This system is really simple:

if it is 17:30 (closing market) buy at market, sell next day at 9:15 (shortly after it opened) :

|

1 2 3 4 5 6 7 8 9 |

// Condizioni per entrata long IF NOT OnMarket and trading=1 and time=173000THEN BUY 1 CONTRACTS AT MARKET ENDIF // Condizioni per uscire da posizioni long If LongOnMarket AND time=091500 THEN SELL 1 CONTRACT AT MARKET ENDIF |

It should be tested with calculated overnight fees though, for a better comparison with real time trades.

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

What original and simple idea. I like it!

Thanks for sharing.

Andrés.

This system is just a basic idea, it should be implemented with filters, I’m sure you can improve !

Yes, of course, but many times we are thinking in complicated indicators and it’s wonderfull to see simple ideas that works.

Six code lines. Great.

I tried the system but does not work, it does not open positions, in any market

so I tried to change it so, for testint it only on the US market

// Condizioni per entrata long

IF NOT OnMarket and time>210000 THEN

BUY 1 CONTRACTS AT MARKET

ENDIF

// Condizioni per uscire da posizioni long

If LongOnMarket AND time>091500 THEN

SELL 1 CONTRACT AT MARKET

ENDIF

set target pprofit 40

the result is that the system open positions only on Sunday to close on Monday …. I use IG account, and i do not understand what the problem is

Because the system must test time of the present candle, this strategy needs to be traded on intraday timeframe. So i believe you have tested it in daily one maybe?

you must have a subscription to view intraday bars, then you put it with graphics of 15min

entry time to be 17:30 (not 21:00), remove the target profit.

ok thanks to both, now works fine…

Bravo Andrea Unger

Questa è un idea che ho trovato su un articolo in una rivista e l’ho condivisa scrivendola con PRT. Spero che se hai qualcosa di interessante anche tu possa condivederlo in questo forum.

Quanto e’ l’ average trade di questa strategia ? Se metti commissioni e slippage vai in perdita .

ciao giulomb,

leggi il mio primo commento in alto.

