Hello everyone,

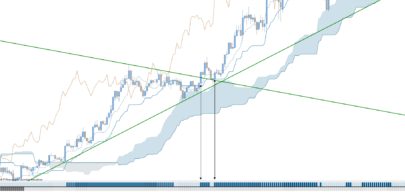

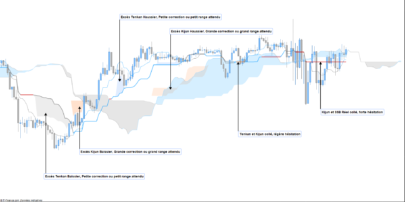

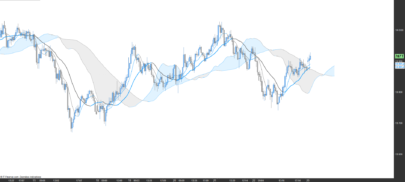

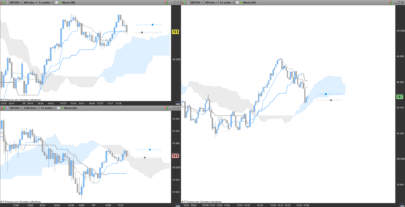

I particularly like to do some studies on the Ichimoku indicator.

There are many strategic possibilities, and unlike some preconceived ideas, it is quite possible to develop automated trading strategies based on this indicator and some predefined rules.

Here, I will present you a very simple strategy, that can surprise by its effectiveness in many conditions.

Indeed, you will find that the result is mostly profitable over the long term (even if the curve of capital evolution is not always beautiful), whatever the stock / index / forex pair, and the timeframe.

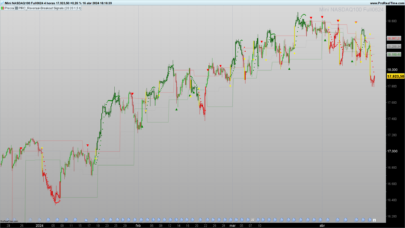

I found that this strategy works rather well on the CFD associated with the DAX, in M15 graphs.

Of course, this strategy is far from being a panacea, but it has the merit of attracting our attention and being able to be developed. There must be many opportunities for improvement.

The rules are simple :

BUY if:

- the price is above the kumo (either it was already,

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Salut Doc,

T’aurais pas fait une erreur dans ton code à la ligne 13 ? -:)

Cdt.

Non je pense en effet également que la Chikou est bien le Close de la bougie actuelle, mais il est vrai que visuellement celle-ci doit être dessiné 26 bougies en arrière. C’est une discussion que l’on a déjà eu dans d’autres sujets sur le forum, ça prête à confusion très souvent 🙂

En effet, c’est l’affectation Chikou=close qui m’a induit en erreur…

// Excusez mon français, j’utilise Google Translate 🙂

Hallo Doctrading,Je suis entièrement d’accord avec vous, l’Ichimoku peut être quantifiée. Je suis nouveau à ProRealTime et a passé les derniers mois à apprendre, mais j’ai créé quelques indicateurs Ichimoku (y compris l’oscillateur de profondeur Kumo, Tenken Kijun pondérée MACD, Kijun profit prendre les canaux, Kijun oscillateur etc).

Merci pour votre post, je vais lire toutes vos études Ichimoku et publier 🙂

Cordialement

Even if Doctrading is French, you can speak English on this website, this is the main language used here 🙂

I’m really interested into your Ichimoku derived indicators’codes, don’t be shy and post them into the Library for everyone’s benefit 😉

Bonjour,

merci pour votre message;

Il n’y a pas d’erreur, la valeur du chikou est bien celle du cours, c’est juste la visualisation en décalage 26 périodes auparavant qui change.

Mais on considère bien la valeur du chikou (clôture actuelle), par rapport au kumo 26 périodes auparavant.

Je vous souhaite d’excellentes fêtes de fin d’année.

A bientôt,

Bien cordialement,

Hello guys!

