Hello,

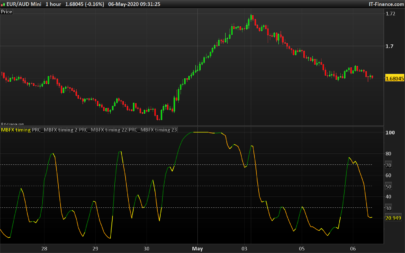

I found this nice and simple strategy playing with the “average fullness of last 5 candles” . I added a simple moving average oscillator, with 5 and 50 period and I considered mean reverting long/short condition by setting a threshold to the “average fullnes”

The strategy is really minimally optimized, I only optimized the threshold and the profit and stop target.

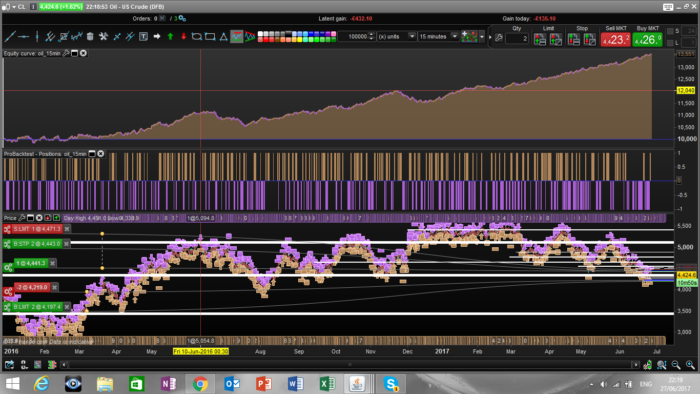

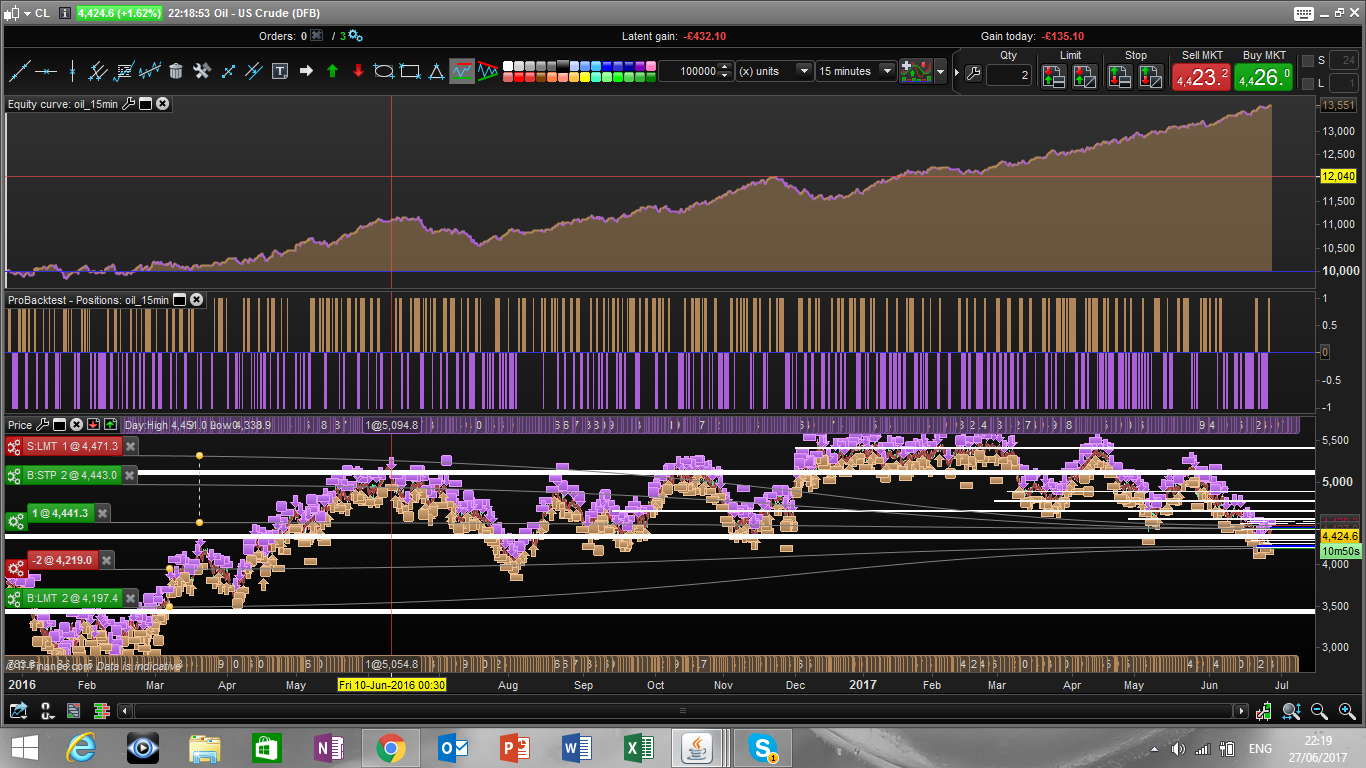

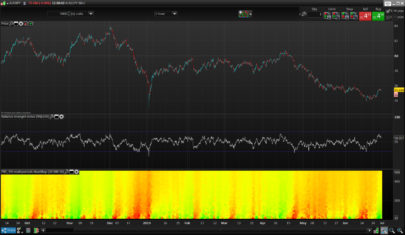

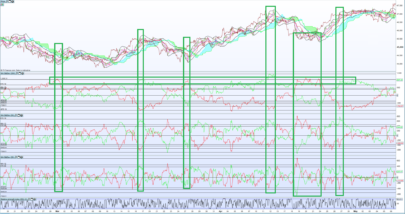

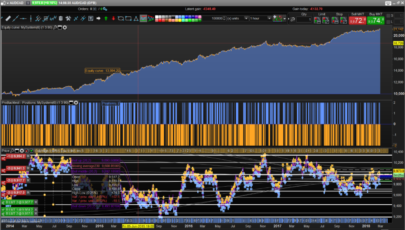

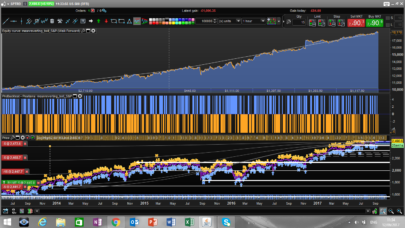

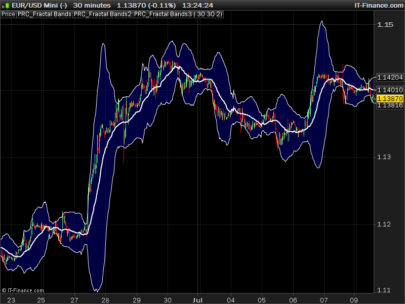

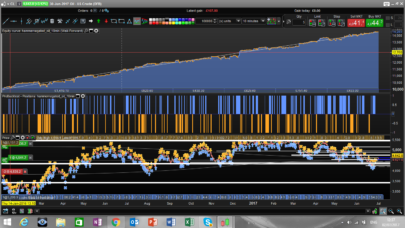

Results of backtest and WF are attached

Regards

Francesco

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 |

//crude oil 15 min strategy DEFPARAM cumulateOrders = False // Cumulating positions deactivated ///parameter definition period = 5 fastav = average[5](close) slowav = average[50](close) maoscillator = fastav-slowav fullness = (Dclose(0)-Dopen(0))/abs(Dhigh(0)-Dlow(0)) avfullness = summation[period](fullness)/period pr = 50 pl = 40 avfullnessthreshold = 0.2 cl = maoscillator > 0 cl = cl and avfullness < -avfullnessthreshold // Conditions to enter long positions cs = maoscillator<0 cs = cs and avfullness > avfullnessthreshold IF cl THEN BUY 1 PERPOINT AT MARKET ENDIF if cs then sellshort 1 perpoint at market endif set target pprofit pr set stop ploss pl |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Nice idea of relative fullness of candle! I like it.

Thank you Wilko!

Nice work Francesco! Have you noticed that the long side is much better than the short?

What spread?

HI Victormonk, thank you, yes I noticed that. Maybe we could try to set different target for long and short to rebalance it, I tried to optimize as little as possible.

Alexinvestgroup, I have used spread = 1 to backtest

Hi thanks for sharing.

Did you tried volatility take profit and stop loss based on atr rather than fixed values?

What does buy 1 «perpoint» means?

I also see there is some inside candlestick trades that i personaly have Never been able to be sucssessfull in.

I see you have alot of great ideas and strategies 🙂

Kenneth, it means that the tick value is 1 euro

Francesco, can you try to make this strategy with short and long proffit tragets just like in your hammernegated strategy?

Hi Francesco,

I have customised your code for Oil USA 15′, applying Nicolas’ super trailing code (thanks Nicolas!) and other minor alterations (Increased STOP distance, closing operations Friday night, etc). The equity curve is a little smother and is working for me in real.