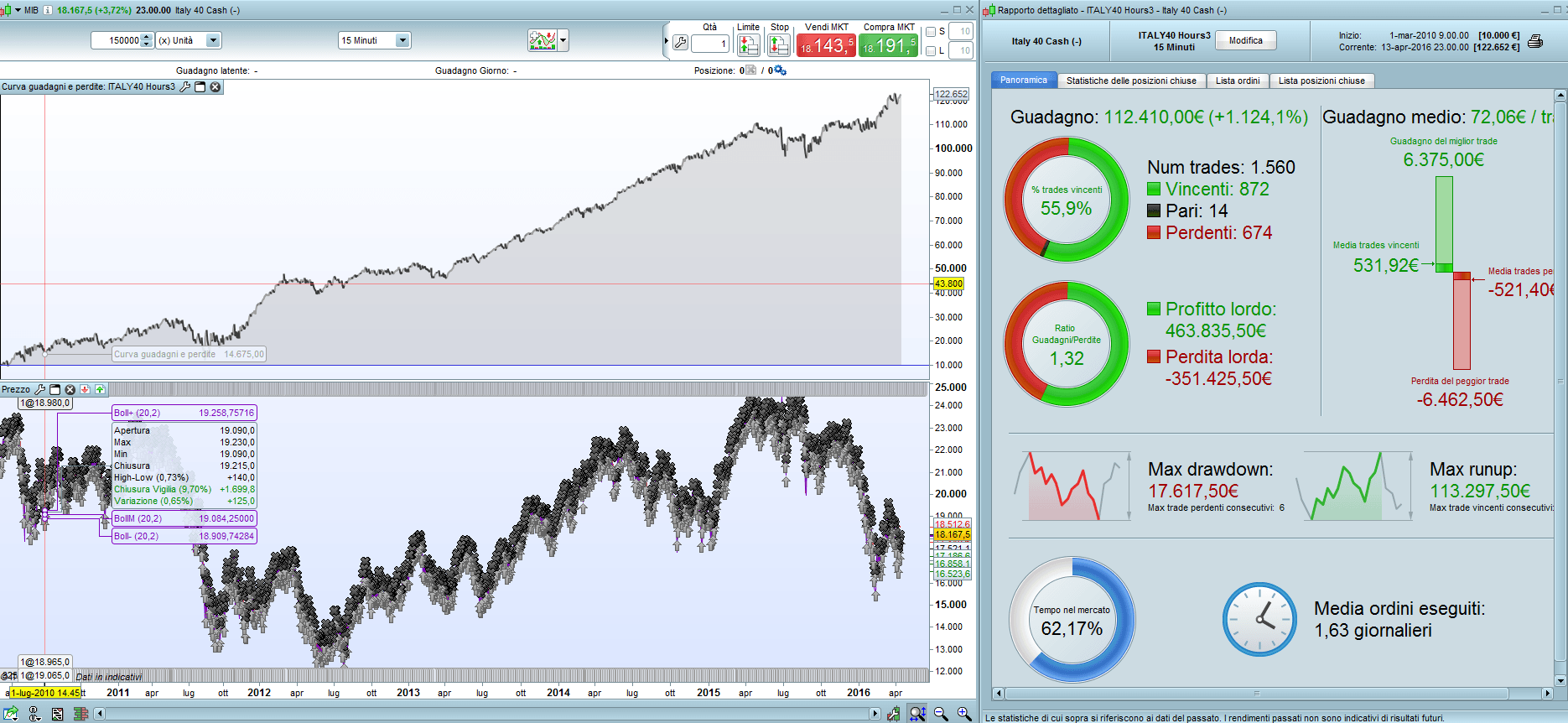

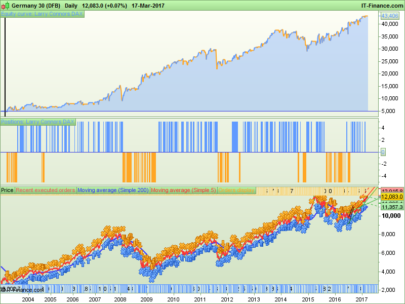

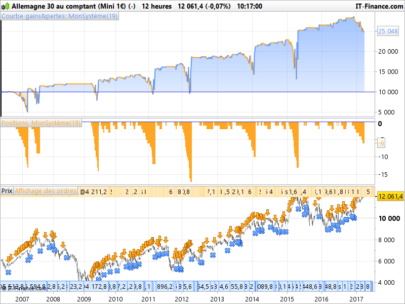

This nice strategy seems regularly profitable before 2010 ; see picture :

http://www.doctrading.fr/wp-content/uploads/2016/05/test-FTSE-MIB-night.png

Strange that it isn’t before.

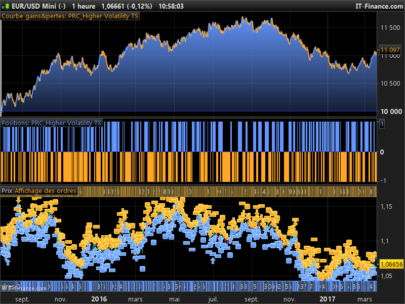

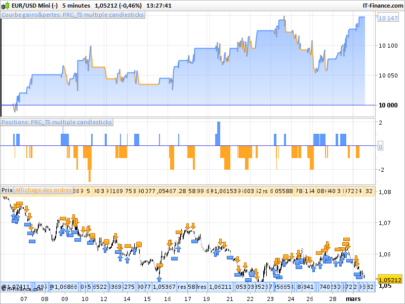

The spread is 20 points by IG markets :

http://www.ig.com/fr/conditions-indices

With this spread, the results are awful :

http://www.doctrading.fr/wp-content/uploads/2016/05/test-FTSE-MIB-avec-Spread.png

Am I wrong ?

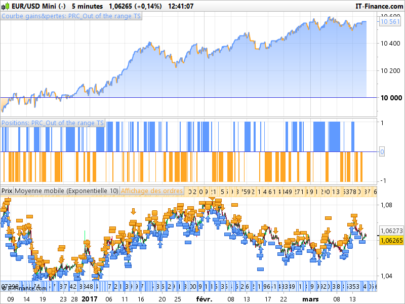

You’re right, it is not good considering the spread… the cfd are too expensive, better to use mini futures I write this is just a starting point for a system.

But look the picture, I sent to you by email, is the same motor with my personal filters, i put 15 points of spreads.

Yes, nice improvement !

You should test it with 20 points spread (common spread on IG Markets).What is the filter code ?

Ho provato questa strategia anche sul dax, a causa dell’elevato spread IG sul ftse mib.

Con un giusto stop loss e take profit sembra essere profittevole, anche se non eccezionale.

La testerò su altri indici

con quale timeframe hai provato sul dax ?