this strategy “+MOMENTUM “ver.

There is something I don’t understand.

It is written as ”CONDBUY” and “CONDSELL”and”s2v”, what should I define?

Also, please tell me the time zone you set.

In “dayofweek 5” where other errors occurred, “” (difference operator) was missing.

I can’t use it well except Japanese, so I’m sorry if it’s strange English.

Waiting for your answer.

Thank You for sharing.

PRT v10.3 says : Syntax error line 34 char 58, it’s pointig at the 5 [dayOfWeek 5].

Am I doing something wrong or is v11 needed ?

Cheers!

Bonjour et merci pour le partage,

Je n’arrive pas à exécuter le code avec le Momentum. J’ai une erreur de syntaxe. could y help 🙂 Thx

Avec plaisir ! 😉

Qu’entendez-vous par performance OOS Nicolas ?

Hors échantillon, puisqu’il me semble que la stratégie a été optimisée sur tout l’historique ? Voir les vidéos sur l’optimisation avec walk forward dans le blog.

Ah je n’utilise jamais le Walk Forward c’est pour ça.

Attention à la suroptimisation dans ce cas ! Si c’était aussi simple.. 😉 Tu devrais regarder les vidéos du blog sur le walk forward, toujours vérifier la robustesse d’une stratégie, c’est la base, à minima sur 30% de données post optimisation ( hors échantillon ou Out Of Sample en anglais).

bonjour Calvin,

merci pour votre contribution, sur quel critère avez-vous définis les valeurs du momuntum.

je souhaite l’adapter à mes stratégies, peut-on en discuter sur un forum ?

Bonjour pjanin972, c’est de l’optimisation.

C’est ces paramètres qui ont le mieux marché durant le backtest.

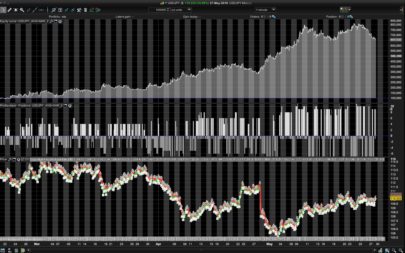

Hi all

Just a little optimization for USD/JPY M15.

Nice performance since 2018, you can do what you want with it (as is it a little bit “optimized”)

Profit factor > 3,5.

Regards,

//———————————————-

// Code principal : End Of Day – USD/JPY M15

// http://www.doctrading.fr

//———————————————-

Defparam cumulateorders = false

// TAILLE DES POSITIONS

n = 1

// PARAMÈTRES

// Plus le “ratio” monte, moins il y a de positions

ratio = 0.64

// HORAIRES

startTime = 210000

endTime = 231500

exitLongTime = 210000

exitShortTime = 80000

// INDICATEUR MOMENTUM

OTa = Momentum[26]

c1a = OTa > OTa[11]

MLTa = Momentum[280]

c2a = MLTa > MLTa[20]

OTv = Momentum[4]

c1v = OTv < OTv[5]

MLTv = Momentum[180]

c2v = MLTv = startTime and time = startTime and time <= endTime and dayOfWeek 5 and dayOfWeek 0 and CONDSELL then

sellshort n shares at ouverture + amplitude*ratio limit

endif

// Stop Loss & Take Profit

set stop %loss SL

set target %profit TP

//set stop loss amplitude * ratioSL

// Exit Time

if time = exitLongTime then

sell at market

endif

if time = exitShortTime then

exitshort at market

endif

Hi Doctrading, Thanks for your code and there is error as follow! could you fix it?

c2v = MLTv = startTime and time <= endTime and dayOfWeek 5 and CONDBUY then

Hello guys, thanks for the code !

Hello guys, thanks !

bonsoir ,

@nicolas

j’ai mis le TP = 100 et la un gros bug .

il affiche gagnant alors quand on regarde de prêt il est perdant et il touche le TP .

position buy et le TP est en dessous de entrée

j’ai fait quelques test sur d’autres parités de devises et sour d’autres timeframes en prenant la strategie d’origine qui me semble assez optiminée,

Hi Doctrading, thanks for this nice and simple strategy. I really would like to backtest the strategy based on the momentum conditions. Is it possible for you to provide this?

