Here is a simple code that I was curious to test.

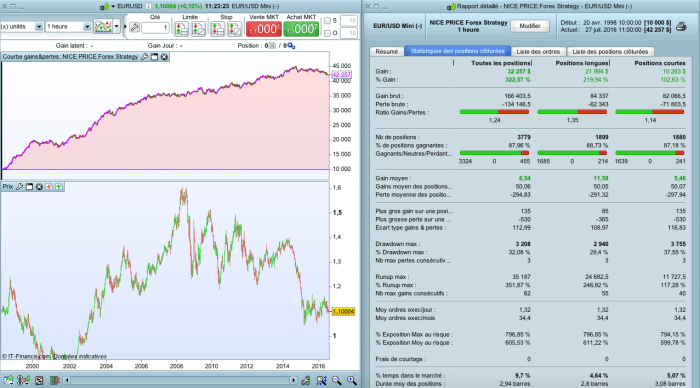

It applies on EUR/USD, H1 timeframe (other pairs / timeframes should be profitable).

We go LONG if :

ADX50 > 10

DI+(50) > DI-(50)

low of the candle < Bollinger20(down) and close > Bollinger20(up)

SL : 60 pips

TP : 10 pips

We go SHORT if we meet the opposite conditions.

So it’s a scalping strategy. Test and improve !

Best regards,

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 |

Defparam Cumulateorders = false n = 5 // ACHAT ca1 = ADX[50] > 10 ca2 = DIplus[50](close) > DIminus[50](close) ca3 = low < BollingerDown[20](close) and close > BollingerDown[20](close) IF ca1 AND ca2 AND ca3 THEN BUY n SHARES AT MARKET ENDIF // VAD cv1 = ADX[50] > 10 cv2 = DIplus[50](close) < DIminus[50](close) cv3 = high > BollingerUp[20](close) and close < BollingerUp[20](close) IF cv1 AND cv2 AND cv3 THEN SELLSHORT n SHARES AT MARKET ENDIF // Stops et objectifs SET STOP pLOSS 60 SET TARGET pPROFIT 10 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Always a great job, Doc.

Thanks again for sharing!

Thank you for sharing strategy and code. Simple and effective. Good job.

Thanks

Hi has anyone been implementing this.

can anyone share with me the performance of this scalping strategy so far.

been trying to find a scalping strategy

Hi Doc,

Firstly, thanks alot for this code. I have applied it to EUR/USD 3min frame & from 1 September to 15/10/2016 great results so far. I increased TP to 15 & got slightly better results over the same period.

My only question when looking through the results, the max profit accross all trades both short & long was $750 . But the loss of worst trade was $3,000.

I am an absolute beginner so i am not sure what the reason behind this but any comments would be appreciated.

Cheers JB

Answered my own question….Sorry about this question. 5 positions, take profit at 15, loss of 60 = 3000 & 750.

You have certainly taught me a few things so thankyou!

sto facendo girare in demo questa strategia modificata a 10 minuti con stop e profit ottimizzati..

non va male ma vorrei ottimizzare anche giorni e orari come posso fare?

che codice devo scrivere ?

resto in attesa grazie

Hello, this strategy improves with the SL 30 and the TP 10. I have done backtesting and it works better. regards