I know it may not reflect a big change, but it very consistence and so far it is working very well. I am also a fan of the hammer negated. It is working for me in Oil USA in 10min, 30min, and …in 2 mins. The results are amazing. The only con, as well as with this code is that I have just tested it in 100k.

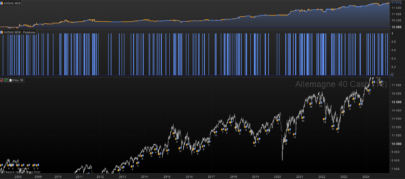

I am trying to adapt the Mean Reverting to other markets, any suggestions would be greatly appreciated. (It is working well with Brent, but not as well as with the USA)

//————————————————————————-

// Código principal : MEANREVERTING w TRAIL15′

//————————————————————————-

//crude oil 15 min strategy

DEFPARAM cumulateOrders = False

// Dias de la semana

IF DayOfWeek = 0 OR Dayofweek = 6 THEN

tradeok = 0

ELSE

tradeok = 1

ENDIF

// Friday 22:00 Close ALL operations.

IF DayOfWeek = 5 AND time = 220000 THEN

SELL AT MARKET

EXITSHORT AT MARKET

ENDIF

Fridaynight = Dayofweek = 5 AND time>220000

//parameter definition

period = 6

fastav = average[4](close)

slowav = average[50](close)

maoscillator = fastav-slowav

fullness = (Dclose(0)-Dopen(0))/abs(Dhigh(0)-Dlow(0))

avfullness = summation[period](fullness)/period

avfullnessthreshold = 0.38

enrojoalcista= (tradeprice(1)-close)>35*pipsize

enrojobajista= (close-tradeprice(1))>35*pipsize

cl = maoscillator>0

cl = cl and avfullness < -avfullnessthreshold

cs = maoscillator avfullnessthreshold

// Largos

IF NOT ONMARKET AND cl AND tradeok=1 AND NOT Fridaynight THEN

BUY 1 CONTRACT AT MARKET

ENDIF

// Cortos

IF NOT ONMARKET AND cs AND tradeok=1 AND NOT Fridaynight THEN

SELLSHORT 1 CONTRACT AT MARKET

ENDIF

// Salida Largos

IF LONGONMARKET AND enrojoalcista AND (open-close)>=30*pipsize AND open>close THEN

SELL AT MARKET

ENDIF

// Salida cortos

IF SHORTONMARKET AND enrojobajista AND (close-open)>=30*pipsize AND open=trailingstart*pipsize THEN

newSL = tradeprice(1)+trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND close-newSL>=trailingstep*pipsize THEN

newSL = newSL+trailingstep*pipsize

ENDIF

ENDIF

//manage short positions

IF SHORTONMARKET THEN

//first move (breakeven)

IF newSL=0 AND tradeprice(1)-close>=trailingstart*pipsize THEN

newSL = tradeprice(1)-trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND newSL-close>=trailingstep*pipsize THEN

newSL = newSL-trailingstep*pipsize

ENDIF

ENDIF

//stop order to exit the positions

IF newSL>0 and tradeok=1 THEN

SELL AT newSL STOP

EXITSHORT AT newSL STOP

ENDIF

//************************************************************************

//set target pprofit 30

set stop ploss 90

I was planning to insert pics of my backtest, but apparently I don’t find the way to insert a png. file in the conversation.

By the way, thanks again for your valuable contribution to this community.

Thank you Juan Salas!, will have a look now

HI Juan, I created this forum where you can share with us your results if you dont mind.

By the way your code as it is doesnt seems to work, can you pls upload the correct version in the forum at this link?

https://www.prorealcode.com/topic/oil-15-minutes-meanreverting-strategy/

Many thanks!

how do you define trailingstep and trailingstart?

Posted solution to the zero div problem which exists in the different versions of the code.

can you explain the flow of the code, just to clarify. RE:fullness = (Dclose(0)-Dopen(0))/abs(Dhigh(0)-Dlow(0))

avfullness = summation[period](fullness)/period. Correct me, but avfullness is based on the dailystats, e.g., dclose, dhigh, dopen,dlow. Since you are using 0 for parameter for dclose(0), and dhigh,dlow,dopen, I assume that during the 24 hour day, these values will change, is that correct, so there fullness will change, as the day proceeds, is that correct?

hi Lizmerril, yes, that is correct

Thanks for replying, so…. I assume in your backtest, the fullness calculations using dclose,dopen, etc were based on the last available prices i.e., the open, h,l, and close of daily frame from yesterday, right?

overfit

Excuse me. I would like to the time zone applied to this strategy.

Hi,

ProOrder does not recognise, “avfullnessthreshold”

any ideas, thanks