AU account losses in AU time zone, spread 2pips, so set set platform hours to Europe +2 “Paris”

ON USDJPY mini, I’v back tested through the similar date rang from current period in 15mn TF 100000 units, “100000 is all you get here in Australia!”

Just trades some inefficient gains and losses and then the account to zero in an nose dive!

Not going to be running this with out a safety net, or ever. Altough some gains in lower tf, however i have not enough data to prove robustness.

Which brings on my question.

### Quit Function ###

If we have a whole or chasm is a strategy. Can we lock in gains with using the Quit function ?

So far i’m only able to use Quit function to close the strategy in a negative situation, or after gains, it quit’s still negative after all the hard work!

which is something like,

If StrategyProfit <-130 then

QUIT

Ouch, little bug with the code display…

Here it is :

//———————————————-

// Code principal : End Of Day – USD/JPY M15

// http://www.doctrading.fr

//———————————————-

Defparam cumulateorders = false

// TAILLE DES POSITIONS

n = 1

// PARAMÈTRES

// Plus le “ratio” monte, moins il y a de positions

ratio = 0.64

// HORAIRES

startTime = 210000

endTime = 231500

exitLongTime = 210000

exitShortTime = 80000

// INDICATEUR MOMENTUM

OTa = Momentum[26]

c1a = OTa > OTa[11]

MLTa = Momentum[280]

c2a = MLTa > MLTa[20]

OTv = Momentum[4]

c1v = OTv < OTv[5]

MLTv = Momentum[180]

c2v = MLTv = startTime and time <= endTime and dayOfWeek 5 and dayOfWeek 0 and CONDBUY then

buy n shares at ouverture – amplitude*ratio limit

endif

if time >= startTime and time <= endTime and dayOfWeek 5 and dayOfWeek 0 and CONDSELL then

sellshort n shares at ouverture + amplitude*ratio limit

endif

// Stop Loss & Take Profit

set stop %loss SL

set target %profit TP

//set stop loss amplitude * ratioSL

// Exit Time

if time = exitLongTime then

sell at market

endif

if time = exitShortTime then

exitshort at market

endif

Hi Doctrading

Thanks for sharing a correction but the error is the same

PRT v10.3 says : Syntax error line 29 char 58, it’s pointig at the 5 [dayOfWeek 5].

Am I doing something wrong or is v11 needed ?

Cheers!

Hi, you need to insert “5”, in order to not trade on Fridays.

Bonjour

J’ai essayé ça ne fonctionne pas

J’ai une position perdante -21 800 yen.

Comment faites vous

Hi, there seems to be a copy/paste error at the end of the Momentum section. Also, the first “if” to enter market seems to have a copy/paste error, wouldit be possible to have a look look? Thanks!

je n’arrive pas non plus avec le dernier code

Syntax error line 29 char 58, it’s pointig at the 5 [dayOfWeek 5].

Bonjour.

Le problème est que mon copier coller de dayofweek 5 supprime le “”.

Désolé.

Il faut remettre ces “” après “dayofweek”.

Cordialement

Essayez donc cette version :

//———————————————-

// End Of Day – USD/JPY M15

// http://www.doctrading.fr

//———————————————-

Defparam cumulateorders = false

// TAILLE DES POSITIONS

n = 1

// PARAMÈTRES

// Plus le “ratio” monte, moins il y a de positions

ratio = 0.64

// HORAIRES

startTime = 210000

endTime = 231500

exitLongTime = 210000

exitShortTime = 80000

// INDICATEUR MOMENTUM

OTa = Momentum[26]

c1a = OTa > OTa[11]

MLTa = Momentum[280]

c2a = MLTa > MLTa[20]

OTv = Momentum[4]

c1v = OTv < OTv[5]

