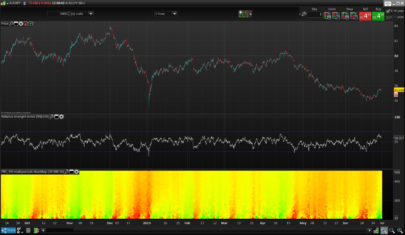

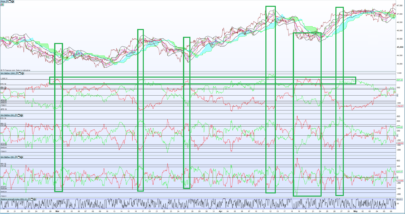

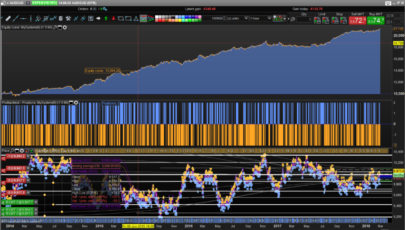

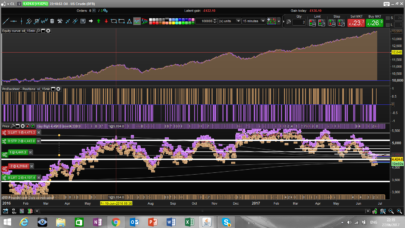

As for an automated trading strategy, this one is very easy. Because of the natural revert to the mean of price, the IBEX35 works well with this simple “long only” conditions to enter market on a daily timeframe.

Of course it has not been optimized and reflect only an easy understanding on how this european indice perform in the past. I think it is a very good start of a more sophisticated trading strategy, with short conditions as well, to avoid long time without any profit. It can also be part of a more complex portfolio of long only traders.

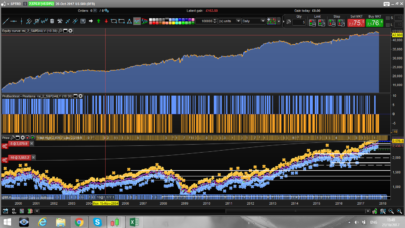

Because of their relative near correlation, other european indices may work well also. I attached French CAC40 screenshot of result as well.

Feel free to explore, react or improve it.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 |

//indis<br /> i1 = average(close)[100]<br /> i2 = average(close)[5]<br /> <br /> tradeinitiate = Close>i1 AND Close<i2 AND Low[3]>Low[2] AND Low[2]>Low[1] AND Low[1]>Low<br /> tradeclose = Close>Close[1]<br /> <br /> IF NOT LongOnMarket AND tradeinitiate THEN<br /> BUY 1 CONTRACTS AT MARKET<br /> ENDIF<br /> <br /> // Conditions pour fermer une position acheteuse<br /> If LongOnMarket AND tradeclose THEN<br /> SELL AT MARKET<br /> ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials