Hi all,

This strategy is very similar to the “Nice Price” Forex Strategy that I’ve just published.

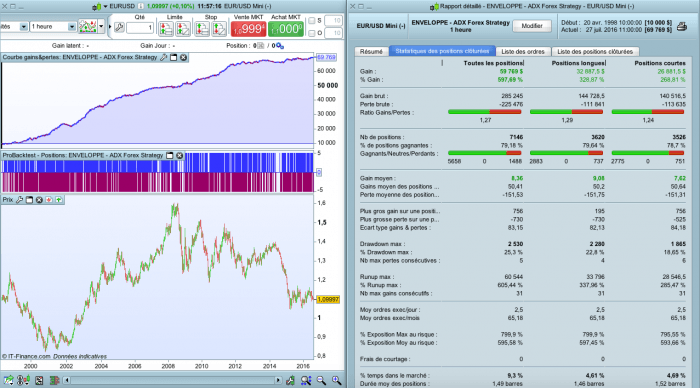

It applies on EUR/USD, H1 timeframe (other pairs / timeframes should be also profitable).

We go LONG if :

- high > Enveloppe sup (20, 0.4%) and close > Enveloppe sup`

- ADX40 > 10

- DI40+ > DI40-

- SL : 30 pips / TP : 10 pips

So it’s a scalping strategy.

It’s not the Holy Grail… but it works.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 |

Defparam Cumulateorders = false n = 5 // ENVELOPPES EnveloppeSup = Average[20](close)*1.004 EnveloppeInf = Average[20](close)*0.996 // ACHAT ca1 = ADX[40] > 10 ca2 = DIplus[40](close) > DIminus[40](close) ca3 = high > EnveloppeSup and close < EnveloppeSup IF ca1 AND ca2 AND ca3 THEN BUY n SHARES AT MARKET ENDIF // VAD cv1 = ADX[40] > 10 cv2 = DIplus[40](close) < DIminus[40](close) cv3 = low < EnveloppeInf and close > EnveloppeInf IF cv1 AND cv2 AND cv3 THEN SELLSHORT n SHARES AT MARKET ENDIF // Stops et objectifs SET STOP pLOSS 30 SET TARGET pPROFIT 10 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Il y a des entrées et sorties sur la même bougie

donc le probacktest n’est normalement pas bon !!!

Qu’en pensez vous ??

Madrosat

Arretons de poster des systemes ou il y a des entrées et sorties sur la même bougie , c est de la pure perte de temps !

Arretons de poster des systemes ou il y a des entrées et sorties sur la même bougie , c est de la pure perte de temps !

juste pour avoir une belle equyity curve qui est fausse .

A volte un sistema affetto da questo problema (entrate e uscite nella stessa candela) quando usato in una situazione di trade reale può portare dei profitti

Beginner’s mistake to fall into one of PRT’s backtesting most obvious drawbacks: You cannot have TP and SL withing same candlestick. PRT backtest will always go for TP before SL. The equity curve indeed indicates a holy grail, but it is not.

What can we do to avoid this TP/SL mistake?

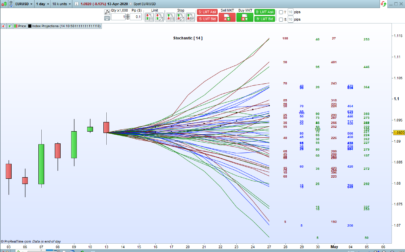

@Wilko, which changes would you suggest then? This system works. But hardly on 1h basis, I changed it to 1 day and it’s excellent here with many currencies and indices. Could you please help me here?

Hi Guys,

Is there a solution to the TP/SL mistake, i am ready to try a few codes live but want to make sure im not set for disaster.

The TP/SL issue should be resolved (at least partly) in PRT v10.3, which I understand will offer Look-Inside-Bar option in the backtest

what is diplus diminus please

Has anyone tested this algon now when PRT 10.3 was released?

does anyone know if the issue with the TP/SL is resolved ?