MLTv = Momentum[180]

c2v = MLTv = startTime and time <= endTime and dayOfWeek 5 and dayofweek 0 and CONDBUY then

buy n shares at ouverture – amplitude*ratio limit

endif

if time >= startTime and time <= endTime and dayOfWeek 5 and dayofweek 0 and CONDSELL then

sellshort n shares at ouverture + amplitude*ratio limit

endif

// Stop Loss & Take Profit

set stop %loss SL

set target %profit TP

//set stop loss amplitude * ratioSL

// Exit Time

if time = exitLongTime then

sell at market

endif

if time = exitShortTime then

exitshort at market

endif

Thanks for the strategy Doctrading! The updated version you have posted is really inconsistent though. Parameters are not defined, conditions are not defined, defined parameters are never used, if-statements that end but never started and so on. Would you mind taking a better look at it?

Still doesnt work for me. error line 29, character 58. Anyone know what to do?

Account goes emptied in 2 trades.

Non of the 3 versions you posted are valid code. Thanks to explain what the code should do with days. dayOfWeek seems messed up.

Bonjour Doctrading, avez-vous un programme qui tourne en réel depuis plus d’un an et comparer les résultats avec un backtest au jour J ? Sont_ils approchant ? Merci , cordialement.

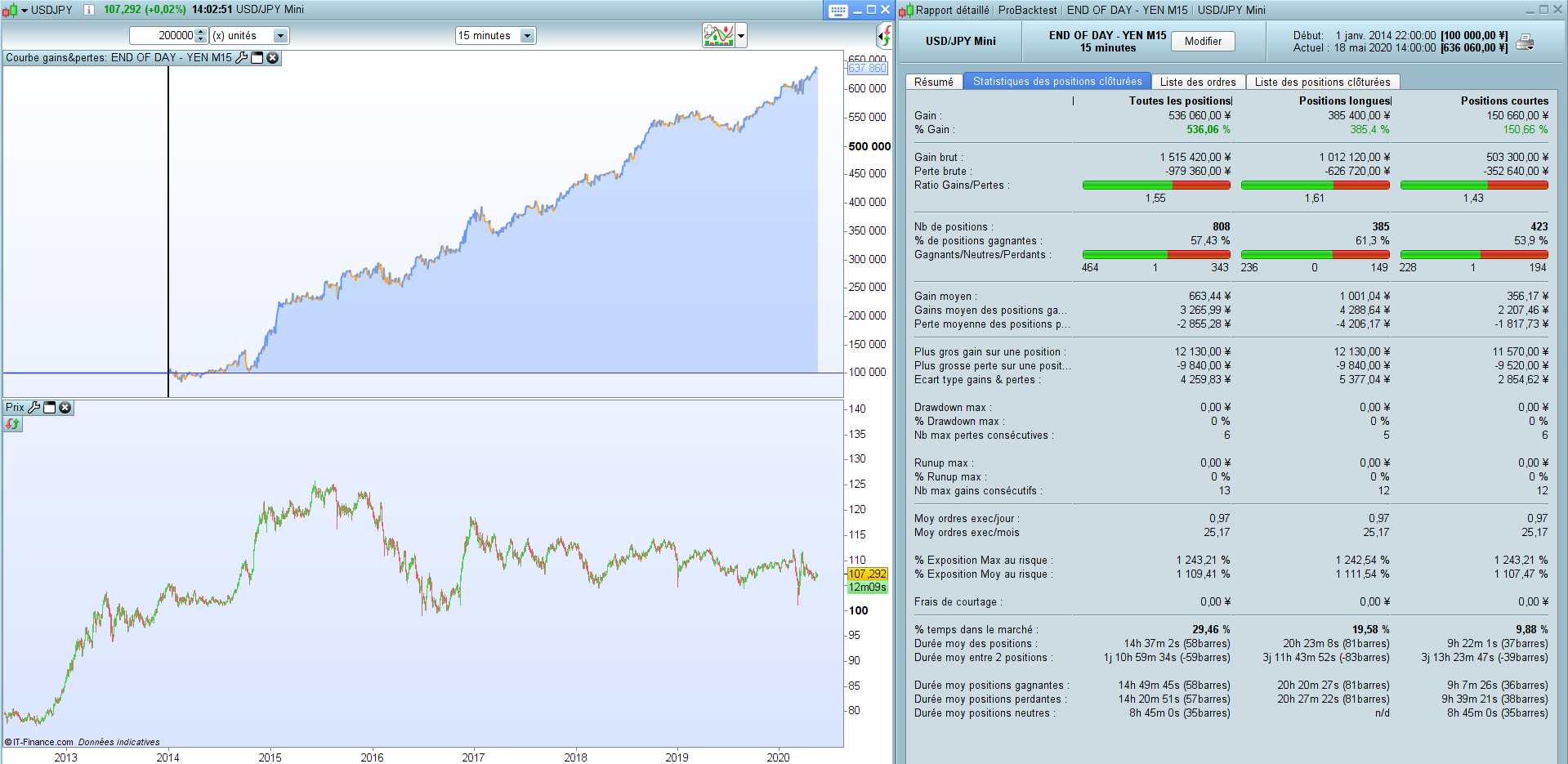

Thanks Doctrading, I have modified the ratio, number of periods, close trade time slightly and it works well in backtest…particularly new trades on Sun, Mon and Tue only, across different pairs. I have also started real trading with just £1 per point, just to see how it goes. It is positive so far…BUT…any idea why the actual trades entered are much fewer than in backtest on some days? As below, overnight 6/7 June ACTUAL generated 1 trade whereas BACKTEST generated 6 trades. This is similar across different pairs and timeframes. 