Warren Buffett once said:

“You do not have to do extraordinary things to get extraordinary results”

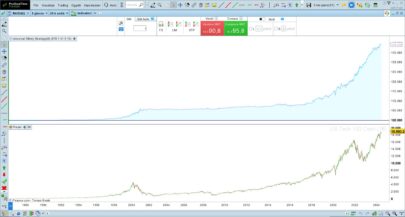

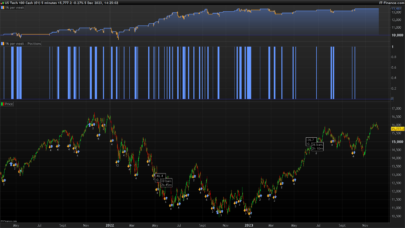

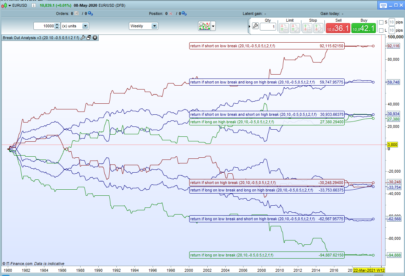

This strategy of accumulative orders proves this. This is a strategy of buying at highs and every time the price crosses a new maximum we add a new long order.

With patience and perseverance I invite you to be a millionaire.

Good luck … although trading does not depend on luck.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 |

// MAXIMUS ====== // Creado Por TradingenelIbex35 para Prorealcode // Version 1.1 Lite // periodo de Prueba NASDAQ Composite index date 010109 hasta hoy // Defparam CUMULATEORDERS = TRUE //Defparam NOCASHUPDATE = TRUE // // // // Filtro =180 Sloss = 10 // % SProfit = 85 // % X = 0 Y = 1 Z = 2 // // //==== CONTRATOS A NEGOCIAR ========= // Xhares = 1 // // ====== Numero Maximo de contratos a negociar ============ // Nshares = 1000 // // // ========== CODIGO =================== // HULL = weightedaverage[filtro](close) IF close[x] crosses over highest[6](high[1]) and hull[y] > hull[z] and COUNTOFLONGSHARES < Nshares THEN buy Xhares CONTRACTS AT MARKET ENDIF IF close[x] crosses over highest[20](high[1]) and hull[y] > hull[z] and COUNTOFLONGSHARES < Nshares THEN buy Xhares CONTRACTS AT MARKET ENDIF IF close[x] crosses over highest[50](high[1]) and hull[y] > hull[z] and COUNTOFLONGSHARES < Nshares THEN buy Xhares CONTRACTS AT MARKET ENDIF IF close[x] crosses over highest[100](high[1]) and hull[y] > hull[z] and COUNTOFLONGSHARES < Nshares THEN buy Xhares CONTRACTS AT MARKET ENDIF IF close[x] crosses over highest[200](high[1]) and hull[y] > hull[z] and COUNTOFLONGSHARES < Nshares THEN buy Xhares CONTRACTS AT MARKET ENDIF SET STOP %LOSS sloss SET TARGET %PROFITsprofit // ========= WARNING LOSS =========== Condiciones de salida de posiciones cortas |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

gracias esto es interesante

Im getting a huge drawdown, seems like i need to be a millionair before i run this 🙂

That’s right, it depends from when you start the strategy! …

Hallo Leute, es wäre interessant aus dieser Strategie mit Hilfe von diesen indikator https://www.prorealcode.com/prorealtime-indicators/mid-level-day-indicator-for-day-trading/

eine day trading strategie zu bauen immer wenn mid1day > mid5day ist und mid1day > als das vorhergehende mid1day wird eine position gekauft stop wäre mid5day!

Vielleicht könnten wir was gutes erstellen wenn einer diese Idee im Forum besprechen möchte.

Funny. Just try this one on NASDAQ 100 (or any other big index) since 2009. Starting capital $ 200.000 or more for the $ 20 mini contract . Same type of method, but much better result.

Defparam CUMULATEORDERS = TRUE

buy 1 contract at market

SET STOP %LOSS 10

SET TARGET %PROFIT 85

This one simply buys every day, no matter what happens. See how easy it is to make millions ? Well, some starting capital is required…

what you see on probacktest is like dreaming on a day time (not even sleep), most of the strategies which make millions on probacktest only makes losses in real time is it better run the strategy on demo

vaya eres increible

sigue subiendo mas contenido

If it seems to good to be true it is . Any long only system started at multi year lows will look good , but be aware its all hindsite curve fitted junk . DO NOT TRADE THIS