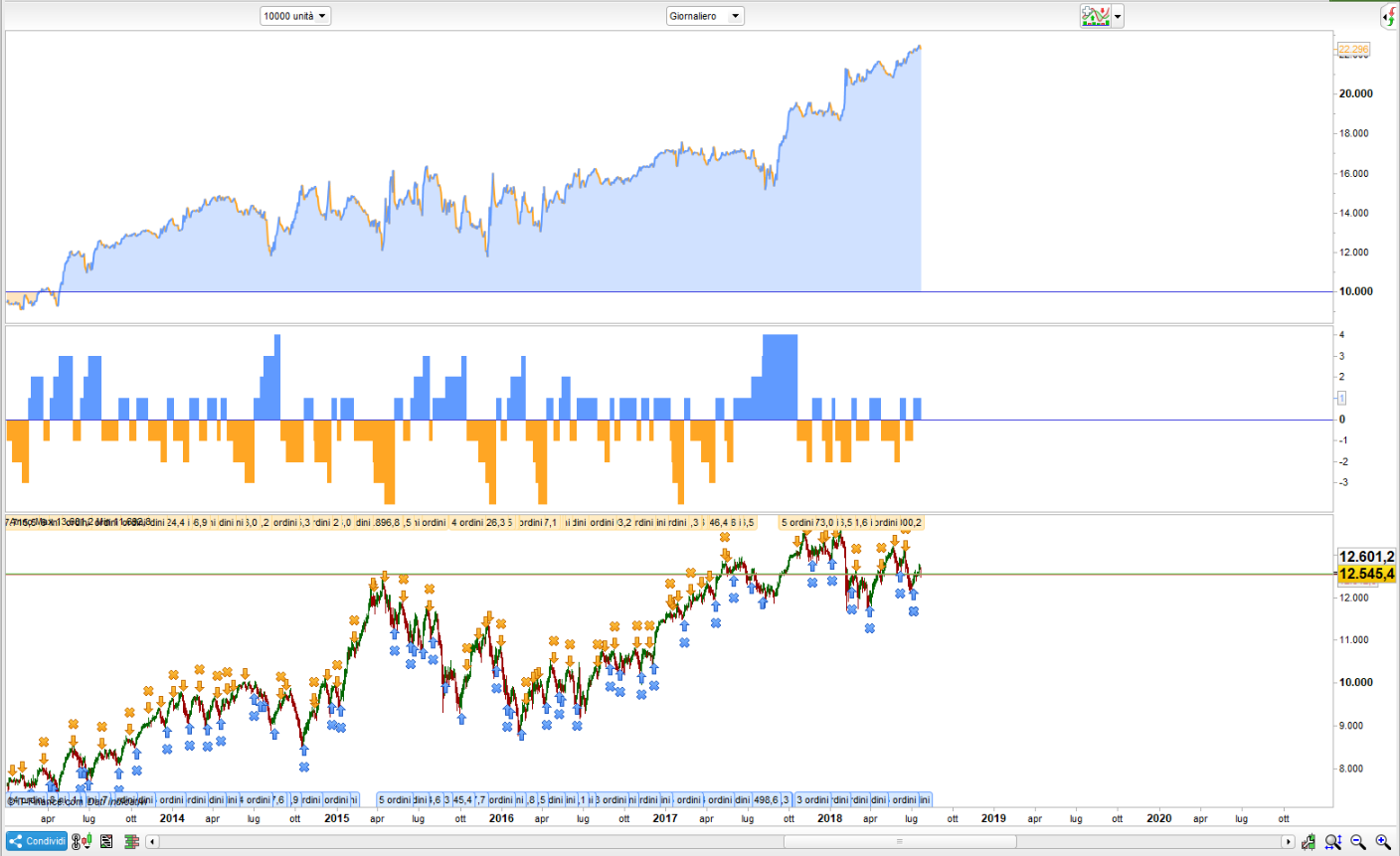

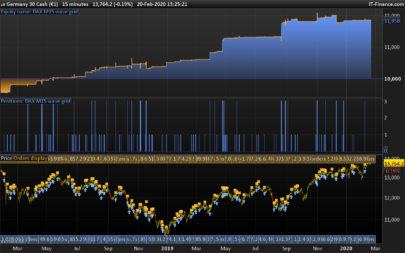

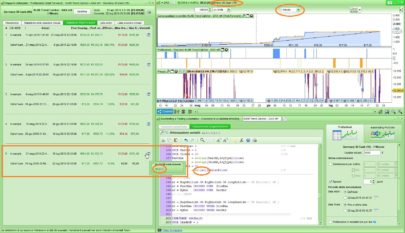

I would like to propose the following Daily Strategy on the Dax based on the Fisher Transform for any changes or opinions.

The Fisher Transform, with its rather complex mathematical formula, aims to create a function similar to a Gaussian probability density function. In this way, a very simple tool such as price is transformed into a technical indicator able to provide “extreme” signals to be exploited tactically.

the spread used is 1 tick

I left activated the cumulative functions, but they can be deactivated.

the system, as you can see, work on the stop and reverse of the fisher, almost always referring to the market.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 |

DEFPARAM CumulateOrders = TRUE // Posizioni cumulate attivate LEN=13 IF BARINDEX < len THEN value1 = 0 fish = 0 ELSE MaxH = Highest[len](TypicalPrice) MinL = Lowest[len](TypicalPrice) Value1 = ( (TypicalPrice - MinL)/(MaxH - MinL) - .5) + .67 * Value1 If Value1 > .99 then Value1 = .999 ENDIF If Value1 < -.99 then Value1 = -.999 ENDIF Fish = 0.5*Log((1 + Value1)/(1 - Value1)) + .5 * Fish a=5 b=-5 ENDIF IF fish CROSSES OVER b THEN BUY 1 CONTRACT AT MARKET ENDIF IF fish CROSSES UNDER A THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thank you for your contribution.

I have tested your system on some instruments and I like it.

Unfortunately, doing the test day after day, change me to closing positions.

Thanks

bonjour j ai tente l installation mais PRT m indique que ce code ne peut etre utilisé qu en cas de syteme de trading…

en effet, il faut utiliser l’éditeur de code ProBacktest, il ne s’agit pas d’un indicateur mais d’une stratégie de trading automatique ! 🙂