3/4 June and 2/3 June were fine. Am I missing something? Thanks

Backtest

Entry date Exit date Type Nbr Bars Abs Perf

06/06/2021 23:00 07/06/2021 04:30 Short 22 -£4.00

06/06/2021 22:45 06/06/2021 23:00 Long 1 £3.80

06/06/2021 22:30 06/06/2021 22:45 Short 1 £3.80

06/06/2021 22:00 06/06/2021 22:30 Long 2 £3.80

06/06/2021 21:45 06/06/2021 22:00 Short 1 £3.80

06/06/2021 21:30 06/06/2021 21:45 Long 1 £3.80

03/06/2021 21:00 04/06/2021 04:30 Short 30 £7.90

02/06/2021 21:30 03/06/2021 04:30 Short 28 -£10.70

01/06/2021 22:15 02/06/2021 04:30 Long 25 £16.90

Actual

Entry date Exit date Type Nbr Bars Abs Perf

06/06/2021 21:59 07/06/2021 04:30 Short 29 £0.30

03/06/2021 21:00 04/06/2021 04:30 Short 32 £8.50

02/06/2021 21:35 03/06/2021 04:30 Short 30 -£10.20

01/06/2021 22:24 02/06/2021 04:30 Long 27 £18.00

Buongiorno doctradinge buongiorno a tutti.

Vorrei riportare all’attenzione questo sistema postato tre anni fa perchè le performance sono ancora interessanti.

In particolare con USD/JPY i backtest sono ottimi negli ultimi 4 mesi, soprattutto con un timeframe di 1 minuto.

Se qualche membro della community ha la possibilità e la pazienza di effettuare backtest più lunghi sarebbe utile per capire se questo sistema è veramente ottimo.

Di seguito propongo una mia versione aggiornata in cui ho inserito la gestione della posizione tramite il sistema KAMA & SMA proposto da Roberto tempo fa, con uno stop fisso a 30.