I´m pretty new to this but dosen´t this code take long and short position at the same time? If I add this peace of code I get a very different result. Am I wrong?

//////////////

IF not shortonmarket and ca1 and ca2 THEN

buy at market

ENDIF

IF not longonmarket and cv1 and cv2 THEN

sellshort at market

ENDIF

Joachim it doesn’t have long or short positions at the same time it’s not possible on PRT currently. It’s saying check which position side is open and if it is don’t take the opposite. Only take a position if the opposite isn’t open.

Bonjour Doctrading,

Merci pour votre travail et d’avoir partagé votre stratégie de trading.

Je me suis permis d’apporter quelques rajouts à votre code initial et de ce fait éviter les frais intradays inhérents.

Bien à vous.

DJ

Defparam cumulateorders = false

Defparam flatafter = 234500

// INDICATEURS

Tenkansen = (highest[9](high)+lowest[9](low))/2

Kijunsen = (highest[30](high)+lowest[30](low))/2

SSpanA = (tenkansen[26]+kijunsen[26])/2

SSpanB = (highest[56](high[23])+lowest[56](low[23]))/2

chikou = close

n = 32 //32

na = 34 //34

nb = 34 //34

n1 = 1 //1

// POSITION KUMO

// ACHAT

ca1 = (close[n] > SSpanA[na] and SSpanA[na] > SSpanB[nb]) or (close[n] > SSpanB[nb] and SSpanB[nb] > SSpanA[na])

// VENTE

cv1 = (close[n] < SSpanA[na] and SSpanA[na] < SSpanB[nb]) or (close[n] < SSpanB[nb] and SSpanB[nb] < SSpanA[na])

///////////////

// POSITION CHIKOU

// ACHAT

ca2 = Chikou > SSpanA[n1] and Chikou > SSpanB[n1]

// VENTE

cv2 = Chikou < SSpanA[n1] and Chikou < SSpanB[n1]

//////////////

IF time > 080000 and time < 194500 and ca1 and ca2 THEN

buy at market

ENDIF

IF time > 080000 and time < 194500 and cv1 and cv2 THEN

sellshort at market

ENDIF

Oups…Je voulais dire éviter les frais overnight ! 🙂

Thanks for sharing your work with this code, Doc.

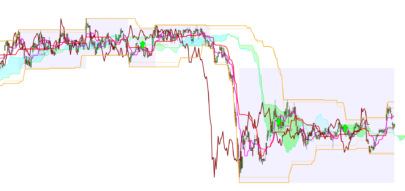

Impressive results in backtests with short timeframes! I trade forex and this works particularly well with EUR/USD and GBP/USD, which interests me. The code posted by Matriciel also shows promising results in backtest too. I’m new to PRT and have never coded, so am unsure what the difference is between the original code and Matriciel’s regarding trade execution.

This is probably a silly question but is there a way to change the position size (currency unit / point) as it appears to be fixed?

Also, is anyone live trading this; do you have performance statistics you could kindly share?

Many thanks,

Jake

Hello,

Actually I’m not trading this strategy.

I’m looking to make a good automated trading strategy with Ichimoku. But only Kumo breakout and Chikou won’t do it…

I must work !

Best regards,

Hello Doctrading,

I am also very interested in the Ichimoku (I am trading it but discretionary and not automated).

Would you like to form a collaboration in a forum and design a system together?Because I agree, using only Kumo and Chikou does not trade well in all markets conditions/instruments.

Kind regards

Salut Doc ,

Je ne vois pas ce qui fait office de stop dans ce code .. un retour dans le nuage ?

Bonjour,

Il s’agit juste d’une stratégie où on est toujours en position : soit à l’achat / soit à la vente. Donc pas de stop loss.

Un sujet d’étude… qui doit être améliorable.

Bonjour,

après quelques essais sur EUR/USD au M15 en rajoutant(car sinon on est en perte) un STOP LOSS et un TARGET PROFIT je n’arrive pas à mieux que 5,33% sur les 2 dernières années …