Defparam cumulateorders = false

// TAILLE DES POSITIONS

n = 1

// PARAMETRES

// high ratio = few positions

// AUD/JPY : ratio = 0.5 / SL = 0.8 / TP = 1.2 / Period = 12

// EUR/JPY : ratio = 0.6 / SL = 1 / TP = 0.8 / Period = 8

// GBP/JPY : ratio = 0.5 / SL = 0.6 / TP = 1 / Period = 8

// USD/JPY : ratio = 0.5 / SL = 1 / TP = 0.8 / Period = 12

ratio = 0.6

period = 8

// HORAIRES

startTime = 210000

endTime = 231500

exitLongTime = 210000

exitShortTime = 80000

// BOUGIE REFERENCE à StartTime

if time = startTime THEN

amplitude = highest[Period](high) – lowest[Period](low)

ouverture = close

endif

// LONGS & SHORTS : every day except Fridays

// entre StartTime et EndTime

if time >= startTime and time <= endTime and dayOfWeek <> 5 then

buy n shares at ouverture – amplitude*ratio limit

sellshort n shares at ouverture + amplitude*ratio limit

endif

// Stop Loss & Take Profit

// Stop e target

//SET STOP PLOSS 25

//SET TARGET PPROFIT 13 //395

//////////////////////////////////////////////////////////////////////////////////////////////////////////

// Trailing Stop

//————————————————————————————

IF Not OnMarket THEN

TrailStart = 10 //10 Start trailing profits from this point

BasePerCent = 0.100 //10.0% Profit to keep

StepSize = 6 //6 Pips chunks to increase Percentage

PerCentInc = 0.100 //10.0% PerCent increment after each StepSize chunk

RoundTO = -0.5 //-0.5 rounds to Lower integer, +0.4 rounds to Higher integer

PriceDistance = 7 * pipsize//8.9 minimun distance from current price

y1 = 0

y2 = 0

ProfitPerCent = BasePerCent

ELSIF LongOnMarket AND close > (TradePrice + (y1 * pipsize)) THEN //LONG

x1 = (close – tradeprice) / pipsize //convert price to pips

IF x1 >= TrailStart THEN //go ahead only if N+ pips

Diff1 = abs(TrailStart – x1)

Chunks1 = max(0,round((Diff1 / StepSize) + RoundTO))

ProfitPerCent = BasePerCent + (BasePerCent * (Chunks1 * PerCentInc))

ProfitPerCent = max(ProfitPerCent[1],min(100,ProfitPerCent))

y1 = max(x1 * ProfitPerCent, y1) //y = % of max profit

ENDIF

ELSIF ShortOnMarket AND close < (TradePrice – (y2 * pipsize)) THEN//SHORT

x2 = (tradeprice – close) / pipsize //convert price to pips

IF x2 >= TrailStart THEN //go ahead only if N+ pips

Diff2 = abs(TrailStart – x2)

Chunks2 = max(0,round((Diff2 / StepSize) + RoundTO))

ProfitPerCent = BasePerCent + (BasePerCent * (Chunks2 * PerCentInc))

ProfitPerCent = max(ProfitPerCent[1],min(100,ProfitPerCent))

y2 = max(x2 * ProfitPerCent, y2) //y = % of max profit

ENDIF

ENDIF

IF y1 THEN //Place pending STOP order when y>0

SellPrice = Tradeprice + (y1 * pipsize) //convert pips to price

IF abs(close – SellPrice) > PriceDistance THEN

IF close >= SellPrice THEN

SELL AT SellPrice STOP

ELSE

SELL AT SellPrice LIMIT

ENDIF

ELSE

SELL AT Market

ENDIF

ENDIF

IF y2 THEN //Place pending STOP order when y>0

ExitPrice = Tradeprice – (y2 * pipsize) //convert pips to price

IF abs(close – ExitPrice) > PriceDistance THEN

IF close <= ExitPrice THEN

EXITSHORT AT ExitPrice STOP

ELSE

EXITSHORT AT ExitPrice LIMIT

ENDIF

ELSE

EXITSHORT AT Market

ENDIF

ENDIF

set stop ploss 30

Hi,

Yes I am monitoring all the strategies posted on this site and I confirm that the strategy is a winner.

However I have just turned it OFF as it iseems to have entered a less favorable market configuration;

I will tell here when the Strategy can be lauched again according to my indicators.

I will also check your algo; thanks for sharing ^^